After his retirement, Ajmer-based Prakash Singh, who did not want to reveal his identity, wanted to invest a lump sum of Rs 40 lakh at age 60. He intended to put the money in fixed deposits (FDs) to benefit from the high deposit rate for senior citizens.

Mis-Selling Saga: Lies Bank RMs Tell You To Meet Targets

Having a dedicated bank relationship manager (RM) is often seen as a privilege, but mis-selling turns that privilege on its head when customers of these so-called premium services end up victims of bad financial advice. We tell you how and why it happens and what you can do about it

However, when he approached his private bank’s RM with the request, the latter persuaded Prakash to invest in a “special FD” that came along with an insurance coverage. The RM convinced him that the product would give guaranteed returns higher than that offered on regular FDs and also showed him proof of past returns. It was only later that Prakash realised that he was mis-sold a unit-linked insurance plan (Ulip) under the guise of a “special FD”.

Ajmer being a small city, with only one Securities and Exchange Board of India-registered investment advisor (Sebi-RIA), Prakash’s financial advisory options are limited. Even otherwise, many investors depend on their RMs, who keep calling them regularly to build familiarity, often with unsolicited offers and financial advice.

Tiruchirappalli-based senior citizen, Aadhavan Narayanasamy, 72, and his wife, 67, who was battling with cancer, and visited their bank branch to renew their existing FDs, had a similar experience. Instead, they were offered a Ulip. They were lured with promises of returns exceeding 15 per cent. Fortunately, he consulted his financial planner before proceeding further, who advised him against investing in a Ulip. Tamil Nadu has a total of 53 Sebi RIAs.

A part of the premium for Ulips goes towards a life insurance cover, while another part is invested and gives market-linked returns; then there are commissions, management and other costs. Many Ulips are single premium plans, however, the money can be withdrawn at the end of the lock-in period of five years. In short, the nature of Ulips is completely different from that of FDs, which have the option to pay regular interest, which seniors often require for regular cashflow in retirement.

Both the incidents are classic examples of mis-selling, where a product or service is sold to someone for whom it is not suitable. For senior citizens seeking risk-free income, a Ulip with a five-year lock-in period is entirely inappropriate.

The above examples are those of mis-selling of insurance products, but those are not the only ones to be mis-sold. The list includes aggressive mutual funds, bundled products, personal loans, and more.

We tell you some of the common tactics you need to be aware about, what regulatory authorities are doing about it and what you should do to avoid such instances.

Tactics Of Trickery

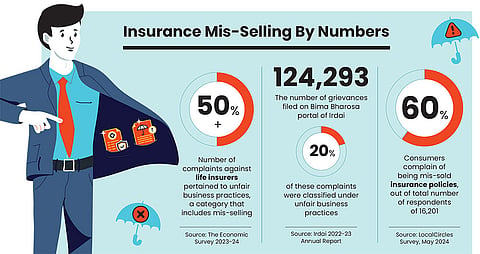

Recent data from the Insurance Regulatory and Development Authority of India (Irdai) shows that in FY23, over 127,378 complaints were received, with 50 per cent of them relating to life insurance companies engaged in unfair practices or mis-selling products.

Irdai's Bima Bharosa portal recorded 124,293 grievances with life insurers, with 20% of complaints being classified under unfair business practices

According to Irdai's annual report for FY23, the Bima Bharosa portal recorded 124,293 grievances with life insurers, with 20 per cent of these complaints classified under unfair business practices, a category that includes mis-selling.

Says Vivek Iyer, partner, Grant Thornton Bharat, a services firm that offers accounting, consulting, tax, and risk services: “Mis-selling is a bigger risk with respect to mutual funds (MFs) and insurance, rather than banking products, because the banking products are more plain vanilla compared to products like MFs and insurance, which are subject to a myriad nature of market risks and fine print conditions, which are sometimes difficult to articulate even for an MF and insurance specialist.”

According to the Economic Survey 2024, insurance is among the most mis-sold financial product by banks. But other instruments are also mis-sold.

In the past, the Yes Bank mis-selling case was played up when the bank was unable to pay the holders of AT-1 bonds, which were sold as FDs. Nobody told the investors at the time that these were perpetual bonds, which do not come with a maturity date, and only pays periodic coupons; also, they can be used to absorb losses of the company, which is what happened in the bank’s case. Lack of disclosure led to massive losses for investors when `8,400 crore worth of bonds were written off in March 2020. In this case too, the majority of investors were gullible senior citizens.

In another incident in early 2024, a 40-year-old Delhi-based customer of one of the largest private banks in India was asked by the RM to take a personal loan and use the amount to open an FD, because interest rates were high during the period. It was sugar-coated as a systematic investment plan (SIP) of an FD, where the equated monthly instalments (EMIs) would be the SIP amount. In this case, the interest rate on the FD was less than that on the personal loan, which the customer realised and didn’t fall into the trap.

Says Madhupam Krishna, Sebi RIA and chief planner, Jaipiur-based WealthWisher Financial Planner and Advisors, “The problem does not only exist in private banks. Public sector banks also have their fair share of mis-selling. There have been many cases when senior citizens have asked for an FD, but they were told the bank has a similar product from their sister concern or a group company, where they will get double the returns. They get signatures on an Ulip form or a close-ended MF form.”

Here are some other common tactics RMs employ to sell unsuitable products that you should be aware of to avoid being duped.

Public sector banks also have their fair share of mis-selling. Senior customers were often offered ‘similar products’ when they asked for fixed deposits

Misrepresenting Insurance As FDs: Bank RMs often market insurance products as high-return FDs. Sometimes they also misrepresent them as short-term investments, with a tenure of barely three–five years, says Debashish Banerjee, partner, insurance sector leader, Deloitte India.

Tuhin Das, an RM with a private bank in Kolkata, who did not want to reveal his real name, says, “People come to our bank to invest in FD products and we try to sell them insurance plans. Since they also have a life insurance component built in, people often buy these instead of an FD. It also helps me fulfil my targets.”

Bundling Insurance With Loans: Purchasing of term, property, and other insurance policies is often presented as a precondition for sanctioning of loans or to even open a bank locker. Borrowers are made to feel that there is no other choice.

Inappropriate Products For Senior Citizens: Ulips, deferred annuities, and guaranteed income plans are most often mis-sold to seniors. Sometimes these are sold as alternatives to FDs.

Aggressive Mutual Fund Schemes: High-risk funds are sold to conservative investors without considering their risk appetite.

Says Rakshith H.D., certified financial planner and head of digital sales, GoalTeller, a Sebi-registered financial planning app, “Portfolio management services (PMS) and alternative investment funds (AIFs) are often marketed as superior to MFs, without disclosing their high fees, risks, and eligibility criteria.”

Personal Loans Without Proper Explanation: Customers are sometimes encouraged to take loans that they do not need, with hidden processing fees. “We also have targets for FDs, and so we sometimes try to lure customers with a personal loan with a lower rate of interest, if they open an FD with the bank,” says Das.

Targets Behind Trickery

What seems to be at the bottom of the problem, when it comes to bank RMs, is the steep sales target. Incentives related to sales usually form a part of their salaries. In other words, the problem lies in the system itself.

Says Rakshith: “RMs, wealth managers, and financial advisors are given ambitious targets, with incentives often linked to the number of policies or investment products sold. The pressure to meet targets means that many RMs, despite knowing better, end up recommending products that may not be in the customer’s best interest.”

Bank RMs often have to meet steep sales target, as incentives related to sales form a part of their salaries. The problem of mis-selling lies in the system itself

According to an October 2024 report by 1 Finance Magazine, over 57 per cent of bank RMs in India admitted to mis-selling financial products to meet their sales targets. Almost 51 per cent said that they feared getting fired for not meeting their sales target, while over 84 per cent said that they were under high pressure to sell financial products.

An RM with a leading private bank in Kolkata, who did not want to be named, admits that sales targets create a lot of pressure and that often makes him pitch products that may not be what the customer needs.

“Let us say, I have a target to sell 20 Ulips a month and my performance (metrics) is linked to that. I, therefore, need to make an effort to sell these policies. So whenever there is a chance, I pitch Ulips. However, nowadays people have become more aware, so it has become difficult,” he says.

How Not To Fall For Mis-Selling

While efforts are on to curb mis-selling (see Regulatory Intervention), it is still a common practice and customers need to exercise caution. Awareness is crucial. It is also important to be aware and do your due diligence before buying any financial product.

Says Ajmer-based Prakash: “Consumers need to be informed about the insurance products they are purchasing, even when buying through banks. The intention behind offering insurance through banks is generally good—providing coverage at competitive prices—but lack of awareness can lead to one falling prey to mis-selling.”

Know The Product: You should never make impulsive decisions when purchasing a financial product based on unrealistic expectations of high returns and benefits. Before investing in any financial product, it is always a good idea to do your own research. A simple search on the Internet can give you a basic idea of the product that you plan to buy. The key things you should look out for are the product’s features, risks, and benefits.

Says Arora: “Instead of blindly trusting the agent, consumers must make rational decisions based on their research. This is crucial when a new product is being launched every day, and bank RMs have a target to complete. This pressure often drives them to sell products without explaining their scope and limitations.” So, when in doubt, consult a financial planner.

Ask The Right Questions: When an RM offers you a product, ask them why they are recommending it and how it will fit into your overall financial plan. It’s a red flag if the RM seems focused on pushing a product without understanding your needs first.

Never make any impulsive decision when buying a financial product. Always do your own research. Always look for the products’ features, risks, and benefits

Beware Of Bundled Products: You should be cautious if your RM insists that you must purchase an additional product (for instance, an insurance plan) to avail of a loan or investment service. “This is a common tactic used to meet sales targets, and in many cases, these additional products may not even be necessary for you,” says Banerjee.

Review Documents Carefully: Review all documents carefully before signing on the dotted line. This is extremely important to understand the terms, charges, and implications of the product being sold to you. If you find it difficult to go through the documents yourself, ask your RM to break it down for you in simple terms. Take extra help if you are not satisfied.

Take Promise Of High Returns With A Pinch Of Salt: A product that promises guaranteed returns cannot provide a very high return. Higher returns are possible only if the product invests in the markets, which involves risk and does not guarantee returns. If the RM is showing proof of high returns in the past, that return may not necessarily be replicated in the future.

Ensure The Product Aligns With Your Needs: The lure of getting something extra is always there, but you should always ask yourself whether you actually need it. For instance, a senior citizen may not need a life insurance cover, as they usually don’t have dependents. In this case, a Ulip will be inappropriate, as a major part of the premium in these goes towards funding the life cover of the insured. Your money may be better invested in an instrument that can give you regular returns.

Redressal For Victims

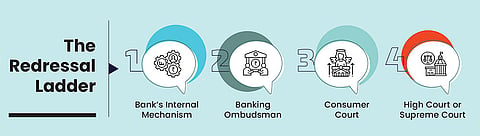

If you have already been mis-sold a product by a bank RM, you are entitled to seek redressal through several formal and legally-recognised avenues. Here is what you can do.

Lodge A Complaint With The Bank: Says Tushar Kumar, advocate, Supreme Court of India: “Initially, the customer should lodge a complaint with the bank’s customer service department or the concerned RM, demanding clarification and resolution. If the complaint is not addressed satisfactorily, the customer may escalate the matter to the grievance redressal officer within the bank.”

Approach The Ombudsman: If the bank’s internal grievance redressal is unsuccessful or delayed, the customer can escalate the complaint to the Banking Ombudsman, a quasi-judicial authority set up by RBI under the Banking Ombudsman Scheme. Says Nishant Datta, advocate, Delhi High Court: “The ombudsman can order banks to reverse the transactions, provide compensation, or offer other corrective actions. This is an efficient mechanism, as it does not require legal representation, and the decision is binding on the bank.”

File A Case With The Consumers Court: If you are not satisfied with the ombudsman’s decision either, and feel that your rights as a consumer have been violated, you may file a complaint with the Consumer Disputes Redressal Commission (CDRC).

If you have been mis-sold a product, you can seek redressal by lodging a complaint with the bank, the ombudsman, and lastly, the courts

The Next Stop Is The Courts: In the event the grievance is of a peculiar nature, then depending upon the facts of a case, you may approach the relevant high court for relief.

Says Ankur Pastor, managing partner, Indore-based Innovis Law Partners: “In such situation, even though buyers are generally expected to check things for themselves (caveat emptor), the courts have sometimes protected customers. They do so by ensuring that both parties truly agree on the terms (consensus ad idem) and by interpreting any vague contract terms against the party who created them (contra proferentem).”

In the past, many instances of mis-selling financial products have been taken to relevant courts, including the Supreme Court, and have been dealt with seriously.

Pastor gives an example. “In the case of Virendra Pal Kapoor versus Union of India (2014) wherein the Allahabad High Court held the insurance company liable for misrepresentation of the returns under the policy and directed Irdai to re-examine each and every insurance policy of the insurance company to ensure adherence to the guidelines laid down by the court in the said case.”

In another significant case involving the mis-selling of insurance policies, the Supreme Court of India ruled in 2013 that banks were liable for the actions of their employees, including RMs who mis-sell insurance products. The court held that banks must ensure that customers are fully informed about the risks, and the terms and conditions of the products they are being sold.

“This judgment reinforced the fiduciary responsibility of banks to act in the best interests of the customer, particularly in cases where RMs deliberately misrepresented products,” says Datta. The company was directed to compensate affected consumers in this case.

Mis-selling can happen through different channels, such as multi-level marketing (MLM) schemes, chit funds, real estate fly-by-night agents and so on, and have the potential to severely damage the finances of a vulnerable investor, and ruin lives.

But when it happens through a bank, it becomes a double-edged sword, as banks are traditionally seen as trustworthy institutions.

People often go to banks for guaranteed return products like FDs and other small savings schemes, and do not suspect foul play. Besides, having a dedicated RM to manage your banking and investments is often seen as a privilege, but mis-selling turns that privilege on its head when customers of these so-called premium services end up as victims of bad financial advice.

Regulatory Intervention

Crackdown On Mis-Selling

Banks must register as corporate agents and follow a strict code of conduct to prevent forced insurance sales.

Banks must disclose details of insurance agents, ensuring accountability even after job changes.

Banks and NBFCs must have grievance departments and heads to address mis-selling complaints efficiently.

Strict penalties and action against financial institutions guilty of mis-selling insurance.

Clear disclosure of risks, costs, and features in financial product offerings to prevent misinformation.

Mis-selling is not a recent phenomenon, but it seems various regulators are trying to curb the menace now. Regulators, including the Reserve Bank of India (RBI), Insurance Regulatory and Development Authority of India (Irdai), Sebi along with industry associations, have designed guidelines to protect consumers and ensure that banks adhere to ethical practices when selling financial products.

Some of the responsibility lies with investors too. Says S. Prakash, a health insurance evangelist: “Regulators are already making efforts to raise awareness. However, it might also be necessary for banks to formally communicate with customers and obtain declarations that they fully understand the policies they are purchasing.”

RBI

Newly-appointed RBI Governor Sanjay Malhotra recently cautioned banks against mis-selling products and warned that any violation will be taken “very seriously”. In the press conference after the February monetary policy commitee (MPC) meet, he addressed banks and insurers, both regulated financial entities that are frequently accused of mis-selling financial products to meet their sales targets. At the conference, he said RBI will also introduce new guidelines to address mis-selling and forced selling of insurance plans.

Earlier, in November 2024, then RBI Governor Shaktikanta Das had asked banks to curb unethical practices, including mis-selling of financial products, on priority.

Says Shilpa Arora, co-founder and chief operating officer, Insurance Samadhan, an organisation that helps policyholders in managing policies and resolving grievances, “Das suggested that staff incentives be structured carefully to avoid any unethical practices. He also cautioned that while unethical practices might lead to short-term gains, they expose the bank in the end, often leading to long-term risks, such as damage to reputation and penalties.”

RBI has, in fact, implemented several regulations to combat mis-selling by banks.

Expanding The Scope Of The Banking Ombudsman Scheme: RBI has expanded the scope of the Banking Ombudsman Scheme to include complaints related to the sale of insurance, MFs, and other third-party investment products by banks. This allows customers to lodge complaints against banks for non-adherence to RBI instructions regarding these..

Certification Requirements: Employees need to know not only the product specifications but also the risks a product entails. Says Krishna: “Banks are required to ensure that employees involved in marketing third-party retail products and wealth management products undergo appropriate certification processes. This aims to minimise customer complaints and address mis-selling issues.”

Penalties And Disciplinary Actions: RBI has also issued various guidelines stating that any regulated entities responsible for mis-selling products like insurance policies and MFs shall attract penalties and face disciplinary actions.

IRDAI

Irdai has implemented the Irdai (Registration of Corporate Agents) Regulations, 2015.

Accordingly, banks have to register as corporate agents and must adhere to a strict code of conduct. This includes not coercing clients to buy insurance products and ensuring transparency during the sale.

Banks will have to register as corporate agents and need to disclose the details of individuals involved in the sale of insurance products. This will help in identifying those responsible for mis-selling even after they change jobs. Says Krishna: “Banks and non-banking financial companies (NBFCs) need to have systems (grievance department and appointment of grievance head) in place to address customer complaints proactively to discourage mis-selling practices. Irdai also has the authority to impose penalties and take disciplinary actions against banks and NBFCs found guilty of mis-selling insurance products.”

In its annual report 2023-24, Irdai said: “To prevent or reduce mis-selling, insurers have been advised to implement strategies, such as assessing product suitability, implementing distribution channel-specific controls and developing a plan to address mis-selling, including carrying out a root cause analysis on a periodic basis.”

SEBI

The capital markets regulator has mandated that financial products must be sold based on the suitability of the product to the customer’s needs and risk profile. This is to ensure that customers are not sold products that are inappropriate for their financial situation.

Sebi has also laid down stringent disclosure requirements to ensure that all material information about financial products is provided to the customers. This includes details about risks, costs, and other relevant features.

Sebi has banned upfront commissions for mutual fund (MF) distributors (banks) to discourage aggressive selling practices. Instead, distributors are compensated through trail commissions, which are paid over the life of the investment.

Says Krishna: “Sebi has set up various investor protection measures, including the establishment of investor grievance redressal mechanisms (SCORE). It has also launched investor education programs through industry players so that mis-selling is stopped.”

AMFI

MF industry body Association of Mutual Funds in India (Amfi) has revised its code of conduct for MF distributors to emphasise transparency, competency, fairness, and integrity. Banks and other distributors are required to avoid conflicts of interest and act in the best interests of their clients.

Amfi provides a distinct number called the Employee Unique Identification Number (EUIN) to people associated with sales of MFs. This number is fed on forms and systems to know who sold a particular MF investment. This helps in identifying and tracking employees of any institution who might mis-sell any mutual fund product.

Amfi has also mandated that MF distributors provide clear and comprehensive information about MF schemes, including risks, costs, and performance, to ensure that investors can make informed decisions.

These regulations aim to protect investors and ensure ethical practices in the sale of financial products by banks as MF distributors.

meghna@outlookindia.com