In India, the practice of saving has been passed down through generations. However, the modes of saving have undergone a sea change. While earlier, parents guided their newly-employed children to open recurring deposits in banks or buy life insurance, now many are emphasising on systematic investment plans (SIPs) of mutual funds.

Equity Investing: Journey From Exclusivity To Accessibility

Stocks and mutual fund investing have evolved over the years in terms of people’s attitudes, technology, and rules; in the future, it is looking at higher personalisation and innovation.

Over the last 25 years, investing in mutual funds and stocks has evolved significantly as has people’s mindsets. The primary reasons for this change are increase in awareness and smoother transactions than before. As far as returns are concerned, equity has always had an edge over other traditional investment products.

In the initial days, fund houses chased investors with guaranteed returns. When capital markets regulator Securities and Exchange Board of India (Sebi) substituted mutual fund regulations, 1993 with mutual fund regulations in 1996, it allowed asset management companies (AMCs) to guarantee returns in specific schemes, only if such returns were fully guaranteed by the AMC or the sponsor. Many fund houses offered guaranteed return products to lure fixed deposit investors. For instance, in May 1998, LIC Mutual Fund came up with LIC Dhanvarsha 12, which offered 13.25 per cent fixed returns and collected roughly Rs 170 crore. In 2003, this scheme was renamed as LIC Monthly Income Plan, and is now known as LIC Conservative Equity Fund, which now offers market-linked returns.

The LIC plan also mirrors the transition in the MF industry. Along with that the investing process has also moved from being cumbersome to one that is streamlined and simplified.

Over the years, the number of AMCs has increased and so has the overall assets they manage. As of January 2003, there were 33 mutual funds with total assets under management (AUM) of Rs 1.21 trillion. Today, this stands at Rs 46.45 trillion across 44 AMCs.

Investing in stocks has also come a long way. Before the introduction of demat accounts in 1991, shares used to be traded and held in paper certificates, which faced the risks of damage, loss and tampering. The new electronic ledger system for trading and holding shares did away with such problems. Before the introduction of demat, people could buy or sell shares only by going to the broker’s office or by couriering the share certificates.

The Way forward

As technology and technology-led products seep into the lives of investors, there is manifold growth in investments, too. The swelling AUM of mutual funds (Rs 46.45 trillion) and the huge number of investors signing up for demat accounts (123.50 million holders as on July 31, 2023) indicates the rising adoption of digitalisation. The journey of investing in equity instruments over the past 25 years illustrates a transition from exclusivity to accessibility, from reliance on traditional sources to embracing technology.

As we look to the future, the landscape will likely be characterised by increased personalisation, and innovative investment opportunities.

Then And Now

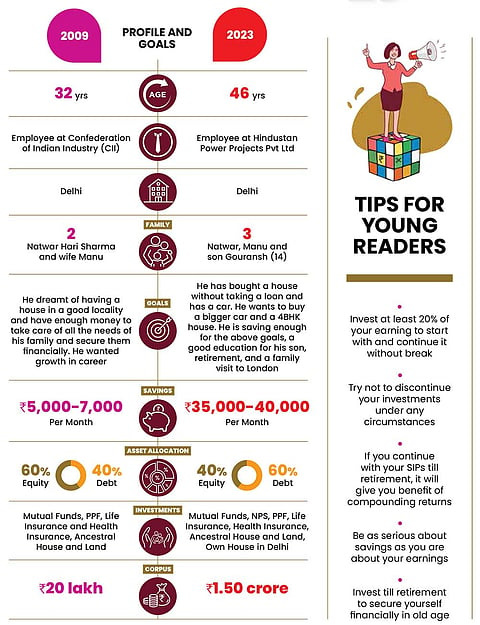

Natwar Hari Sharma

Photo: Bhupinder Singh; Suresh K Pandey

When Natwar Hari Sharma featured in Outlook Money’s December 2009 issue, he was already investing in mutual funds. His bank had introduced him to MFs, but recently he had signed up with a broker who charged him a ? xed annual fee. Mutual fund distribution was in a ? ux at the time, and entry loads had been recently banned. After the interview, he started investing consistently in high-growth instruments.

Over the years, he has been able to ful? l many of his goals and is happy to have achieved what he had dreamt of. “Financial security is important. Everyone looks forward to a good life,” he says.