Sanjiv Bhasin Sebi Order: The Securities Exchange Board of India (Sebi) enforced an interim order cum show-cause notice against Sanjiv Bhasin and eleven other entities. The capital market regulator alleged in its order that the entities mentioned in the order have indulged in stock manipulations. Apart from Bhasin, the market regulator also named RRB Master Securities Delhi Limited, a Sebi registered broking member and several relatives of Bhasin. Entities such as Venus Portfolios Private Limited, Gemini Portfolios Private Ltd, HB Stockholdings Ltd and Leo Portfolios Private Ltd were also named by the regulator.

Sebi Investigation Decoded: A Deep Dive Into Market Watchdog’s Crackdown On Sanjiv Bhasin

Sanjiv Bhasin News: The market regulator said that the eleven entities mentioned in the order had made unlawful profits of Rs 11.37 crore cumulatively

Bhasin’s Modus Operandi

The market regulator stated in its preliminary analysis that Bhasin appeared on several news channels and was a director at wealth management firm IIFL Securities Ltd. Bhasin undertook trades through RRB Master Securities Delhi Ltd. along with the other entities mentioned in the order. As per the order, Bhasin took positions majorly buying via Venus, Gemini and HB through Jagat Singh and Rajiv Kapoor, the dealers of RRB Master.

Subsequently, he would recommend the same securities vis-a-vis buy calls on some news/social media channels. Some of the scrips mentioned in the order include LTTS, Parag Milk, Interglobe Aviation, Steel Authority of India Ltd and Godrej Consumer Products Ltd. Relatives of Bhasin such as Lalit Bhasin, brother of Sanjiv Bhasin, Ashish Kapur (brother-in-law of Lalit Bhasin), Mamta Kapur (wife of Ashish Kapur), Rajiv Kapoor, Jagat Singh who were dealers of RRB Master in its order were also found to be involved in the alleged market manipulation scam.

Once sufficient demand was created for the securities, which in turn raised their price on the exchanges, Bhasin would pare his stake in the securities, accruing a profit. The sell part of the market manipulation scam was carried out through RRB Master within a few minutes of recommending the stocks. Notably Ashish Kapur, Rajiv Kapoor and Jagat Singh also mirrored Bhasin’s trades in their personal accounts.

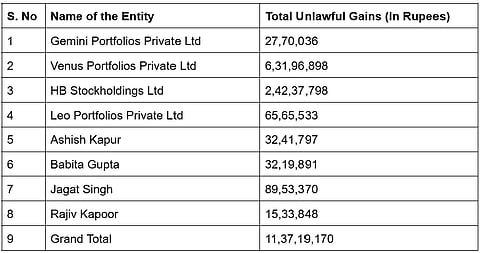

The table shown above details the profits earned by the entities involved in the market manipulation scheme. While cumulatively all the entities made unlawful gains of Rs 11,37,19,170, Venus Portfolios and HB Stockholdings made most of the gains as their unlawful gains stood at Rs 6,31,96,898 and Rs 2,42,37,798 respectively.

What Did Sebi’s Order Say

The market regulator said the eleven entities mentioned in the order had made unlawful profits of Rs 11.37 crore cumulatively. The regulator said that the unlawful gains would be impounded and directed Bhasin and the other entities named in the order to open fixed deposit account(s) in a Scheduled Commercial Bank to credit the amount with a lien marked in favour of SEBI.

Additionally, Sebi also barred Sanjiv Bhasin and his relatives and the other entities named in the order apart from RRB Master Securities Delhi Ltd from accessing the securities market and prohibited from buying, selling or otherwise dealing in securities. Sanjiv Bhasin was also directed to preserve records of his social media accounts. The market regulator also directed the notices to furnish a complete inventory of all their assets or any interest or investment in any of such assets immediately but not later than 15 days of the order.

What Sebi Said In The Matter

The market regulator said that the acts carried out by Bhasin and the other parties involved in the market manipulation are in violation of Sebi’s norms and the market regulator cannot remain a mute spectator in such cases.

“The acts carried out by Noticees in the instant matter and the manner in which they have been done are, prima facie, in my view, in violation of the provisions of the SEBI Act, 1992, PFUTP Regulations and RA Regulations. SEBI cannot remain a mute spectator when such kind of fraudulent and manipulative activities take place in the securities markets by personalities who are actually revered in the securities markets domain and have a huge following on various social media platforms,” Sebi said in the order.

The market regulator also urged investors to remain diligent, attentive and exercise caution while believing anyone giving stock market recommendations.

“SEBI has time again advised investors in the securities markets to remain diligent, attentive and exercise caution while believing anyone giving stock market recommendations associated with securities markets. Noticees herein are individuals who have been associated with securities markets for quite a long time,” Sebi said in the order.