Treat your Diwali bonus as a way to fast-track financial goals, not just fund festivities. This Diwali, spend with joy, but invest with purpose. Let your bonus light up your future, not just your home.

Diwali Bonus: Smart Ways to Invest, Not Just Spend

When the diyas fade, what remains is not the sparkle you spent, but the security you built. This Diwali, let your bonus light the future as brightly as your home.

Gurugram-based Niraj Prakash still remembers last year's Diwali. His Diwali bonus hit his account, and within a week, it had vanished: a new TV, designer kurtas for the family, an impromptu hill station trip. By February, when his daughter's school fees were due, he was scrambling for funds. That's when it hit him: the money meant to secure his future had only decorated his present.

This year, Niraj made a different choice. He sat down with a notepad, divided his bonus into three buckets, and for the first time, felt genuinely in control of his money.

The Three-Bucket Strategy:

Bucket 1: Immediate Needs (30 per cent): Yes, celebrate. Buy that ethnic wear, buy gifts for your parents, and enjoy a family meal. Festivals aren't just about restraint - they're about joy. But cap it at 30 per cent. This way, you indulge without guilt and without derailing your financial goals.

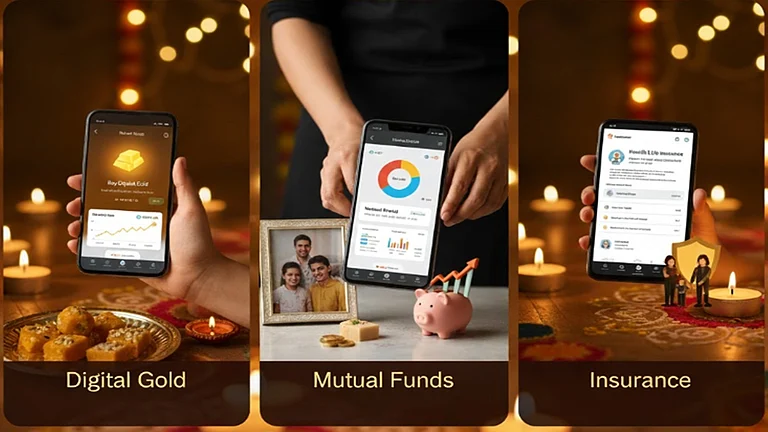

Bucket 2: Future Growth (50 per cent): This is where your bonus truly works for you. Start an SIP in equity mutual funds. Even Rs 5,000 monthly compounds beautifully over 10 years. Consider diversified or index funds if you're new to investing. Already have SIPs running? Use your bonus to top them up.

"Most people treat bonuses as windfall gains to be spent immediately," says Sanjiv Bajaj, Joint Chairman and MD at BajajCapital. "But the smartest investors see them as accelerators, opportunities to fast-track goals that would otherwise take years to achieve."

If you have a longer horizon, explore equity-linked savings schemes (ELSS) that offer tax benefits under Section 80C while building wealth. For those nearing retirement, debt funds or balanced advantage funds provide stability without sacrificing growth entirely.

Bucket 3: Protection (20 per cent): Financial security isn't just about growing wealth; it's about protecting it. Use this portion to strengthen your safety net. Review your health insurance. Does it cover your entire family adequately? Consider topping up, if needed. If you don't have term insurance yet, this is the year to get it.

An emergency fund is equally critical. Park this money in a liquid fund or high-interest savings account or somewhere accessible but not tempting to dip into for everyday expenses.

Bajaj adds, "A bonus gives you the rare chance to plug gaps in your financial armour without disturbing your monthly budget. It's not about perfection; it's about progress, one smart decision at a time."

Make This Diwali Different

Niraj's transformation wasn't dramatic; it was deliberate. He didn't deny himself the festivities, but he also didn't let the bonus slip through his fingers like sand. Today, his SIPs are running, his insurance is in place, and he sleeps better knowing his family's future is a little more secure.

Your bonus isn't just a number, it's a crossroad. One path gives fleeting memories; the other builds a foundation for decades. Will you choose wisely? When the diyas fade, what remains is not the sparkle you spent, but the security you built. This Diwali, let your bonus light the future as brightly as your home.