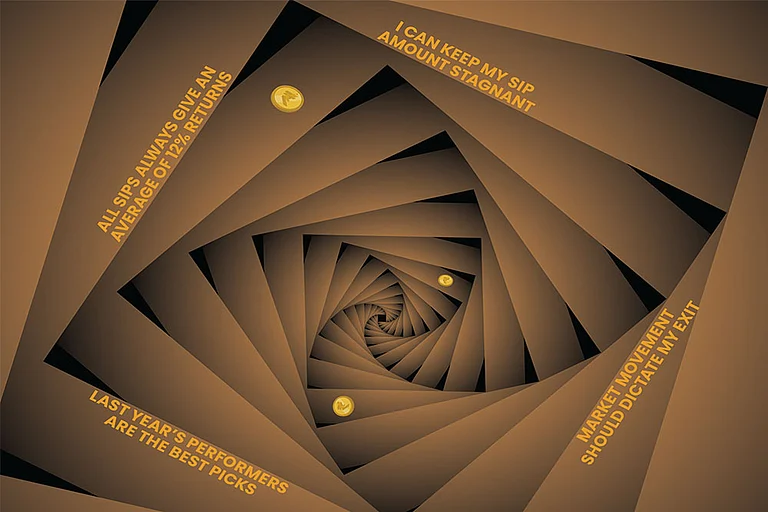

Record SIP inflows highlight rising preference for disciplined investing

Data shows SIP returns remain similar across market cycles

Time and consistency matter more than market entry timing

Can SIP Investors Really Ignore Market Highs And Lows?

An analysis by DSP Mutual Fund of rolling seven-year SIP returns for the Nifty 500 index looks at how SIPs have performed when started in very different market conditions – at all-time highs, after strong rallies, and following deep corrections.

The rise in SIP inflows has continued even as stock markets have seen sharp moves and investors remain alert to near-term volatility. Mutual funds have garnered record high inflows through systematic investment plan (SIP) as the year 2025 came to an end. Total amount collected by mutual funds during December stood at massive Rs 31,002 crore vs from Rs 29,445 crore in November.

This took overall SIP assets under management (AUM) to Rs 16.63 lakh crore, which is 20.7 per cent of the mutual fund industry’s total assets. Historical data suggests, however, that for long term SIP investors, the point at which they invest or enter the market has had limited influence on their overall returns and wealth creation.

An analysis by DSP Mutual Fund of rolling seven-year SIP returns for the Nifty 500 index looks at how SIPs have performed when started in very different market conditions – at all-time highs, after strong rallies, and following deep corrections. The results show that long-term outcomes have remained surprisingly close across these scenarios. Nifty 500 index represents the largest 500 companies of the country.

Coming back to the analysis. Here’s what the analysis shows.

Median seven-year SIP returns were around 13 per cent when SIPs were started at market highs. When investments began after the index had rallied 20 per cent or more in the previous year, median returns were slightly higher at about 14 per cent. Even when SIPs were initiated after the index had fallen 20 per cent or more, median returns were still close to 12 per cent. The spread between these outcomes remained narrow, broadly within a one percentage point range.

The analysis points to a consistent pattern: once investments are held over a medium- to long-term horizon and aligned with an investor’s risk profile, the impact of entry timing fades. According to DSP Mutual Fund, the dispersion in rolling seven-year SIP returns has remained relatively limited across market cycles, despite sharp interim swings.

“When investments are aligned with the investor’s risk profile and held over a medium- to long-term horizon, the impact of entry timing diminishes materially,” notes DSP Mutual Fund.

Historical outcome underlines the role of disciplined, systematic investing, where time in the market and consistency matter more than short-term market conditions or efforts to fine-tune entry timing.

As SIP inflows hit fresh records and retail participation continues to expand, the data reinforces a simple message: for long-term investors, staying invested and investing regularly has mattered far more than trying to get the timing right.