Shares of National Securities Depository Limited (NSDL) continued their strong post-listing rally for the fourth straight session on August 11, 2025. The stock, which debuted on the BSE on August 5 at Rs 880, a 10 per cent premium over its issue price of Rs 800, has now surged over 78 per cent from the issue price and 62 per cent from the listing price.

SBI, IDBI Bank And Other Pre-IPO Investors Mint Up To 711x Returns With NSDL

Early investors in NSDL, including SBI and HDFC Bank, have seen staggering returns. Some have multiplied their investments by up to 700 times post-listing

In today’s session, NSDL shares touched a record high of Rs 1,425 apiece, up 9.6 per cent intraday.

This stellar rally has turned NSDL into one of the most successful initial public offerings (IPO) of the year, turning a goldmine for particularly for early institutional investors some of whom are now sitting on 700x gains from shares acquired at just Rs 2 each.

SBI, IDBI Bank, SUUTI Lead the Pack

One of the biggest beneficiaries of this rally is the State Bank of India (SBI). The country’s largest public sector lender had bought 6 million shares, or a 3 per cent stake, at just Rs 2 each, for a total investment of Rs 1.2 crore. At the intraday high of Rs 1,425 apiece, that investment is now worth Rs 854 crore, an unbelievable return of 71,150 per cent. In other words, for every Re 1 invested, SBI has gained over Rs 711.

IDBI Bank too had bought nearly 3 crore NSDL shares for Rs 5.99 crore, and now those are valued at over Rs 4,266 crore. This again represents a 711 bagger and over Rs 4,260 crore of profit.

IDBI Bank has seen an even larger notional gain due to its bigger holding. The lender had picked up 2.998 crore shares, or 14.99 per cent stake, at Rs 2 apiece, investing Rs 5.99 crore. At the intraday high, that stake is now worth Rs 4,272.15 crore, resulting in a profit of over Rs 4,266 crore and matching SBI’s return of 71,150 per cent.

Another standout from NSDL’s pre-IPO investor list is state-owned Specified Undertaking of Unit Trust of India (SUUTI), which had acquired 1.0245 crore shares, or 5.12 per cent stake, at Rs 2 each, with an investment of Rs 2.05 crore. This investment has now ballooned to Rs 1,458.57 crore, delivering a 711-bagger return and a notional profit of Rs 1,456.52 crore.

NSE, HDFC Bank, Union Bank Too Sitting With Multi-bagger Gains

Even institutions that entered at higher prices have seen eye-popping gains. The National Stock Exchange (NSE), which held a 24 per cent stake in NSDL before the IPO, sold 9 per cent during the public offering and retained 15 per cent, or 2.99 crore shares. NSE’s average acquisition price was Rs 12.28 per share, bringing its investment to Rs 36.84 crore. At the current price, the retained stake is worth Rs 4,238.16 crore, resulting in a profit of Rs 4,201.32 crore, a 115-bagger or 11,404 per cent return.

Among the surprising outperformers is Union Bank of India, a PSU lender that bought 51.25 lakh shares, or 2.56 per cent stake, at Rs 5.20 per share, with an investment of Rs 2.66 crore. Its stake is now valued at Rs 727.64 crore, delivering to a notional profit of Rs 724.98 crore, a 27,248.87 per cent return, or a 273-bagger.

Private lender HDFC Bank too made significant gains. It acquired 1.38995 crore shares, or 6.95 per cent stake, at an average price of Rs 108.29 per share, for a total investment of Rs 150.54 crore. HDFC Bank’s holding as now swelled to Rs 1,980.41 crore, yielding in a notional profit of Rs 1,829.87 crore and a return of 1,115.90 per cent, or an 11x gain.

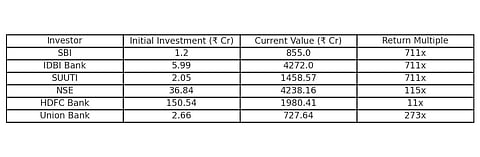

Here's a round-up of NSDL's pre-IPO investors current portfolio value and their initial investments.