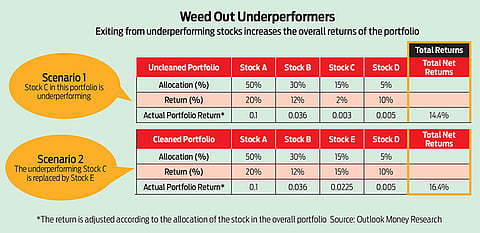

Market news, positive or negative, usually has a direct bearing on the performance of any stock. Underperformers can pull down the value of your portfolio, which is why spring-cleaning matters (see Weed Out Underperformers).

Freedom From Laggards

Freedom From Laggards

Before weeding out an underperformer, try and find out the reason. Look at whether the company itself is in trouble or is it an industry-wide phenomenon. “If a stock is not doing good and the industry (to which it belongs) is also not doing good, then it’s possible that the entire industry is going through a lean phase. In this scenario, it makes sense to hold on to the stock, especially if the industry is cyclical in nature,” says Vishal Wagh, research head, Bonanza Portfolio, a brokerage firm.

When it comes to equity mutual funds, it is difficult to predict whether last year’s market beating funds will continue their winning streak into the next year. Underperformance of a fund for a long period of time can be one of the triggers to sell it. Look at the fund’s performance on a relative basis (with benchmark and peers) and not only on an absolute basis. If the fund has underperformed the average of its peers and its benchmark for, say, four to six quarters, then it is better to exit the scheme.