Before putting money into mutual funds, most investors take a look at past returns. But here’s the tricky part: returns can be measured in more than one way, and each method tells a slightly different story. One of the most frequently used metrics is the Extended Internal Rate of Return (XIRR) and the Compound Annual Growth Rate (CAGR). Both are popular. Both are useful. But they are not interchangeable, and choosing the wrong one can distort the real picture of your investment.

What is XIRR? Its Calculation, And Difference from CAGR in Mutual Fund Returns

When it comes to tracking mutual fund performance, two measures often come up: XIRR and CAGR. XIRR is the go-to tool for SIPs or any investment with staggered or irregular cash flows, while CAGR works best when you’ve invested a lump sum and want to see how it has grown over time

What is XIRR?

XIRR, or Extended Internal Rate of Return, is built for real-world messiness. Investments don’t always flow in neat, equal chunks. Systematic investment plans (SIPs), top-ups, partial redemptions, and sudden withdrawals create irregular cash flows. XIRR accounts for that chaos.

It calculates the annualised return by looking at each inflow and outflow, alongside the exact dates. In other words, it respects time and money together. If Rs 10,000 goes in every month, but one month you skipped or another month you added more, XIRR adjusts for it.

XIRR is not a random guess; it reflects both timing and cash flow, making it closer to how the investment really behaved.

How to Calculate XIRR With Example

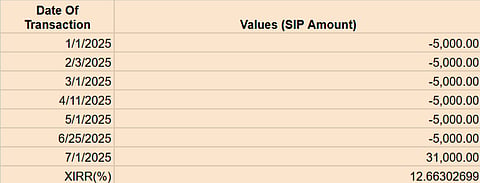

Illustrative Example: If you invested every month in mutual funds via SIPs, a sum of Rs 5000 for 6 months.

In Excel, the formula is simple:

Values = your cash flows (negative for investments, positive for maturity amount)

Dates = the exact dates of those transactions

Step-by-Step: Calculating XIRR in Excel

List your transactions

In Column A, enter the dates of your investments and the date of your redemption.

In Column B, enter the amounts. Put a minus sign before investments (outflows) and keep the collected amount (inflows) positive.

Add the current value

If you haven’t redeemed everything, add today’s date and the current value of your investment as the final inflow.

Run the XIRR function

In an empty cell, type: =XIRR(B1:B7, A1:A7)*100

Example: SIP of Rs 5,000

Let’s say you invest Rs 5,000 each month from January to June 2025, and you redeem everything in July for Rs 31,000.

What is CAGR?

CAGR, the Compound Annual Growth Rate, may look simpler but it does not show the entire picture and sometimes it can be superficial. It assumes the investment grew at a stable rate from start to finish. One investment goes in at the beginning, the redemption comes out at the end. CAGR links those two dots in a smooth line, regardless of what happened in between.

For instance, if someone invested Rs 1 lakh in 2017 and it doubled to Rs 2 lakh in 2022, CAGR tells us the annual growth was 14.87 per cent. That’s neat, easy to grasp, and perfectly valid but only when the investment was a lump sum. If there were multiple deposits and withdrawals along the way, CAGR fails to capture reality.

XIRR vs CAGR: The Core Difference

The difference between XIRR and CAGR In Mutual Funds:

XIRR deals with irregularity, multiple transactions, and exact dates.

CAGR is useful when money goes in once and comes out once, simple start, simple finish.

But when investors deal with SIPs, top-ups, or partial withdrawals over time, CAGR falls short. That’s where XIRR does a better job, since it accounts for multiple cash flows. In short, use CAGR for lump sum investments or long-term benchmarks with fixed cash flows, and XIRR when money moves in and out at different points.

XIRR is usually recommended for calculating returns from periodic (non-lump sum) investments such as SIP. CAGR is most effective when measuring the growth of a lump sum investment in mutual funds. In simple terms, it shows how much the investment has grown on average each year, smoothing out the ups and downs of the market.

Where CAGR measures the annualised compounded return on investment for a certain period, XIRR measures the average return earned by the investor after factoring in periodic cash flows separately during the stipulated period.

Advantages and Limitations of XIRR

Advantages

It tracks the real conduct of SIPs by accounting for dates along with cash flows.

Factors in the time value of money are unlike crude averages.

Helps compare different investment avenues, such as equity, fixed deposits, and real estate, on fairer terms.

Portfolio monitoring is purposeful when there are various funds and non-uniform activity.

Limitations

Data input needs to be precise. The results can be distorted even by small errors in dates or amounts.

Very sensitive. A minor change can swing numbers disproportionately.

Backwards-looking only, no predictive power.

Can mislead in short-term cases; a small gain in a few days, annualised, looks absurdly high.

Advantages and Limitations of CAGR

Advantages

Simple to understand, even for beginners.

It is useful to draw a comparison between funds over the same tenure.

Ensures that short-term volatility is smoothed out, making it an ideal tool for long-term analysis.

Limitations

The assumption is that markets will grow continuously, which is something that they rarely do.

Masks volatility and hides real ups and downs.

Useless for SIPs or irregular investments.

XIRR vs CAGR: Which One Should Investors Use?

The choice depends squarely on how the investment is made. In case of SIPs, non-uniform transactions, or partial redemptions, XIRR can be the suitable tool.

For lump sum investments say, one cheque written and forgotten for 5 years CAGR is more appropriate. It shows the clean, long-term growth rate without overcomplicating things.

Neither method is universally superior. Each is fit for purpose. Using CAGR on SIPs will mislead. Using XIRR on a plain lump sum is overkill. Smart investors know when to use which. Both XIRR and CAGR have their place in mutual fund analysis. XIRR mirrors the complexity of SIPs and irregular cash flows, while CAGR is perfect for single-entry, single-exit investments. To measure returns properly, investors must align the method with the cash flow pattern.