Highlights:

NFO opens on December 10, 2024, and closes on December 17, 2024

Offers investors access to India’s top 500 companies based on market capitalization

Minimum Application Amount: ₹100 (plus in multiples of ₹1)

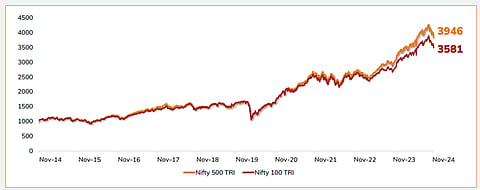

ICICI Prudential Mutual Fund announced the launch of ICICI Prudential Nifty 500 Index Fund, an open-ended index scheme replicating Nifty 500 Index. This scheme is designed to replicate the performance of the Nifty 500 Index. The new fund offer (NFO) allows investors to participate in the growth story of India’s top 500 companies, representing nearly 94% of the nation’s listed universe (Source: Nifty Indices. Nuvama Research Data as on 31st October 2024).

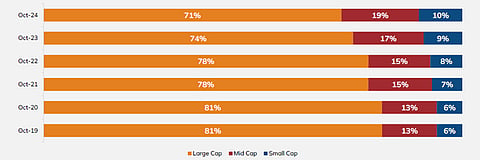

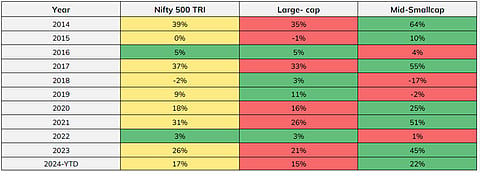

The Nifty 500 Index offers diversification across sectors and market caps, providing dynamic exposure to large-cap, mid-cap, and small-cap segments. This comprehensive approach ensures that investors can capture growth opportunities while adapting to changing market conditions.

Abhijit Shah, Head of Marketing, Digital, and Customer Experience at ICICI Prudential AMC, stated, “With the launch of the ICICI Prudential Nifty 500 Index Fund, we aim to provide investors with an opportunity to gain access to a well-diversified portfolio that mirrors the performance of the Indian equity market as a whole. This offering is designed to cater to those looking for a low-cost, passive investment strategy to participate in the long-term wealth creation potential of Indian equities.”

The index is rebalanced semi-annually, so it could entirely align with market trends and valuation principles.

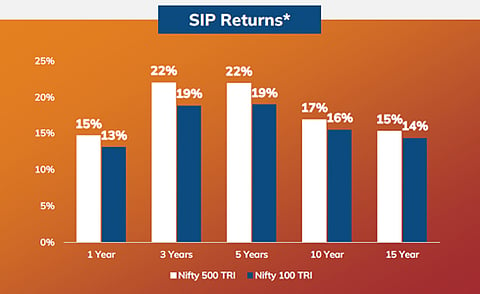

Why should investors invest in Nifty 500?

Broad Market Coverage: Access to the top 500 companies based on market capitalization

Robust Diversification: Offers robust sector-level diversification encompassing over 50 Industries

Dynamic Market Cap Exposure: Offers exposure to large, mid, and small-cap stocks, adapting to changing market trends

Cost-Efficiency: As a passive investment strategy, the scheme aims to deliver returns with minimal costs and tracking errors

Proxy to Indian Economy: Offers a broad coverage of 94% of India’s listed universe

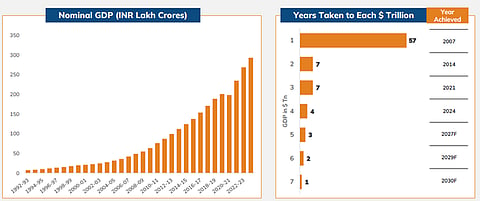

Riding India's Economic Growth:

India's economy is growing quickly and steadily, offering opportunities for investment. With its nominal GDP expected to increase significantly in the coming years, India is set to become one of the major player in the global market. This growth creates a strong chance for investors to potentially benefit from the country’s expanding industries and markets, making it a good choice for building long-term wealth.