While real estate, land, gold, and fixed deposits continue to be the favoured investment options in India, mutual fund as an alternative is slowly making inroads. Young demographics, rise in financial awareness and increase in appetite of taking risks are some of the many reasons for this change. The total Asset under Management (AUM) of mutual fund industry to Gross Domestic Product (GDP) ratio of India stands at around 10 per cent. Though this is way below the global average of 55 per cent, factors like awareness campaigns launched by Association of Mutual Funds in India (AMFI) and policy decisions like demonetization, have helped the mutual fund industry to grow substantially.

Mutual Funds Yet to Hit Hinterlands

The penetration of mutual funds in smaller cities and rural areas continues to be modest

According to the latest data by AMFI, the total asset managed by the mutual fund industry at the end of June 2018 was Rs 23.57 lakh crore (trillion). This is up by 18.32 per cent, and as of June 2017 it was Rs 19.92 lakh crore. Similarly in the period post demonetisation, the Systematic Investment Plans (SIPs) saw a 60 per cent rise in the monthly collection from Rs 3434 crore in October 2016 to Rs 5516 crore in September 2017.

But few questions do arise, such as—is entire India opting for this emerging asset class? Is this wealth creation tool confined to few pockets of the country? Is the growth limited to only few regions?

As per AMFI data on March 31, top five cities, viz. Mumbai, Delhi, Bengaluru, Kolkata and Pune are contributing 63.37 per cent of the total AUM followed by next 10 cities with 13.19 per cent contribution. The next 20 cities contribute 4.99 per cent and the last 75 cities contribute 6.05 per cent. Rest of India put together in the other category contributes a meagre 8.09 per cent.

The AMFI data also points out that the B30 cities (Beyond Top 30) has only contributed 14 per cent to the asset in June 2018, which is only three per cent up since the last time.

According to N S Venkatesh, Chief Executive Officer, AMFI, “The main challenge in reaching out to Tier 2/3 cities and beyond is the language barrier”. He adds that AMFI works in seven regional languages apart from English and Hindi, it will be soon available in more regional languages. ‘Jan Nivesh’, a program is focusing on Tier 2/3 cities and towns, but the progress is somewhat modest.

Pankaaj Maalde, a Certified Financial Planner, feels that the lack of visible presence of AMC is one of the many reasons. “People will be comfortable if they see physical presence in their area. AMCs should open branches wherever possible or at least have CAMS, Karvy or MF Utility offices in such places”, he adds. Maalde also says that the mutual funds industry does not recruit new distributors aggressively. “AMCs nowadays rely on online platforms and support national distributors and banks. Online businesses can’t grow in small cities this way”, he says. He gives an example of life insurance industry’s focus on recruiting agents which the mutual fund industry according to him, totally ignores. “None of the top AMCs offer training for mutual fund distributors exam. AMFI and SEBI are equally responsible for this. There are around 30 lakhs insurance agents compared to only 1 lakh mutual fund distributors”, he says.

The point of distributors is further elaborated by C S Sudheer, Founder and MD, Indiamoney.com. He believes that the finance driven industry it has to be a tech and touch model. “The penetration can happen only when the product is pushed to people manually. The role of agents is of prime importance here”, he says. But he also adds that the distributors are not much active due to low commission that they receive. “The agents should be paid a decent commission so that they can at least recover their travel costs”, he elaborates.

Besides visibility, other problems that are hindering the growth of mutual fund industry in the country’s hinterland and beyond is the lack of awareness and a conventional mindset. Ashish Gupta, 27, a civil service aspirant from Maharajganj—a village in Uttar Pradesh, hails from a well-to-do family. But he says that in his village, hardly anyone has heard about mutual funds. “Villagers prefer to invest in land or reinvest in their businesses. Earlier they used to save cash in their homes. But now with bank accounts under the Jan Dhan Yojana, some part of the money goes in bank savings and some in the recurring deposit accounts”, adds Gupta.

On the same issue, Rahul Jain, Head, Edelweiss Personal Wealth Advisory, has to say, “Typically, a bank FD is the only option known in these markets for savings. In our experience, we have observed that being a FD mindset, the client has tendency to preserve capital/principle”. A high profile retired banker from Mumbai who didn’t wish to be named prove Rahul’s point. The banker says that he still looks for security through FDs and real estate over mutual funds. He has no investments in mutual funds yet. He is 63 and has an experience in the banking industry for over 30 years. Like him there are many examples in Mumbai (which gives 32.55 per cent, highest contribution in AUM) who are still skeptical of investing in mutual funds. If this is the state in the financial capital of India, the condition in tier 2/3 cities and beyond would be no good.

Pritish Pankaj, 33, an architect from Darbhanga, Bihar faced similar problems. He came to know about mutual funds only on coming to Mumbai for opportunities. “Back in Darbhanga, villagers are hardly interested in any such things. Life there is tough and we don’t get time for all these”. He adds that if he had not come to Mumbai, mutual funds as an avenue for investments would have remained alien to him.

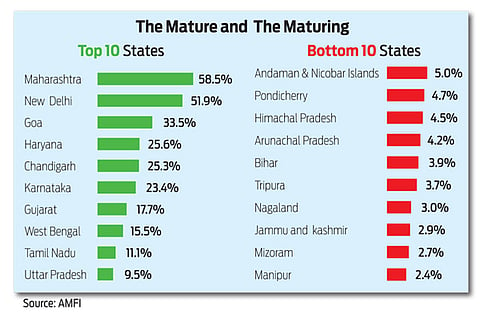

Pankaj’s complain regarding lack of awareness is visible (though not quantifiable) through the data available on AMFI website. As per data available on AMFI, Bihar is one of the least performing states with only 3.9 per cent as AUM of GDP.

According to Swarup Mohanty, CEO, Mirae Asset Global Investments, the teachings passed on through generations (FDs, gold and land being safe and secured) is a big concern. “Earlier, the return on FDs was close to 13–14 per cent (1995–96). Now, though the returns have gone down, but the conventional wisdom of safety remains intact.”

Mohanty believes that mutual funds will only grow exponentially when interest rates bottom out and real estate prices soar. “We are heading towards that, but it will take some time,” he adds

Awareness created by various fund houses and the Sahi Hai initiative by AMFI, Mohanty expects, the number of folios to double up in next five years.

If Mohanty’s statement is to be believed, it will be interesting to see the share of contribution of India and Bharat in it.

suyash@outlookindia.com