The government has discontinued sovereign gold bonds (SGBs). In the absence of SGBs, investors need to explore other gold investment options.

No New SGBs? Why Gold ETFs Are Now The Best Way To Invest In Gold

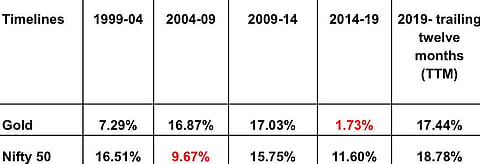

Gold has historically served as a reliable hedge against inflation and economic uncertainty, but its elevated prices and volatility may prompt investors to consider broadening their portfolio

According to experts, physical gold is not a great idea for investing in gold because it involves storage costs and is also not liquid. Another way to invest in gold is digital gold, but unlike gold ETFs and gold Mutual Funds (MFs), it is not regulated by Securities and Exchange Board of India (Sebi). This leaves us with gold ETFs and gold MFs.

“With no new SGBs launched recently, Gold ETFs are now the next best option for gold investments. Gold ETFs invest in gold bullion of 99.5 per cent purity, This provides a secure and cost-effective way to gain exposure to gold without the hassle of physical storage. Gold Mutual Funds, which are funds of funds investing in gold ETFs, come with slightly higher expense ratios due to their structure, making them less efficient compared to ETFs,” says Shweta Rajani, head - mutual funds, Anand Rathi Wealth.

Agrees Sachin Jain, regional CEO, India, World Gold Council, “Generally, Gold ETFs are considered the most cost-effective and safe alternative to Sovereign Gold Bonds (SGBs) for most investors. They offer a good balance of liquidity, transparency, and lower costs and are also backed by gold. AUM of Gold ETFs in India grew from 43.8 tonnes in January 2024 to tonnes in January 2025 to 61.9 tonnes.

The table below compares different ways to invest in gold in terms of returns, taxation, liquidity, and other factors.

Should You Invest

Given the current market conditions, diversification remains a prudent strategy. “While gold has traditionally been a hedge against inflation and economic uncertainty, its volatility and increased prices may push investors to consider widening their portfolios,” says Prithviraj Kothari, Managing Director, RiddiSiddhi Bullions.

Gold's safe-haven attributes make it an essential component during turbulent times. “However, a more assorted approach allows investors to get growth opportunities in varied sectors and reduce portfolio concentration. It is important to maintain a balanced portfolio that shows your risk tolerance, investment horizon, and market outlook,” adds Kothari. According to experts’ recommendations, investors should have five to ten per cent of their portfolio invested in gold.