When the Indian stock market saw a sudden boom post the Covid 19 pandemic, so did the number of investors. This was the period when more and more people became comfortable with using smartphones, and brokerage apps simplified the demat account opening process. Incidentally, the number of demat accounts has jumped from 39.3 million in 2019 to 192.4 million today—a four-fold growth in just five years.

Big Losses In The F&O Game Of Quick Gains

For many small traders, the lure of quick profits in Futures and Options (F&O) is hard to resist. But the reality is far more challenging and ridden with risks

Markets and businesses celebrated this peaking interest of retail investors in the markets.

However, there was a small problem. Among the new investors, a large chunk constituted of people who were big on aspirations, but small on cash. This set of investors was drawn to futures and options (F&O) trading, tempted by the idea of turning small sums into big profits.

Says Sahaj Agrawal, senior vice president and head of derivatives research, Kotak Securities: “While derivatives have long been a part of the financial landscape, the post-Covid period saw an unprecedented surge in retail interest, particularly in F&Os. Derivatives, by design, serve purposes, such as hedging, arbitrage, and active trading. However, the current retail participation is overwhelmingly skewed toward speculative activity.”

While the idea of making huge profits through F&Os seems promising, the reality is challenging, to say the least. That’s because F&O trading involves speculation, which makes it highly risky. The lure of high returns often blinds novice investors to the risk they face. Besides, the process can be very complicated for retail investors, who end up with losses in most cases.

The idea of making huge profits through F&Os seems promising, but the reality is challenging. F&O trading involves speculation, which makes it highly risky

According to a study by the capital markets regulator, the Securities and Exchange Board of India (Sebi), released in 2024, 91.1 per cent of individual traders (around 7.30 million traders) lost money in the F&O segment in FY24. Only about 1 per cent of individual traders earned profits exceeding Rs 1 lakh after adjusting for transaction costs.

The worrying part is that over 75 per cent of individual F&O traders (6.54 million traders) in FY24 reported an annual income of less than Rs 5 lakh. The proportion of low-income traders (earning less than Rs 5 lakh annually) increased from 71 per cent in FY22 to 76 per cent in FY24.

Despite these staggering statistics, the number of younger and smaller traders is still on the rise. More than 75 per cent of loss-making traders continued trading in F&O, despite experiencing losses in the previous two consecutive years (FY22 and FY23), the study showed.

Though the current market volatility has put a spanner on optimism over the possibility of making high returns, F&Os still charm risk takers. In fact, the intent to average out the losses already made in the market may be a driving factor to resort to F&Os.

What comes in the wake of such risk-taking behaviour is individuals staring at huge losses and losing the opportunity of making returns by sticking to other instruments, or following a saner marketing strategy. We try and understand what draws retail investors to F&Os, the common mistakes they make, and what they should know before entering this dangerous terrain.

The F&O Draw

One of the biggest factors that draws investors to F&Os is the possibility of making quick money. Investors who do not understand or know about the risks involved may see it as a source of creating a side income or just a bonus amount for discretionary spends.

Manish Kumar, 30, a Noida-based actuary at a private firm, entered the F&O market in the latter half of 2020 “to make quick money”.

“I didn’t have a big target, like becoming a crorepati overnight. My target used to be very small, like if I made a profit of Rs 500 or even Rs 300 in a day, that was enough. And I thought if I consistently did this, it would create a side income for me.”

The markets were on a high when Manish entered in 2020 after touching dismal lows earlier in the year, and he came out with a profit, though a rising market is no guarantee for making profit, as he experienced later. His second brush with F&Os was not that smooth; he traded in F&Os in two-three phases between 2020 and 2024. However, it was only in the first phase that he made a profit.

According to information shared by Bajaj Broking Research with Outlook Money, “The influx of small traders into F&O markets has been supercharged by social media and financial influencers, or finfluencers. Post-Covid in 2020, when regulatory oversight of financial content was minimal, social media platforms like YouTube, Instagram, and X (formerly Twitter) were flooded with success stories of F&O traders boasting extraordinary profits.”

It adds, “These narratives triggered a powerful Fear Of Missing Out (FOMO) narrative among novice investors, driving many to enter the market unprepared. Financial influencers often exaggerated returns, downplaying risks, and created a misleading impression of F&O trading as an easy path to riches. This influx of inexperienced traders has directly contributed to the high loss rates highlighted by Sebi.”

Recognising the dangers of such mis-selling, Sebi has taken several actions to regulate finfluencers ever since. For example, in mid-2024, Sebi prohibited regulated entities—such as brokers, mutual funds, and investment advisers—from associating with unregistered finfluencers who provide financial advice or make performance claims without Sebi registration. This includes bans on monetary transactions, client referrals, or any promotional collaboration.

More recently, in January 2025, Sebi escalated its crackdown by banning finfluencers from using live stock market data (or data from the preceding three months) in educational content, aiming to prevent real-time trading advice disguised as education. Unregistered finfluencers are also barred from offering specific stock recommendations or implying future price movements, with violations potentially leading to penalties, registration cancellations, or market bans.

Another aspect that attracts investors is the possibility of spending less but earning big.

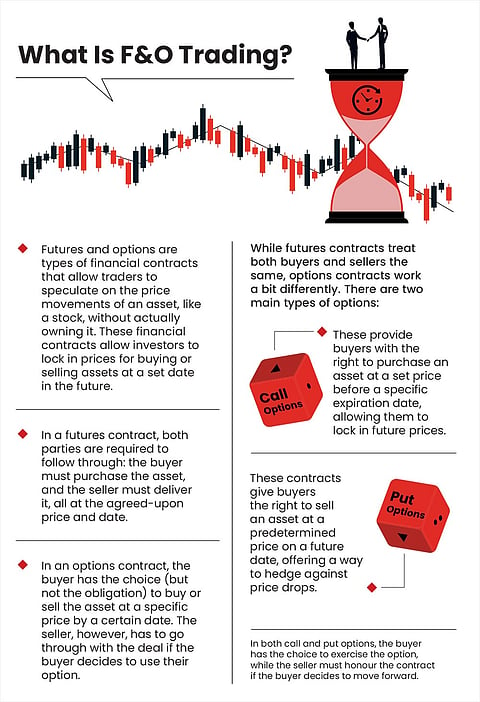

The way F&O works is that you only pay a premium (based on the current market price of the stock) on the basket of stocks (lot size) on which the contract is based, and not the full stock price.

The premium amount can go up and down, depending on how close the lot price reaches or drifts away from the strike price, which is what you speculate at the beginning of getting into a contract. Your profit or loss is the difference between the premium you pay and the current market price of the contract.

However, some investors look at buying large contracts to make bigger profit. For this they often depend on leverage or loans to fund the bigger buy, hoping they will come out with enough profit to pay off the loan.

Says Agrawal: “One of the biggest draws for small traders is the seemingly low capital requirement to enter positions, thanks to leverage. This creates an illusion of affordability and the lure of multiplied returns, pulling in many new and inexperienced participants.”

The more aggressive the trader, the more likely they are to embrace leverage—amplifying both potential gains and potential risks, he adds.

Since these are usually monthly contracts, the lure of making quick gains, of course, attracts many investors.

The F&O Challenge

Trading in F&Os presents a twin challenge. One, it is a complicated exercise and you would need to be able to decode market jargons to understand it. Two, market and stock movements depend on various domestic and international factors, and predicting a rise or fall of a stock is next to impossible. Even seasoned experts caution against speculating, which is at the core of F&O trading.

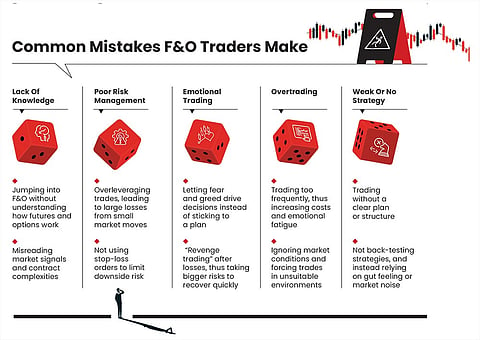

In case you are confident about overcoming the second challenge, it is important to have a strategy in place. Agrawal of Kotak Securities says the most fundamental mistake traders make is entering the market without a clear, structured method for selecting trades. “Whether in the cash market, equity derivatives, or commodities, success requires a well-defined, thoroughly tested strategy that provides a statistical edge. Without this, trading becomes a matter of chance rather than skill,” says Agrawal.

It is important to understand the workings of the F&O market. Recalling one of his ordeals, Manish says, “One day, I placed a trade on a Thursday, not realising it was the expiry date. I thought things would work out in my favour by the evening, but due to time decay, its value dropped to nil.”

For those unfamiliar with the concept, time decay refers to the gradual loss of an option’s value as its expiration date approaches. The closer the expiration, the faster the option’s value decreases, especially if the underlying asset doesn’t move in a favourable direction.

Manish also experimented with paper trading. He would create Excel sheets, simulate buying and selling options in real time, and check later to see if he made a profit. However, he didn’t pursue this practice for long because it was time-consuming, and he had his job responsibilities to manage as well.

“When you start making money with a particular strategy, it creates the illusion that it will be easy to keep making more, but the truth is that the same strategy doesn’t work every day,” he says. “The strategy that worked for me at first ended up causing bigger losses in my later trades,” he adds.

Leverage, of course, is a slippery slope. For Ashu Agarwal, 30, who is self-employed and lives in Delhi, trading in F&Os has been a traumatic experience. He has lost up to Rs 25 lakh in F&O trades between FY21 and FY24. What led to Ashu’s losses was the lack of understanding of how options and leverage work. “The concept of leverage was something I didn’t fully grasp,” he says.

Says Agrawal: “In the pursuit of quick profits, many novice traders over-leverage their positions, exposing themselves to outsized risks that their capital cannot absorb. A lack of discipline compounds these risks. Every strategy, no matter how robust, will face periods of underperformance. Staying committed to the process, especially during challenging market phases, is critical to realising long-term success.”

The Behavioural Challenge

The most dangerous aspect of F&O trading is the addiction or the behavioural trap that gives the false illusion that the next trade will smoothen things out.

Alok Dubey, certified financial planner (CFP) at Prime Wealth, says, “What many mistake for ‘research’ is often borrowed conviction from watching YouTube channels, following social media gurus, or joining WhatsApp and Telegram groups. This creates an illusion of expertise without any actual understanding of option pricing models and derivatives. Unfortunately, for most retail traders lacking proper knowledge and discipline, F&O trading functionally becomes indistinguishable from gambling.”

Ashu is not trading in F&Os for now, but he still feels that reading up more about it can make a difference in the future. For now, he invests in stocks and mutual funds. “I am still reading about F&O, and I may go back to it in the future, though I am not sure when,” he says.

Manish recalls that the more he lost during his second and third attempts to make quick money in the F&O market, the more risks he took in a bid to recover his previous losses. “When my losses crossed Rs 5,000, I started taking even bigger risks, thinking I needed to at least recover my initial amount. In that rush, I ended up making some poor trades, rushing my decisions, and trading under a lot of stress,” says Manish.

Manish’s attempt to recover his losses only resulted in more setbacks. “In an attempt to recover those losses, I took more trades, but things never turned around; I just kept losing more,” he adds.

Eventually, his entire initial capital (around Rs 40,000) was wiped out, and he lost the confidence to invest in F&Os. Now he stays away from F&O trading.

Ashu sums it up: “You need to have patience and need to know when to cut your losses. Don’t let your ego fool you into thinking the market will turn in your favour. What starts as a Rs 10,000 loss today can become Rs 50,000 or Rs 5 lakh in no time, and you won’t even realise how it is slipping away.”

The first biggest loss he made in a single trade was in options, where he lost around Rs 5 lakh during a monthly expiry.

“I wasn’t aware what it is. I never expected it to go down to nil, but when it started going down, that’s when the fear triggered. I was extremely stressed. I lost my capital of Rs 5 lakh in a single day. That was extremely difficult,” he says.

Institutional Edge Over Retail

Mostly, the gains we see in the F&O segment is driven by institutional investors who have the wherewithal to handle such trades.

Institutions enjoy significantly lower transaction costs due to economies of scale, bulk trading, and better brokerage deals.

Says Ravi Singh, senior vice president, retail research, Religare Broking: “Institutional traders have a clear advantage over retail traders in the F&O segment due to superior technology, lower costs, and disciplined strategies. Proprietary traders and foreign portfolio investors (FPIs) earned Rs 33,000 crore and Rs 28,000 crore, respectively, in FY24, while retail traders collectively lost over Rs 61,000 crore before transaction costs.”

According to the Sebi’s research, nearly 89 per cent of active retail traders in the F&O segment ended up losing money in FY22, and more than 75 per cent of them kept on trading despite the losses. On average, each retail trader lost around `1.10 lakh, while those who did turn a profit made relatively modest gains of about `45,000.

Singh adds: “Moreover, institutional players avoid the behavioural pitfalls—like overconfidence and anchoring bias—that trap retail traders. The combination of advanced tools, cost efficiency, and rational decision-making gives institutions a structural advantage in F&O markets.”

Another advantage that institutions enjoy is algorithmic trading. Singh says 96 per cent of proprietary trading profits came from such strategies, which are faster, data-driven, and emotion-free. In contrast, only 13 per cent of retail traders use algo trading.

There’s more. Says Naman Shah, senior vice president, head sales, Ohm Dovetail, a clearing member: “Institutional traders—including hedge funds, proprietary desks, investment banks, and high networth individuals (HNIs)—operate with a multi-faceted advantage that makes it nearly impossible for the average retail trader to compete on equal footing.”

He adds: “Institutions have access to real-time market feeds with microsecond latency, high-frequency trading algorithms, lower brokerage rates, hedge with options, volatility spreads, and direct market access (DMA). In contrast, retail traders rely on delayed data, higher per-trade costs, frequent slippage, basic indicators, or crowd-sourced tips from social media, which is a dangerous way to trade a leveraged product.”

F&O trading is risky for retail investors as they usually do not have access to information and infrastructure advantages that institutional investors have

What Should You Do?

F&O trading is risky for retail investors as they may not have the information, infrastructure and other advantages that institutional investors have access to.

Says Agrawal: “Emotional decision-making, overtrading, neglecting stop-losses, and operating without a structured game plan often accelerate capital erosion. Ultimately, successful trading is not just about capturing profits in favourable conditions, it’s equally about preserving capital and navigating the inevitable rough patches with resilience and discipline.”

According to Bajaj Broking Research, retail investors, who want to go ahead with F&O trading despite the risks, need to keep four things in mind.

First, they need to master the technical complexity of derivatives—concepts like margin requirements, volatility, and option pricing. Unlike traditional equity investments, F&O demands serious effort to achieve even basic proficiency, an important step many retail traders skip in their rush to trade.

Second, they must recognise the competitive landscape. The market pits small players against institutional heavyweights who have cutting-edge tools and decades of experience. The rare cases of option buyers reaping exponential profits are exceptions, not the rule.

Third, traders should adopt a disciplined mindset over speculative impulses. Hedging—the original purpose of derivatives—requires strategy and patience, and contrasts sharply with the get-rich-quick mentality.

Fourth, small traders must be wary of finfluencers. Sebi’s restrictions—such as requiring influencers to register with the regulator if they provide advice, and mandating disclaimers and credentials in their content—aim to ensure transparency. However, unregistered influencers still pose risks, and traders should verify the credibility of any advice they encounter.

Says Agrawal: “Investing and trading are fundamentally different approaches to market participation. Investing demands patience and a long-term mindset, whereas trading often appeals to those with a higher risk appetite and a preference for immediate action.”

It is worth keeping in mind that even informed retail investors may be better off sticking with mutual funds and stocks, bought in line with their needs and long- and short-term goals. Even to invest in these regulated instruments, you may need expert advice from professional advisors.

rishabh.raj@outlookindia.com