Past performance offers comfort, not reliable future direction

Majority of top-quartile funds fail to repeat performance

Chasing recent winners often leads to investor disappointment

What Is The Problem With Buying Mutual Funds Based On Past Performance?

Nearly 60 to 80 per cent of mutual fund schemes that ranked in the top quartile, that is, the top 25 per cent of performers, during the period from 01 January 2020 to 31 December 2022 slipped into lower quartiles over the next three years.

Investment selection, whether it is stocks, mutual funds, gold, silver, or even real estate, still largely revolves around past performance. The reason is simple. Past returns are easily available, straightforward to understand, and offer a quick, quantifiable way to compare options. Numbers give comfort. Rankings feel decisive. But the real question investors need to ask is whether this is the right approach.

According to data analysis by DSP, the answer is a clear warning sign.

Nearly 60 to 80 per cent of mutual fund schemes that ranked in the top quartile, that is, the top 25 per cent of performers, during the period from 01 January 2020 to 31 December 2022 slipped into lower quartiles over the next three years (01 January 2023 to 31 December 2025). In other words, most of yesterday’s winners failed to remain winners over the following market cycle.

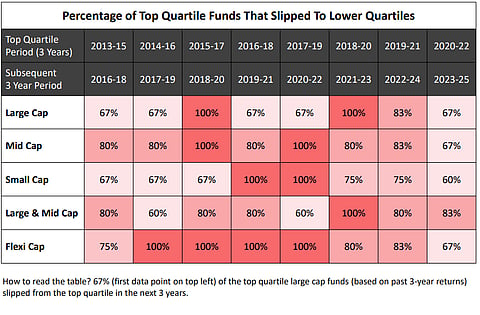

This is not a one-off phenomenon driven by an unusual market phase. According to data analysis by DSP, this pattern repeats itself consistently across all rolling three-year periods over the past decade. Irrespective of market conditions, fund categories, or styles, a large proportion of top-quartile funds struggle to retain their leadership in the subsequent three years. In several instances, the “failure” rate (funds dropping out of the top quartile) is as high as 100%, as shown in the chart below.

The data makes one thing clear: performance persistence in mutual funds is far weaker than most investors assume. Yet, many continue to rely heavily on recent returns while making investment decisions.

Part of the problem lies in how investors mentally process performance numbers. Some view past returns through the lens of everyday consumption logic. DSP Mutual Fund explains that if a scooter manufacturer claims a mileage of 70 kmpl, the buyer assumes that even in real-world conditions, they might still get 50 kmpl. The expectation is of a small, acceptable downgrade.

“The same flawed logic is often applied to mutual funds. If a fund has delivered a 20 per cent CAGR over the past three years, investors subconsciously anchor to that number and expect at least 15 to 18 per cent going forward,” says DSP Mutual Fund. This anchoring bias is precisely what leads to disappointment. Markets do not offer minimum guarantees, and past outperformance does not translate into a reduced “floor” of future returns.

To sum up., past performance may be easy to measure, but it is a poor predictor of future outcomes. As per the historical data, while past performance can be one of a metrics to be looked at while selecting funds to invest, complete reliance on them may be a mistake.