The Securities Exchange Board of India has eased its ‘skin in the game’ regulations for Asset Management Companies.

Sebi Revises Skin In The Game Guidelines For Asset Management Companies

The development is aimed at ensuring that the top brass of the company actively works towards ensuring that the schemes of the fund meet their investment objectives, since a significant part of the top brass’ income will now rely on the performance of the fund

“With an objective to facilitate ease of doing business for Mutual Funds, amendments to SEBI (Mutual Funds) Regulations, 1996 (‘MF Regulations’) were carried out to relax the regulatory framework relating to ‘Alignment of interest of the Designated Employees of the AMCs with the interest of the unitholders’ (hereinafter referred to as ‘skin in the game requirements’,” Sebi said.

The market regulator mentioned in the circular that it has come up with a slab-based system for allowing Asset Management Companies (AMCs) to contribute to the schemes they manage.

Sebi added that the new rules will be enforced from April 1, 2025. Notably prior to the introduction of the slabs, designated employees were mandated to receive 20 per cent of their remuneration in the units of the mutual funds managed by them. The Sebi said that the introduction of the slab-based system is aimed at ensuring that the interests of investors are in-sync with the interest of the fund managers.

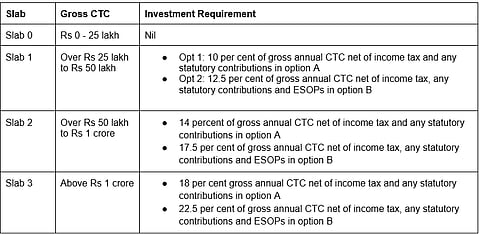

"A minimum slab-wise percentage of the salary/ perks/ bonus/ non-cash compensation (gross annual CTC) net of income tax and any statutory contributions (i.e. PF and NPS) of the Designated Employees of the AMCs shall be mandatorily invested in units of Mutual Fund schemes in which they have a role/oversight," the market regulator said.

The development is aimed at ensuring that the top brass of the company actively works towards ensuring that the schemes of the fund meet their investment objectives, since a significant part of the top brass’ income will now rely on the performance of the fund.

Employees with an annual gross cost-to-company (CTC) less than Rs 25 lakh will be exempt from the new rule. The market regulator has formed the slabs in such a way that the higher-paid employees will need to have more ‘skin in the game’.

Notably AMCs have been given the option to choose between either having slabs in which the minimum percentage will include Employee Stock Ownership Plans (ESOPs) and another option in which the percentage will exclude the ESOPs.

Here’s a look at how the investment requirements will be for different income slabs:

The Sebi has also proposed that employees of AMCs will also be divided into two categories. Category A will include CEOs, CIOs, fund managers, investment research teams, dealers, Chief Risk Officer (CRO), Compliance Officer and investment committee members. Employees in Category A will have to contribute a portion of their CTC according to their respective income-based slabs.

Direct reportees to the CEO (excluding Personal Assistant / Secretary and Category A employees), Chief Information Security Officer (CISO), Chief Operation Officer (COO), Sales Head, Investor Relation Officer(s) (IRO), heads of departments other than investment and risk functions will be part of Category B. Employees in Category B will either be put under Slab 0 or Slab 1, irrespective of their CTC.