Imagine you have a flat in a posh area that has the potential to earn substantial rent. But you haven’t put it on rent because you don’t want to take the trouble of dealing with agents, tenants and the associated tasks of maintenance.

How Rental Arbitrage Works For The Owner And Lessee

Rental arbitrage frees house owners from the inconvenience of maintaining a house while getting some income. Lessees with less capital can convert it into a sustainable business. Mind the risks though

So, the house is gathering dust due to lack of upkeep, and giving you no rental income either. But you can change that with a little effort.

Enter rental arbitrage, where you lease out a property to a lessee, which could be a company, operator or individual, who will handle the tenant and the property, and will pay you too. More and more owners are warming up to the idea of handing off their properties to professional short-term rental operators. At the same time, it’s also an emerging entrepreneurial venture for the lessees.

Let’s understand how it works and whether it’s worth it.

What Is Rental Arbitrage?

Think of rental arbitrage as a gray zone between ownership and operation that’s turning empty flats into income streams, and casual landlords into passive investors.

Under this arrangement, you can lease your house to such a company or operator, which will furnish it, and list it on portals for short-term sub-letting and pay you a fee.

The Upside: The operator will handle the furniture, the Wi-Fi, the listings, guests, presentation of the property, photographs, the reviews, and the plumbing and lights, too.

Rental arbitrage comes with full monthly rent, or the amount agreed upon by the owner and the operator, but you need to vet the operator carefully. The model offers peace of mind and predictable cash flow.

What’s The Downside?

Less Income For More Freedom: All the services that the operator provides for comes at a cost. So, the potential returns would be higher if you do things on your own.

Varun Gupta, 47, a businessman from Jammu who owns a property in one of the busiest areas in Katra, used to run a short-term rental on his own. “However, it became taxing for me to travel every day from my home (which is 2 hours away) and cater to the guests,” says Varun, who runs multiple businesses.

The demands were difficult to meet. He says: “I always had guests who come for religious purposes. They sometimes asked for mules for the trip to the Vaishno Devi Temple or a guide-cum-host. It was getting tough for me to travel every day, manage the upkeep of my place, and then cater to the needs of the guests. Additionally, the hassle of finding new guests, coordinating with them, managing the dynamic prices of the stay got a little too much.”

To focus on his other businesses and to be able to spend more time with his family, he opted for rental arbitrage. “I saw a decline of around 10-20 per cent in the income from the property compared to what I was earning when I managed it myself.”

The freedom to focus on my other businesses came with a slight downgrade in the income, he adds.

Possibility Of Disputes: Short-term rentals may feel transactional, but the law still treats them as tenancy unless clearly defined.

Disputes usually arise when agreements are vague, or timelines aren’t clearly enforced or rent is received after the expiry of the agreement. The gray zone opens up further when properties are sublet to short-stay guests without explicit permission, or when operators continue using the space after their lease runs out. There could be other disputes too over fitting and fixtures that the lessee might have added.

So, property owners can’t afford to rely on generic rent agreements, but draw up a specific lease agreement for safety should things go south.

Karan S. Thukral, an advocate at the Supreme Court of India, who specialises in real estate cases, says: “While Indian tenancy law does offer protection to tenants in cases of unjust eviction, short-term rental operators are typically governed by the terms of their lease agreement. If the lease clearly defines the duration and does not confer any tenancy rights beyond that term, the tenant’s legal standing for long-term possession is very limited. However, disputes can arise when there is either a poorly drafted agreement or continued possession after lease expiry, especially if the rent is still being accepted by the owner.”

So, what should a lease contain? Says Thukral: “A well-drafted lease should explicitly define the terms of tenancy, the permitted use of the property, and the conditions under which the agreement can be terminated. Importantly, landlords should reserve the right to end the tenancy if the tenant misuses the premises, engages in sub-letting or commercial activities without consent, or breaches any material term. Security deposits should be proportionate to potential damage especially when there’s a possibility of high guest turnover through short-term rentals.”

Including provisions for periodic inspections, guest registration (where feasible), and mandatory compliance with local housing rules further reduces the risk of a tenant overstaying or abusing tenancy protections. The goal is not to deprive tenants of rights, but to avoid misuse by individuals who may exploit legal protections for commercial gain.

He explains through an example. “Landlords should treat Airbnb disclosure like a fire exit clause, if it’s not built into the agreement, you’re exposing yourself to unwanted risk.”

Does It Make Sense For Lessees?

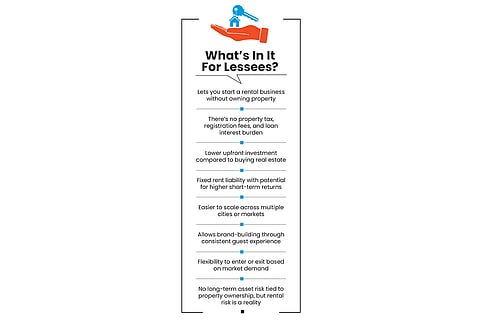

If you are a lessee, it could well become a source of side income for you. A growing wave of freelancers, hospitality workers, and start-up dropouts, are signing long-term leases on well-located flats, flipping them into Airbnb-style rentals, and pocketing the spread.

Rental arbitrage lets lessees act like mini-hotel operators without owning the property. If done the right way, it can be scaled quickly, too.

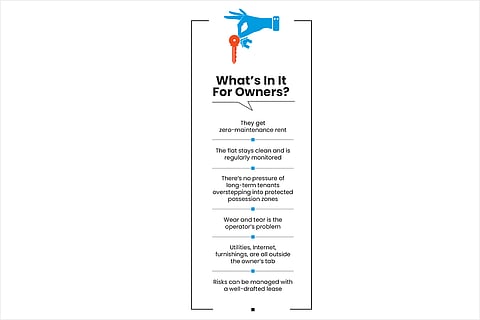

The lessees pocket the difference between what they earn from short-term bookings and what they pay the owner (see What’s In It For Lessees?).

Deepika Shrivastava, an MBA graduate, doesn’t own a single property, but operates six. At 29, she walked away from her corporate job to build a rental business in Goa. She started with one leased flat with Rs 1.5 lakh in hand, most of it spent on deposit, soft furnishings, and making the space photo-ready. Today, she manages six units, all leased and listed and run under her name.

“I don’t own the flats. I lease them, furnish them, list them, and manage the guest experience, maintenance, and pricing. The owners get the rent. I earn the margin,” she says

The real work, she explains, happens behind the scenes, such as pricing dynamically with seasonality, responding to guest requests, training caretakers, maintaining linen stock, and keeping every unit camera-ready. “People think it’s passive income. It’s not. You’re working daily, at least a few hours, to keep things running smoothly.”

Deepika reports a profit of roughly Rs 4 lakh per unit annually from budget properties, with total revenue per unit hovering around Rs 11 lakh. Her income is taxed as business revenue, and she lists them on multiple platforms, to spread her risk. She also maintains back-up listings and builds offline agent networks to ensure bookings never fully dry up (see Where Can Lessees List Short-Term Rentals in India?).

Meanwhile, some businesses are building the entire ecosystem from the ground up.

Take Sachin Chopda, managing director, Pushpam Infra, whose company is involved in developing second homes in destinations like Karjat, Alibaug, and Dapoli. He offers end-to-end rental management for buyers who want returns without responsibilities. “People bought second homes, visited twice a year, and spent the rest of the time worrying about upkeep. That’s when our ‘kamaane wala ghar’ model came in (a property that earns money when you’re not using it),” he says.

Instead of just selling vacation homes, he offered a structured buy-and-rent-back model. Buyers paid in construction-linked tranches, and once built, the property was managed entirely by the company, right down to the linen, pool care, garden, and bookings. Owners earn rental income without lifting a finger. “The idea is simple. Own a villa, enjoy it when you want, and let it pay for itself the rest of the year,” he says.

The returns, Chopda says, can be significant: about Rs 20,000-22,000 a month from a Rs 50 lakh property. Appreciation runs even higher, especially in fast-developing areas like Karjat and outskirts of Alibaug, where land prices are catching up.

But as with any other business, there are risks involved. Umesh Bhati, director of operations, Bayside Corporation, says: “A commonly overlooked risk in rental arbitrage is the assumption of passive income. In reality, the financial model is vulnerable to regulatory shifts, volatile occupancy rates, and landlord negotiations, all of which can challenge sustainability if not factored in from the outset.”

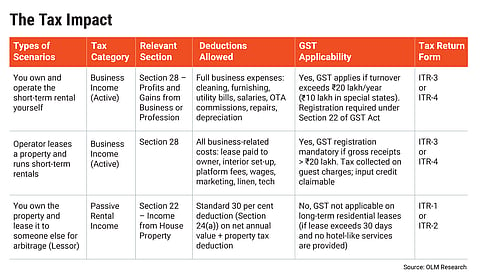

Margins are tight and if your expenditure exceeds the revenue, it’s a loss. Also, Goods and Services Tax (GST) registration is mandatory if gross receipts are more than Rs 20 lakh per annum (see The Tax Impact).

What Happens When The Lease Ends?

If you have taken the property on lease and spent money on furniture and fixture fittings, then you can take them back with you unless the lease agreement states otherwise. Most well-drafted agreements clarify what counts as removable fixtures versus permanent improvement.

So, any AC, bed, or temporary lighting you have installed while taking the lease can be removed, but you cannot claim things like false ceilings, tiling, or structural changes. This works for the lessee as well, who can take what’s theirs when it’s time to walk out.

shivangini@outlookindia.com