For most Indians, buying a home is achieving the ultimate financial milestone. It’s usually a tedious and long-drawn process, where multiple factors have to come together—you should like the house, the area, and it should fit into your budget. But the mistake that a lot of people do is to believe that the price quoted on a builder’s brochure is the final cost. But that’s not true. The real cost of ownership often goes far beyond.

Buying A Home? Look For The Hidden Price Tag Too

Rera has made property buying more transparent, yet other costs can raise the actual price by 10–20 per cent. Buyers should not assume the price on the brochure is final. The true cost of homeownership is far higher

Property consultants say hidden or non-explicit costs vary by project type and budget segment, that is luxury, mid-income and affordable. “On a Rs 1 crore home, that could be another Rs 10-15 lakh,” says Santhosh Kumar, vice chairman, ANAROCK Property Consultants.

Varying state-level levies, goods and services tax (GST) implications, and new maintenance fund structures make the house pricier, making it difficult for buyers to estimate their total cost of ownership before signing on the dotted line.

Experts say greater transparency has emerged post the establishment of the Real Estate (Regulation and Development) Act, 2016, or Rera, but the fine print still hides plenty of surprises. So, what really goes into owning a home today?

One-Time Costs

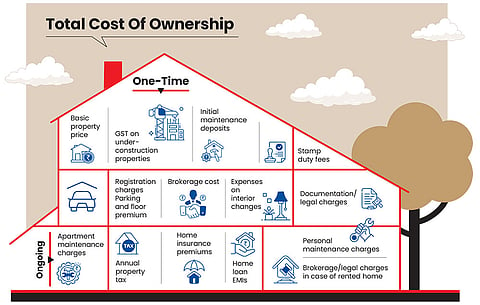

Amid stamp duty, registration fees, GST on under-construction units, parking and floor-rise premiums, maintenance deposits, legal documentation, interiors, and brokerage, the true price of homeownership can easily balloon by an additional 10-20 per cent.

GST On Under-Construction Homes: The one-time cost increases if you choose an under-construction project. “Under-construction projects, while appearing more affordable initially, often involve additional costs such as GST, maintenance deposits, interest or rent overlaps during the construction phase, and corpus fund contributions, which can materially increase the effective acquisition cost,” says Sachin Vyas, principal partner and chief sales officer, Square Yards, a real estate platform.

That’s not always the case with ready-to-move-in homes because they offer instant possession and an assurance of “what you see is what you get”, with no GST.

Tax-Related Charges: State-level stamp duty and registration charges also add a lot. “Though some states offer concessions for first-time buyers or women purchasers, these statutory levies typically add 7-10 per cent to the property’s value, making them a crucial factor in any homebuyer’s budget,” says Vyas.

Legal experts advise buyers to be aware of the applicable registration fees and stamp duty on sale or conveyance deeds, which vary across states. Some states also offer stamp duty exemptions or concessions for women buyers.

“In addition to these statutory charges, buyers must budget for brokerage fees, maintenance deposits, and legal costs incurred for due diligence and documentation. Nominal charges may also apply for home loan processing, if the purchase is financed through a bank or NBFC,” says Manmeet Kaur, partner, Karanjawala & Co, a full-service law firm.

Maintenance: Developers seem to be more transparent about upfront maintenance charges and corpus funds. Some collect advance maintenance (or corpus funds) for one to two years or more, while others term it a “sinking fund” for future repairs. In premium projects, developers sometimes offer free maintenance for X years or flexible payment schemes to attract buyers.

Recurring Costs

Once you have owned and moved into the house, you may assume there’s nothing to spend on, other than maintenance activity you take up on your own. But that’s not true.

“Recurring costs like maintenance fees, property tax, and home insurance can add another Rs 5-10 lakh over 10 years,” says Kumar.

For example, premium and gated developments now come with professional facility management, landscaped gardens, clubhouses, and concierge tie-ups, all translating into higher upkeep costs. Earlier, luxury projects, typically, offered a basic clubhouse with a gym, swimming pool, and squash court. Today, projects come packed with amenities from jacuzzis and expansive green spaces to smart security systems, premium landscaping and more.

Says Kumar: “Across cities, many developers are also partnering with top hospitality or international brands to cater to ultra-luxury buyers. These collaborations have struck a chord with high-net-worth homebuyers seeking the finest living experiences.” For instance, Bengaluru-based Prestige Group tied up with The Leela to develop Prestige Leela Residences. The branding itself elevated costs in this case, says Kumar.

And don’t forget the equated monthly instalment (EMI) if you’ve taken a home loan. If you add up the amount of interest you end up paying, the cost of the property goes mind-bogglingly higher. For instance, if you borrow Rs 80 lakh at 9 per cent interest for 20 years, you will end up repaying approximately a total of Rs 1.73 crore, of which Rs 92.74 lakh is interest. Add Rs 20 lakh down payment made at the time of purchase, and the total cost of a Rs 1 crore home effectively becomes approximately Rs 1.93 crore.

Offsetting Extra Costs

There are a few tax deductions and benefits that can offset some of these extra costs. However, most of these can be availed only under the old tax regime.

Deduction On Principal Repayment And Stamp Duty And Registration Charges: According to Section 80C of the Income-tax Act, 1961, buyers can claim tax deduction on home loans on repayment of the principal amount and can also avail deductions for stamp duty and registration charges paid to purchase the property. The maximum deduction on both these amounts available is Rs 1.5 lakh per annum. However, to claim this benefit, the house should not be sold within 5 years of possession.

Deduction On Repayment Of Interest Charges: Under Section 24 of the Act, one can claim a tax deduction on the interest amount of the EMI up to a maximum of Rs 2 lakh per annum for a self-occupied house.

With stamp duty, registration fees, GST on under-construction units, legal documentation, and so on, the true price of a property can balloon by 10-20 per cent

“However, for a let-out property there is no upper limit on this interest amount against the rent amount received for each of the properties. Budget 2019 further extended the benefit of self-occupied property to two houses which means that if one occupies more than one property, the notional rental income on the second property is exempted from income tax,” says Kumar.

Deduction For First-Home Buyers: If a buyer is availing a home loan to buy the first home, they are entitled to an additional deduction of Rs 50,000 per annum on the repayment of interest under Section 80EE. However, the loan amount should be Rs 35 lakh or less while the property cost should not exceed Rs 50 lakh.

What Should You Do?

According to industry and legal experts, while post-purchase expenses are generally predictable, typically related to maintenance, unexpected costs, such as resident welfare association (RWA) demands, property tax revisions, and club or parking charges often catch buyers off guard.

“An effective way to avoid such surprises is to remain vigilant about these caveats and conduct detailed enquiries with the vendor beforehand,” suggests Kaur.

Also, keeping the above factors in mind, estimating the total cost of ownership is a prerequisite before buying a home today.

“Although there is no straight-jacket formula to estimate the ‘total cost of ownership’, the buyer should be mindful of the intricacies of the builder-buyer agreement and the ever-evolving GST framework,” advises Kaur.

Homebuyers should, in fact, look beyond the quoted property price and factor in the full picture, from stamp duty, registration, and GST to interiors, parking, and ongoing maintenance.

“Considering these costs upfront ensures smarter financial planning and fewer surprises later. As a rule of thumb, budget an additional 12-20 per cent over the base price to get a realistic picture of the total ownership cost,” says Vyas.

Keeping these factors into consideration, a key question is: Should regulatory frameworks mandate more transparent disclosure of lifetime ownership costs in property advertisements or sale deeds?

Requiring developers to disclose the estimated monthly or annual average ownership costs in advertisements and in the builder-buyer agreement or sale deed would enable buyers to compare properties more transparently and realistically. Such a framework would also help curb misleading pricing practices and strengthen consumer protection.