10 Stocks To Consider In 2026

Top analysts recommend 2 stocks each, backed by solid analysis on why they chose them

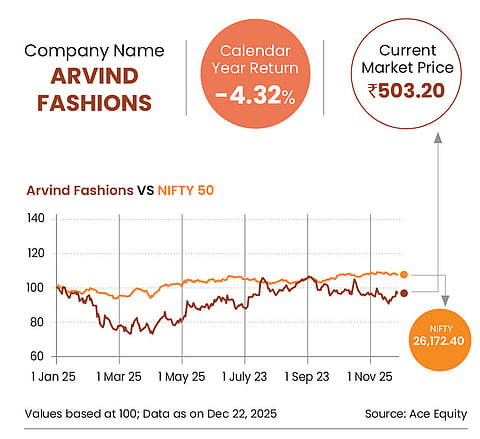

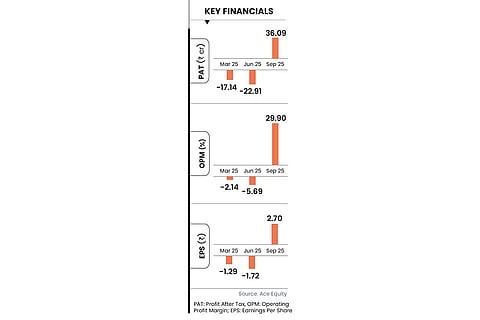

Arvind Fashions (AFL) is a multi-brand apparel company that retails global brands, such as US Polo Association (USPA), Tommy Hilfiger, Arrow and Calvin Klein under license, along with its own in-house denim brand Flying Machine. It operates through 998 retail outlets across 1.26 million sq.ft store space and 9,000-plus multi-brand outlets (MBOs) and departmental stores in India.

USPA, India’s top casual wear brand, has achieved over Rs 2,000 crore in net sales value, making it the largest apparel brand in India, while Arrow has established itself as a leading brand in men’s formal apparel segment.

AFL has transformed its business by rationalising its portfolio on five marquee brands, increased focus on scaling up direct-to-consumer (D2C) sales, and strengthened its balance sheet through better management of working capital and reducing debt.

Its revenues are expected to grow at a compounded annual growth rate (CAGR) of 13 per cent over FY25-28 through direct channels and online D2C sale. Contribution of both the channels together improved to 43 per cent in FY25 and is expected to improve to 50 per cent by FY27-28. Retail channel is expected to grow in low-to-mid teen driven by 8-10 per cent in like-for-like (LFL) growth, while online D2C business is expected to grow by 25-30 per cent.

Its earnings before interest tax depreciation and amortisation (Ebitda) are expected to consistently improve by 40-50 basis points (bps) over 2-3 years with better mix towards high margin retail channels, strong growth in high margin adjacent categories and operating efficiencies (likely to reach 15 per cent by FY28).

AFL has restructured its sale or return (SOR) model to a consignment model, thus improving the inventory turn from 2.4 times to 4.3 times, and working capital days from 99 to 50, in FY21 and FY25, respectively.

AFL has also reduced its debt from Rs 1,210 crore in FY22 to Rs 390 crore in FY25. With improvement in cash flows, it is likely to be debt free by FY28.

Consistent improvement in profitability and reduction in debt has led to return on capital employed (RoCE) and return on invested capital (RoIC) improving to 22.4 per cent and 15.5 per cent in FY25, respectively, from 0.90 per cent and 0.7 per cent in FY22. We expect RoCE and RoIC to cross 30 per cent by FY28.

The stock is currently trading at a discounted valuation of 10.5 times and 8.6 times its FY26 and FY27 enterprise value (EV)/Ebitda compared to some other apparel players.

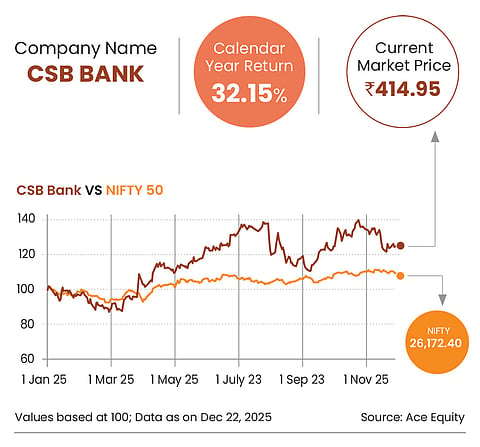

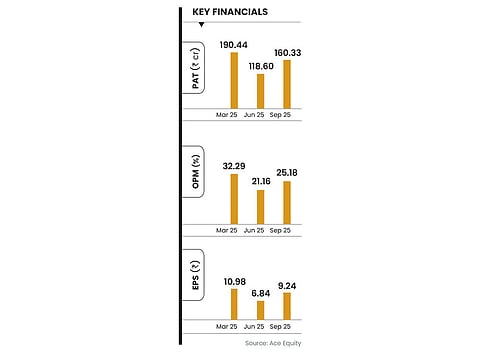

Banking On Gold Loan Books

CSB Bank is a Kerala-based private bank with strong promoter backing from Fairfax India Holdings, which holds 40 per cent stake. Gold loans comprise the major chunk of advances (47 per cent), followed by wholesale, retail, and small and medium enterprise (SME) loans at 23, 17, and 13 per cent, respectively.

The management has outlined the “SBS 2030” strategy focusing on technology investments (AI and cloud solutions), digital transformation, and building distribution franchise. The bank is now targeting to grow advances at 25 per cent in FY27-30, while operational leverage is expected to bring down cost-to-income (CI) ratio to 45 per cent by 2030.

The bank’s portfolio is heavily tilted towards gold loans, which is expected to remain a healthy segment. However, the core of the strategy lies in active diversification into retail (two-wheeler, personal loans), SME, and select wholesale segments to de-risk the portfolio and sustain growth visibility.

The bank has nearly completed a full-stack tech overhaul—core banking solution (CBS), migration, cash management system (CMS), loan origination system (LOS), digital onboarding, new mobile/Internet banking, and risk management systems. From FY27, these upgrades are expected to improve customer acquisition and cross-sell, strengthen current account savings account (CASA) franchise, enhance underwriting and risk controls, support scalable retail and SME expansion (currently 30 per cent of the book).

A key metric for future performance is the CI ratio, which was 63 per cent in FY25. The bank plans to bring it to 45 per cent by FY30.

The bank has focused on non-interest income, with robust growth in core, granular fee income from sources like insurance, loan processing charges, and transaction banking. The completion of CBS and digital platform rollouts is aimed at enhancing cross-selling opportunities and customer acquisition, which will naturally boost fee-based revenues and aid achievement of targeted operational efficiency.

The bank had a gross non-performing asset (GNPA) of 1.81 per cent and net NPA (NNPA) of 0.52 per cent, reflecting prudent provisioning and negligible unsecured exposure (<3 per cent of the book). The bank is steadily expanding its branch network, adding 50-60 branches annually, while maintaining focus on asset quality discipline and cost optimisation. The bank’s capital to risk-weighted assets ratio (CRAR) of over 20 per cent provides comfort for future credit growth, which is targeted at an aggressive 25 per cent over FY 2027-30.

The bank is trading at 1.2 times FY27 book value (BV). Considering substantial proportion of fixed rate loan book aiding margins, higher than industry credit growth and improvement in return on assets (RoA) at 1.4-1.5, CSB Bank is attractively placed. Given strategic roadmap focused on scaling of business, diversification and reaping benefits from operating leverage, we give a buy.

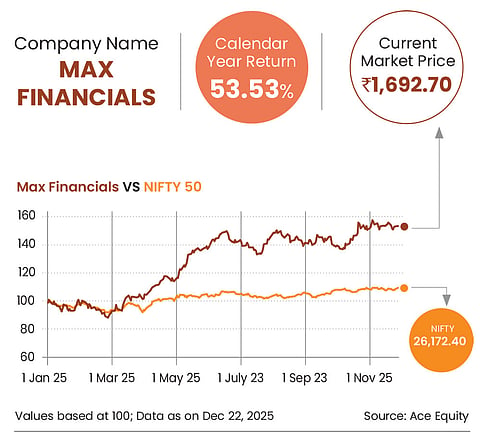

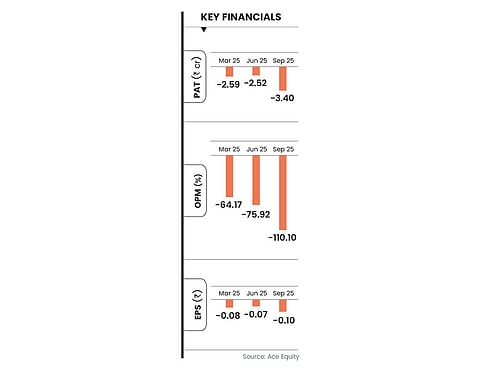

Higher Margins Bode Well

Max Financial Services owns 80 per cent of Max Life, which is one of India’s largest private life insurers. Over time, Max Life has grown faster than the industry, having shifted its focus toward higher-margin products, such as non-participating (non-par) savings and protection insurance. These form a large part of its business, and have helped it earn better margins, reduce dependence on unit-linked insurance plans (Ulips) and remain resilient even when interest rates fall.

Max Life has a strong bancassurance with Axis Bank, but is also expanding its presence with other banks, while simultaneously building its own distribution network through the agency channel. This dual approach of using both banks and agency makes it less vulnerable than peers who rely on one channel.

Profitability remains strong due to a favourable product mix and increasing rider sales. To offset the short-term pressure created by the removal of the goods and services tax (GST) input credit, the management is renegotiating commissions and improving operating efficiency. Customer persistency has also improved across longer-duration policies. The management remains confident of achieving mid-20s value of new business (VNB) margins over FY26, driven by continued focus on non-par and protection products, new launches, and rider attachment.

Max Life is well placed to benefit from long-term trends, such as rising awareness of protection insurance, regulatory support for non-par products, and increasing demand for long-term savings solutions. The company’s strong brand, wide distribution reach, and disciplined execution have helped it consistently outperform the industry over multiple cycles.

An important medium-term trigger is the proposed reverse merger of Max Life into Max Financials. If approved, this could simplify the group structure, unlock operational and capital benefits, improve transparency, and support valuation re-rating.

We expect Axis Max Life to report an annualised premium equivalent (APE)/VNB CAGR of 18 per cent/21 per cent over FY25-28. Growth is expected to be driven by continued improvement in product mix, expansion across banca and agency channels, and operating leverage. With strong growth visibility, better margins, and potential structural catalysts, Max Financials remains well positioned for long-term value creation on the franchise.

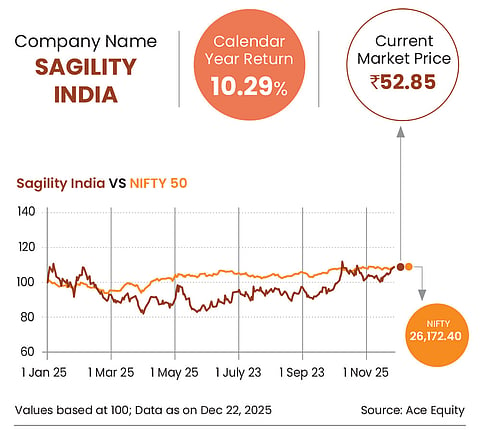

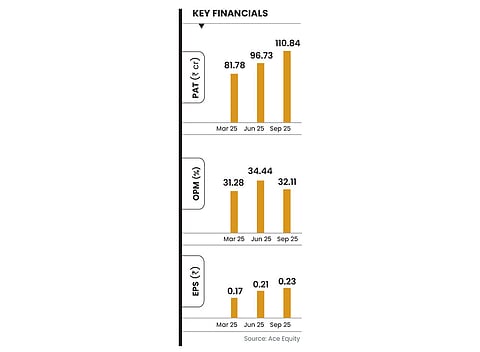

Tech-Savvy Healthcare Edge

Sagility India is a technology-led, healthcare business process outsourcing (BPO) provider with expertise across the US healthcare ecosystem. The company supports clients for functions, such as claims management, member engagement, clinical services, payment integrity, and revenue cycle operations. Its exclusive focus on healthcare creates strong entry barriers, long contract tenures, and high client stickiness, thus differentiating it from diversified BPO peers. Around 90 per cent of its services revenue is recurring, providing strong visibility and stability.

The company has long-standing relationships with six of the top 10 US payers, who contributed 88 per cent of H1 FY 26 revenue.

Sagility’s positioning is further strengthened by its proprietary technology stack spanning automation, analytics, robotic process automation, and Generative AI. These help clients improve efficiency, ensure compliance, and reduce turnaround times.

Technology-led delivery also enhances client stickiness and supports deeper cross-selling across services. The acquisition of BroadPath Healthcare Solutions in 2025 further helped it expand into the payer mid-market and add specialised capabilities in medicare and medicaid member acquisition.

The integration of BroadPath’s Bhive remote workforce platform improves operational resilience and scalability in a distributed delivery model. Along with earlier acquisitions, such as Devlin and Birch, this further strengthens Sagility’s ability to deliver high-value, technology-enabled solutions while diversifying its client base.

From a growth perspective, Sagility benefits from both scale and client mining opportunities. The top three clients have an average relationship size of around $130 million, while the remaining clients are significantly smaller, highlighting meaningful scope for wallet-share expansion. Growth is expected to be driven not only by large existing accounts but by a broader client base, supported by cross-selling, acquisitions, and operating leverage. A multi-shore delivery model and disciplined execution further support margin expansion.

Financially, Sagility’s revenue increased from Rs 42.2 billion in FY23 to Rs 55.7 billion in FY25, translating into a CAGR of 15 per cent. Revenue is projected to reach Rs 91.9 billion by FY28, implying an estimated CAGR of around 18 per cent over FY25-28. Operating leverage, technology adoption, and synergy benefits are expected to drive Ebit margin expansion from 14.9 per cent in FY25 to about 17.4 per cent by FY28. As a result, earnings growth is expected to outpace revenue, with estimated Ebit/profit after tax (PAT) CAGR of roughly 24 per cent/31 per cent over FY25-28. Supported by strong domain expertise, a high share of recurring revenues, and powerful structural tailwinds from US healthcare outsourcing, Sagility appears well-positioned for sustained long-term growth.

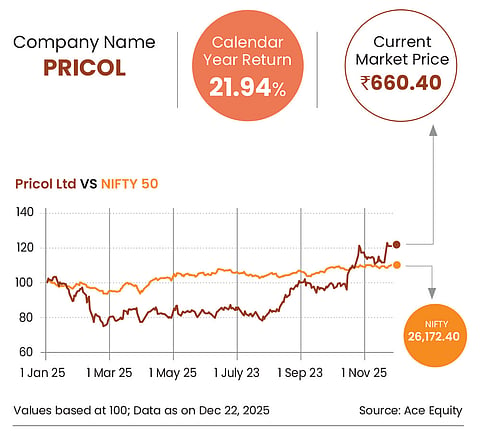

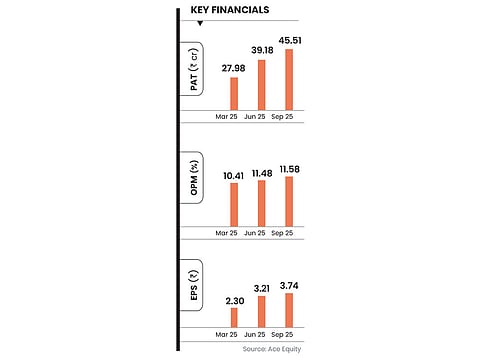

All Right For A Smooth Drive

Pricol is one of India’s leading auto component manufacturers, specialising in instrument clusters and fluid management Systems. Its product portfolio consists of instrument clusters and information display systems that relays information, such as vehicle speed, fuel level, and other emerging features, such as navigation, tyre pressure to the driver of the vehicle.

Pricol holds the largest market share in instrument clusters for two-wheelers, off-road vehicles and commercial vehicles in India. It supplies pumps and modules for fluid management (water, oil, fuel). To further expand its portfolio, Pricol acquired the injection moulding business of Sundaram Auto Components through its wholly-owned subsidiary, Pricol Precision Products (P3L) in January 2025, adding new products, such as dash board assembly, fuel tanks and radiator grill to its portfolio. Pricol has also added disc brakes as a new product line and should see ramp up from FY27.

Pricol is a key supplier to leading domestic auto majors, such as Bajaj Auto, TVS Motor, Hero MotoCorp, and Suzuki in the two-wheeler space; Tata Motors and Force Motors in both passenger (PV) and commercial vehicle (CV) segment; and Ashok Leyland, Volvo Eicher, and Daimler in the CV segment. It also supplies to off highway makers, such as Tata Hitachi, TAFE, JCB and Caterpillar.

Pricol is a supplier to popular models, such as Bajaj Pulsar, Hero Xtreme 125R, Vida V1, TVS Apache, Raider, Ronin, Jupiter, Ntorq, and iQube, Suzuki Access and Burgman, and Tata Punch, Nexon and the new Altroz facelift. Internationally, Pricol also supplies to Volvo Thailand (cars); Harley Davidson, BMW, and Ducati in the US and Europe (motorcycles); and JCB UK, CNH Turkey and Caterpillar USA (off-highway vehicles).

Pricol has also entered into mass production for Honda Motorcyle and Scooter India (HMSI’s) motorcycle models. Yamaha, too, is looking at sourcing from Pricol and commercial discussions are currently underway.

The stock is trading at price to earnings (P-E) of 25.2 times FY27. We expect 31/33/36 per cent CAGR in revenue/Ebitda/PAT over FY25-27, respectively, led by steady increase in content per vehicle, contribution from new product launches and expansion in product offerings through acquisitions. Ebitda is expected to improve during the same period led by increasing share of premium instrument clusters, operating leverage and higher integration.

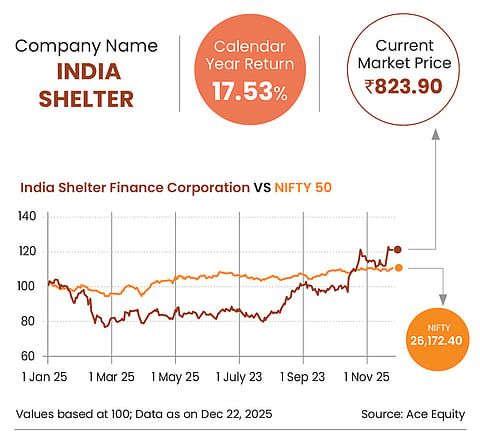

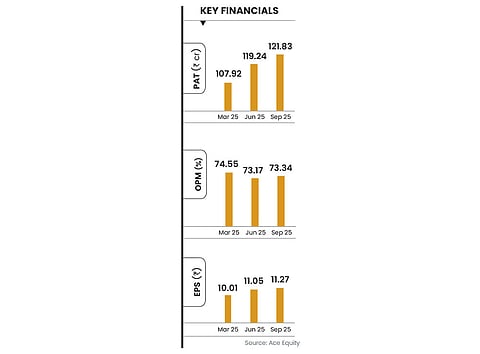

Riding On Expansion In South

India Shelter Finance Corporation is one of the fastest-growing affordable housing finance companies (HFCs) in India, catering to home buyers in tier II and III cities and towns. It operates across 15 states and Union Territories (UTs) with major presence in Rajasthan, Maharashtra and Madhya Pradesh.

WestBridge Capital holds a 46 per cent stake.

The portfolio is focused with 91 per cent of loans sourced from Tier II and III cities, with 75 per cent of customers being self-employed and 71 per cent being first-time borrowers.

As of Q2 FY26, its assets under management (AUM) was Rs 9,252 crore, comprising home loans (57 per cent) and rest as loans against properties (LAP), derived predominantly from Rajasthan (31 per cent), Maharashtra (16 per cent) and Madhya Pradesh (11 per cent). However, the company plans to ramp up operations in Andhra Pradesh, Karnataka, Telangana and Tamil Nadu.

We expect a strong AUM growth of 30 per cent CAGR over FY25-27, aided by healthy disbursement growth of 20 per cent in the same period.

A higher share of LAP helps the company deepen wallet share among self-employed borrowers, who form more than 75 per cent of the borrower base. The company earns 200 basis points (bps) higher yield on the LAP book compared to the home loan book. The company aims to maintain an AUM split of 60:40 of home loans and LAP in the medium term. We expect the net interest margin (NIM) to expand, driven by decline in the cost of borrowings and change in mix towards high-yield LAP segment.

Delinquency metrics have also remained contained due to early warning systems, strong field collection capability and focused borrower engagement. The company has also weathered macro disruptions without material slippage, which highlights its underwriting strength, and strikes the right balance between field-level assessments and centralised monitoring.

We expect Gross Stage 3 to remain in the 1-1.1 per cent range and Net Stage 3 to remain at 0.8 per cent during FY26-27. Credit cost is expected at 50 bps with ramp-up in operations, book seasoning and higher LAP.

RoA remains among the highest in the industry, supported by strong AUM growth (30 per cent-plus), high-yielding loans (40 per cent of LAP portfolio), disciplined credit underwriting, strong pricing power and controlled credit costs (50 bps). RoA is expected to remain above 5 per cent over FY25-27, driven by robust growth, improved operating efficiency and controlled credit costs. Return on earnings (RoE) is expected to inch up to 18 per cent by FY27.

The stock is trading a price to book (P-B) value of 2.4 times FY27. We expect revenue/pre provision operating profit (PPOP)/PAT of 32/30/31 per cent CAGR respectively over FY25-27. We assign a target price of Rs 1,120 based on 3.2 times FY27 P-B multiple, factoring in its superior earnings trajectory, growth story and scalability potential.

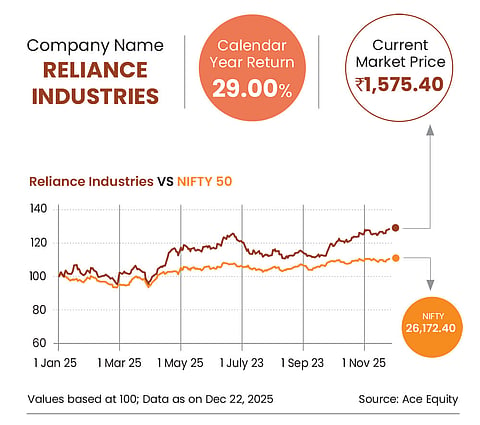

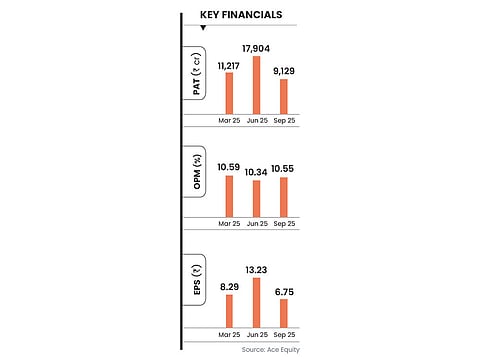

Reliance On Strong Growth

Reliance Industries’ has returned 26 per cent in CY25 year-to-date (YTD) against 9 per cent for Nifty 50 in the same period. This is mainly due to three key factors. One, a sharp jump in petroleum product cracking and the continuation of sanction on Russia, which implies high gross refining margins (GRMs), given the higher demand for diesel during winters in Europe. Two, a retail business valuation of 25 times EV/Ebitda at steep discount to that of D-Mart (which is trading at 42 times FY27 EV/Ebidtda). Three, continued strong earnings momentum in consumer centric businesses. Q3 is seasonally the best quarter for retail business and this time it will have additional benefits of GST cut, too.

Additionally, tariff hike and scale-up in home broadband and enterprise business will support growth in the telecom sector. Lastly, the Jio listing would be the biggest catalyst to re-rate telecom business along with robust earnings growth outlook.

The rally in RIL’s stock price is likely to sustain in our view given near-term tailwinds across businesses due to recent surge in the diesel/petrol/ATF, owing to sanction on Russia which will drive GRMs, retail business that will benefit from GST cuts, the retail performance in Q3 FY26 and the potential telecom tariff hike.

RIL’s earnings growth would be driven by consumer-centric businesses, while commission of new energy business would set the path for growth. RIL has said that new energy business has the potential to generate Ebitda equal to that of the order-to-cash (O2C) business.

On a consolidated basis, RIL is trading at FY27 P-E of 21 times (3-year avg: 24 times) and FY27 EV/Ebitda of 11 times (3-year avg: 11.8 times).

We believe ample catalyst for RIL to outperform due to the above mentioned factors—upside to earnings from recent rise in petroleum product cracks, benefits in retail business from GST cuts and festive demand, and potential telecom tariff hike and likely listing of Jio platforms in 2026.

RIL has the potential to deliver 15-20 per cent earnings CAGR over the next three years, which is much higher than the 12 per cent CAGR for Nifty 50 earnings.

The key risks to look out for are: unexpected decline in refining margins, unexpected fall in petchem Ebitda margins, downside in retail profitability risks and lower average revenue per user (ARPU) and subscriber growth in the telecom sector.

We advise buy on RIL with a target price of Rs 1,700 per share.

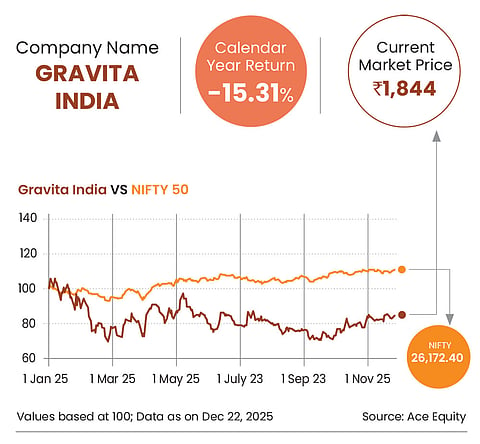

Massive Expansion Drive

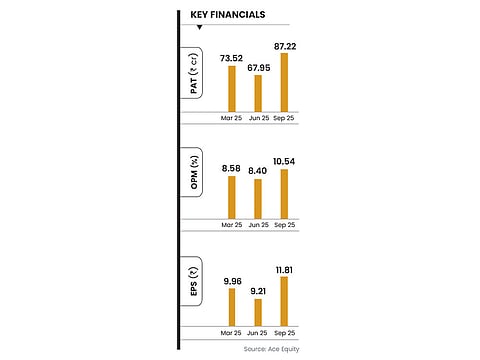

Gravita India is a global recycling and manufacturing company specialising in lead, aluminium and plastic.The company plans to add 130,000 tonnes of new capacity in FY26 with expansion expected to come on-stream from Q3 FY26 onwards.

The company is also targeting to expand overall capacity to 730,000 tonnes by FY28 (CAGR of 30 per cent over FY25-28) with an estimated capex of Rs 1,500 crore (Rs 1,000 crore for exiting verticals and Rs 500 crore for new verticals). The management has said that 15 per cent volume growth is achievable from existing verticals (lead, aluminium and plastics) and 7-8 per cent growth from new verticals in FY26.

Gravita is also net cash positive (Rs 462 crore as on Sept’ 25), and is exploring inorganic opportunities in Eastern Europe, the Middle East, and Asia Pacific for existing verticals. In FY25 Gravita had acquired a waste tyre recycling plant (18,000 tonnes capacity) in Romania through its subsidiary Gravita Netherlands BV (GNBV stake at 80 per cent and investment of Rs 32 crore). The management has said that rubber vertical (Rs 3-4 billion in revenues expected by FY28) is likely to be the key growth driver for the company over the next couple of years.

However, the stock is down 16 per cent in CY25 YTD despite strong earnings growth in FY25 and H1 FY26. The management has maintained its volume/PAT CAGR guidance of 25/35 per cent over FY25-29. Post this, the valuation is reasonable at 26 times FY27 EPS given our expectation of 29 per cent earnings CAGR over FY25-27.

Gravita has also achieved volume/Ebitda/PAT CAGR of 18/38/56 per cent, respectively, over FY21-25, and average RoCE of 24.6 per cent over the same period.

Strong track record, capacity expansion, regulatory tailwinds in lead and likely listing of aluminum alloy on the Multi Commodity Exchange (MCX) makes us optimistic that management guidance is achievable, though there may be variance in quarterly performance.

The key risks to look out for are: impact on volume from any logistics disruptions, delay in ramp-up of new capacities, volatility in aluminum price, which could impact margins in the absence of back-to-back hedging mechanism, and country-specific risk given large overseas capacities.

We believe that regulatory tailwinds in the domestic lead recycling space, aluminum alloy listing on MCX, (which is under process) and expansion into new verticals would drive high double-digit earnings growth. The company has massive capacity expansion plans to diversify earnings from non-lead business/improve value added products (VAP) mix (30 per cent+/50 per cent share), which will likely drive strong 29 per cent PAT CAGR over FY25-27.

We recommend buy with a target price of Rs 2,260 (32 times FY27 EPS). At present, the stock is trading at 33/26 times FY26/FY27 EPS.

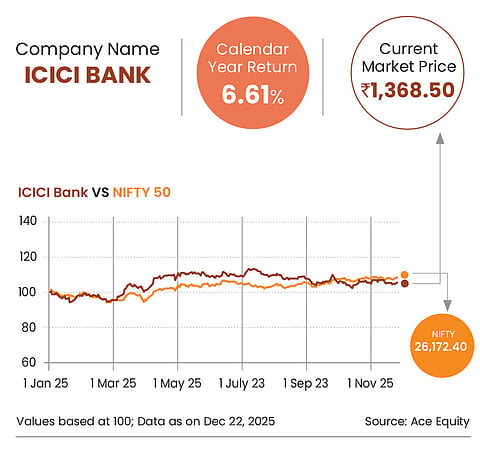

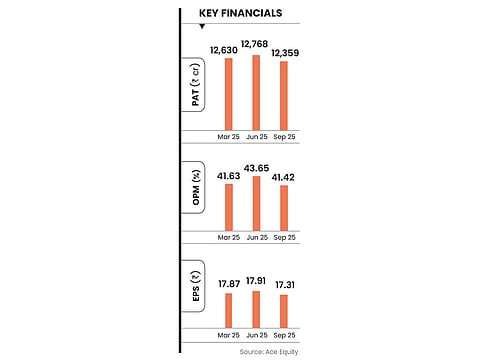

Banking On Loan Growth

ICICI Bank is among India’s most structurally strong private banks, backed by consistent financial performance, superior risk management, and a well-diversified business franchise. It has built a high-quality balance sheet over the years, reflected by stable margins, asset quality, and industry- leading return ratios.

Although loan and deposit growth moderated this quarter, its NIM was healthy at 4.30 per cent, driven by the bank’s strong liability franchise, retail deposit base, and high proportion of floating-rate loans, which allowed it to quickly transmit rate movements. Fee income trends are equally encouraging, supported by diversified retail fees on cards, distribution income, and transaction banking, which provides a strong cushion in periods of slower credit growth.

The bank reported GNPA at 1.60 per cent, with credit costs contained at 0.30 per cent, among the best in the industry. Recoveries remain strong, and provisioning levels conservative with a large contingent provision buffer. These ensure that the bank is well protected even if macro conditions worsen. Slippages remain controlled, and the bank continues to see steady improvement across most stressed portfolios. There has also been a steady reduction in corporate NPAs over the years.

Business banking continues to grow at 25 per cent year-on-year (y-o-y), supported by increasing penetration in SMEs and better cross-sell opportunities. The mortgage portfolio also remains strong, driven by stable demand for home loans in urban areas and among salaried segments. Credit cards are also seeing renewed traction due to expansion of consumption and digital payments.

While operating expenses remain elevated due to investments in technology and distribution, this is expected to deliver long-term benefits in customer acquisition, cross-selling and risk monitoring.

Return on equity (RoE) remains strong at 16 per cent, reflecting efficient capital utilisation and sustained profitability. While there has been some investor concern around top-level management transitions, the depth of the leadership bench, and long-term strength of the franchise mitigate the risk.

The stock is trading at 3 times FY27 P-B, which is reasonable given its consistent earnings, superior asset quality, and strong outlook for steady compounding over the medium term. The bank is well-positioned to benefit from improving system liquidity, pickup in loans, and overall macro stability.

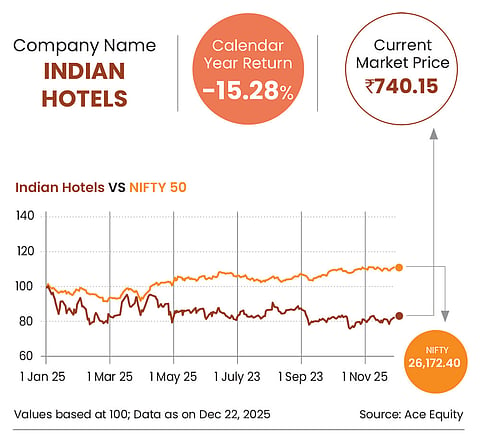

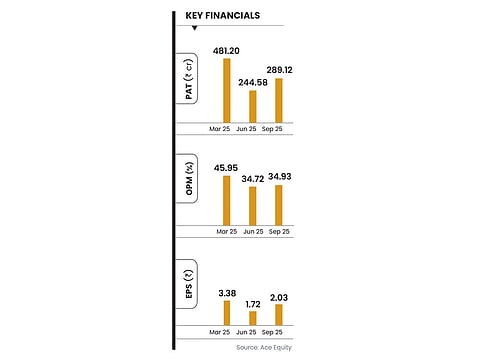

Adding More Jewels To Taj

IHCL remains the largest player in India’s hospitality sector, supported by its extensive presence across mid-to-premium segments and strong positioning in business and leisure destinations. FY26 has continued to show healthy momentum despite some demand moderation due to extended monsoons.

It operates 28,300 keys (rooms)—14,800 owned and 13,400 managed—and plans to add another 22,000 over the next 4-5 years. In H1 FY26, it signed 32 new hotels and entered sales/distribution agreements for 14 hotels with Brij and UP Hotels. Also, 151 keys at Ginger Ekta Nagar and 127 keys at Vivanta Ekta Nagar became operational in October 2025. Upcoming additions include Taj Frankfurt (126 keys) and a 100-key expansion at Taj Ganges in Q4 FY26, followed by the opening of Ginger Goa–MOPA Airport (275 keys), 100-key brownfield expansion in Lucknow in FY27, and Taj Pushpabanta Palace, Agartala (100 keys) in FY28. Other owned and leased assets under development include Taj Lakshadweep (180 keys), Taj Shiroda (300 keys), Taj Ranchi (200 keys), and Gateway at Aguada Plateau, Goa (110 keys). IHCL has also secured approvals for the new Bandstand hotel (450 keys), with excavation already underway.

Over the next 5-6 years, the company plans to add 22,000 keys (4,000 owned and 18,000 managed keys).

IHCL has also signed agreements to acquire a 51 per cent stake each in ANK Hotels and Pride Hospitality, which together operate 135 hotels with 6,800 keys across 100 locations under The Clarks Hotels & Resorts brand. About 70 per cent of the acquired portfolio is located in new geographies, which will help broaden IHCL’s market presence. Notably, these keys are incremental and are not included in IHCL’s existing 22,000-key development pipeline.

IHCL reported soft performance in Q2 FY26, with consolidated revenue up 12 per cent y-o-y and Ebitda rising 14 per cent y-o-y, resulting in an Ebitda margin of 27.90 per cent, compared to 27.50 per cent in Q2 FY25. Adjusting for the consolidation of Taj SATS, revenue and Ebitda grew 6 per cent and 9 per cent y-o-y, respectively.

IHCL also reported a flat Q2 FY26 average room rate (ARR) of Rs 14,200 per day and steady occupancy at 78 per cent, resulting in a revenue per available room (RevPAR) of Rs 11,100 per day. On a consolidated basis, RevPAR growth remained muted. However, business has rebounded in Q3 FY26 and IHCL expects a strong performance in H2 FY26.

As of September 2025, IHCL held Rs 2,850 crore in gross cash. For FY26, the company has guided for Rs 1,200 crore in capex, with 60-65 per cent allocated to renovation and maintenance, and the rest towards growth. Over the next 4-5 years, IHCL expects cumulative capex of Rs 5,000 crore. The management anticipates healthy double-digit revenue growth in FY26 and beyond. IHCL is positioned to benefit from the favorable demand-supply in the hotel sector.