After an exhilarating rally till September 2024, the Indian stock market is going through turbulent times. Both the Sensex and the Nifty are down by 9.08 per cent and 10.02 per cent, respectively, as on December 20, 2024, showing a sharp reversal from their recent highs (as on September 26, 2024). It’s not just the external factors that are weighing heavily on Indian equities, even company fundamentals are playing a role.

Volatility Ahead: Play Safe

After an exhilarating rally till September 2024, the Indian stock market finds itself in turbulent waters and is expected to continue to do so in 2025. We give you some stock picking strategies that will help you play safe. We also have a list of 10 stocks recommended by experts which you can consider for your portfolio

The primary culprits behind this sharp correction appear to be disappointing corporate earnings and flight of foreign portfolio investors’ (FPIs) money. According to Crisil research, “Domestic financial markets have been facing pressure from FPI outflows since October.”

For the first time in over four years, top Indian companies have reported their weakest quarterly performance ending September 2024, raising alarm bells about a potential economic slowdown. Around 40 per cent of the 50 companies in the Nifty 50 index have either posted negative or muted growth in the last quarter ending September 2024, according to data from trendlyne.com, a stock analytics firm. To be precise, 16 of them have posted negative profit growth and four neutral profit growth rates. The numbers suggest that high interest rate, lower demand, and muted government and private capital expenditure may have already begun to dent corporate profitability, leaving investors on edge.

Says Ruchit Mehta, head of research at SBI Mutual Fund: “The year 2025 can be volatile, like we have seen in the past few months. For markets to deliver double digit returns, earnings growth has to sharply rebound from the current sluggish levels. This would need revenue and sales momentum to recover and be the primary driver of earnings growth. We could see revenue growth momentum recovering, as economic growth pulls through from the current slow phase, in the second half of 2025.”

The Nifty price-to-earnings (P-E) ratio which peaked to 24.38 on September 16, 2024, when the Nifty was trading above 26,200, has fallen to 21.71 as on December 20, 2024, down by 11 per cent. The other market segments are showing similar trends. Some of the top stocks have corrected over 25-30 per cent from their peaks.

Clearly, 2025 could be challenging. You need to have a neatly-crafted portfolio to ride the market. “The year 2025 is for recalibration. Precision in strategy is crucial,” says Somnath Mukherjee, chief investment officer and senior managing partner, ASK Private Wealth.

Stock Strategies

Given the volatility in the market, it is important for investors to play it safe. “Investors should focus on quality and growth factors, which have historically demonstrated resilience in challenging conditions,” says Mukherjee.

Besides, unrealistic return expectations can be a risk factor. Says Mehta: “After the success of the last three years, there is a need for investors to adjust expectations. It is unlikely we will see strong returns that we saw in recent years.”

If you want to be a winner in the stock market game, here are some tried and tested strategies to follow.

Go Long-Term: Over the last 20 years, the Sensex appreciated 13 per cent a year, way above inflation. Some of the sector indices such as Nifty Bank, Auto, FMCG delivered a little over 16 per cent in the last 20 years. You could achieve such returns, too, if you focus on the long term, buy fundamentally strong companies, and wait for them to appreciate.

Over the long term, equities will remain the best means for compounding capital.

Says Mehta: “What happens in the shorter term, as in just one calendar year, is uncertain and difficult to predict. From a valuation and sentiment perspective, there appears to be froth in the broader market, which can act as a headwind going ahead.”

You should accumulate small chunks of good companies every now and then, rather than putting all your money in one go. Buy stocks every time they dip or fall, or when they look attractive. Over 15 years, an investment of Rs 10,000 a month that returns 15 per cent per annum accumulates to about Rs 66 lakh. But over 25 years, it nearly quintuples (increases five times) to Rs 3.2 crore.

Ride Twists And Turns: The volatile nature of the stock market can make you jittery. But volatility lasts only for the short term, depending on news flows and trends. In the long run, if you purchase good companies that are growing their businesses, volatility evens out.

The constant news flow, good or bad, impacts prices. Government policies and regulations also affect them. The key is to not get ruffled by such developments, but keep an eye on the far shore. Avoid the “noise”, the crashing waves, the turbulent winds, and focus on the essentials. Keep an eye out for material developments that can change the course of the long-term direction of your investment. Broadly, forget the stock market turbulence and focus on the long-term goal of accumulating.

Look For Outliers: While buying stocks for the long haul, don’t forget to check whether they have the potential to deliver returns. You wouldn’t want to buy stocks that go nowhere, or one that grows fast in the first decade and then stumbles.

Focus on buying companies that can last for decades and are highly competitive in their fields. Only those that have a competitive edge will outperform the rest.

Add Bruised Blue Chips: Motilal Oswal Financial Services came up with 29th Annual Wealth Creation Study, 2024 on December 10, 2024, titled Creating Wealth through Bruised Blue Chips, which suggests that occasionally, even blue-chips get “bruised” and their stock price sees a meaningful fall.

Such bruising offers opportunity to build large positions in a stock. The study highlights that even a bruised blue-chip company could be a rewarding investment option if it is fundamentally strong and you hold it for the long term.

One of the classic examples in this category is Bharti Airtel. Reliance Jio’s entry into the telecom sector caused Bharti Airtel to get bruised. The stock which was trading at a high of Rs 508 in 2018 reached a low of Rs 251 in 2019. The market price has now reached around Rs 1,500.

“A sector’s competitive landscape changes adversely when new players enter the arena, especially those with deep pockets. This impacts financial performance of incumbents, driving down profits and profitability, in turn, causing even blue-chips to get bruised,” the report says.

Diversify To Minimise Risk: Diversification is the best bet to offset market volatility. “Diversification and disciplined portfolio construction are key, as markets face opportunities and risks,” says Mukherjee.

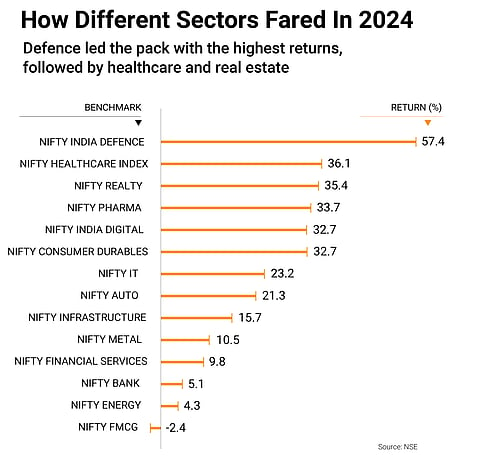

Sometimes stocks or entire sectors take a pounding from an unfortunate incident (see How Different Sectors Fared In 2024). A portfolio largely exposed to such an event could slip into the red and erode returns.

Going for up to 15-20 high-quality names should be your first aim. Do not exceed 25 stocks for ease of management and review. Hold around 4-10 per cent in each depending on where you position your portfolio. Ensure that no stock exceeds 10 per cent of your portfolio value. When the stock market turns nasty and a stock that constitutes 10 per cent of your portfolio goes belly up, 90 per cent of the portfolio would still remain unharmed.

Keep An Eye On Numbers: Watch for growing sales figures and rising earnings. Use valuation metrics such as P-E ratio to decide when to buy a stock, and metrics, such as return-on-capital-employed (ROCE) to decide if such stocks are investment worthy in the long term.

The Solution

To make your life easier, we approached top investment experts and managed to convince them to sift through the large universe of stocks and recommend a few for you.

The suggested stocks are from a variety of sectors, but two of the 10 are from banking, and one is from defence, which was a darling in 2024.

The recommendations are long-term bets and should not be assessed from the lens of short-term volatility. Read the analysis, but look at their suitability for your portfolio before making any decision.

Consult an advisor if need be.

kundan@outlookindia.com