It was in 2011 when India got its first unicorn InMobi. As of January 2026, it has 126 unicorns, according to Prime Minister Narendra Modi’s address at the 10th National Startup Day on January 16, 2026, putting India at the third place globally. Start-ups valued at more than $1 billion (roughly Rs 9,000 crore taking the rupee rate at Rs 90 per dollar) are known as unicorns. But if you look at the total number of start-ups, including smaller set-ups and ventures, the number has reached a staggering 200,000 in 2026, up from less than 500 in 2014, said Modi.

Founders’ Full Circle: From Entry To Exit

While it’s simpler to open a new business or a small venture in India, the shutdown process can be a nightmare. Simplifying the exit process is crucial to give an opportunity to failed founders to learn from their mistakes and try again. We give you a lowdown on how to open a start-up and how to close one should you lose interest or are unable to sustain it.

Sanjiv Bikhchandani, one of the earliest backers of India’s start-up dream, and Info Edge founder and executive vice chairman, says more and more middle class individuals are choosing entrepreneurship.

“I’ve witnessed a dramatic shift: only 10-15 per cent of IIM graduates aspired to be entrepreneurs in the late 80s, compared to 50-60 per cent today. Highly educated, middle-class individuals are choosing entrepreneurship by choice, not inheritance.”

So, what’s changed? Among the key reasons for the boom in start-ups is the mindset shift. The quintessential middle-class Indian dream or success story of securing a government job and sticking to it till retirement-do-us-part has fallen apart as government jobs have got squeezed over the years and new opportunities beckon.

The new generation is reimagining success. For some it is about solving real-world problems by creating a new product independently, for others it’s about a cause or passion they might want to pursue, and for still others, poor job market prospects, especially after 40, has necessitated a rethink. Bikhchandani adds that the shift also stems from the desire for independence and experimenting with creativity.

For Susmita Chakravarty, 42, a Kolkata-based schoolteacher-turned-entrepreneur, who started her own cloud kitchen, Eastern Staple, in 2020, it was about the desire to give back to the society.

“It has been a journey of self-realisation for me. During the Covid years, I noticed a clear gap in the market, many people were looking for affordable, homemade staple food, and there simply weren’t enough reliable options offering that at scale. So, it wasn’t a financial tipping point for me as I was in a stable job, but an emotional one.”

Moreover, the government’s Startup India initiative, launched in 2016, has given a push to small businesses and ventures.

The success rate of start-ups depends on a variety of factors that go beyond funding. In India, entrepreneurs often shut shop due to lack of product fit or regulations

Further, several initiatives have been announced as part of Union Budget 2026, which seek to help entrepreneurs, such as setting up of a dedicated Rs 10,000 crore small and medium enterprise (SME) Growth Fund to create “future champions” and an addition of Rs 2,000 crore to the outlay for Self-Reliant India Fund.

Says Anil Bhardwaj, secretary general, Federation of Indian Micro and Small & Medium Enterprises (FISME): “In the last decade, the government has made conscious efforts in developing an enabling ecosystem for Make in India, start-ups, and has simultaneously pushed for grassroot self-employed individuals through initiatives such as PM Vishwakarma and Lakhpati Didi, among others.”

At the same time, the success and continuity rate of start-ups depends upon a variety of factors going beyond funding. In India, entrepreneurs often shut shop for reasons ranging from lack of product-market fit, regulatory tightening to lack of feasibility. In some cases, founders successfully exit the venture by selling the ownership to a bigger industry rival or venture capitalist.

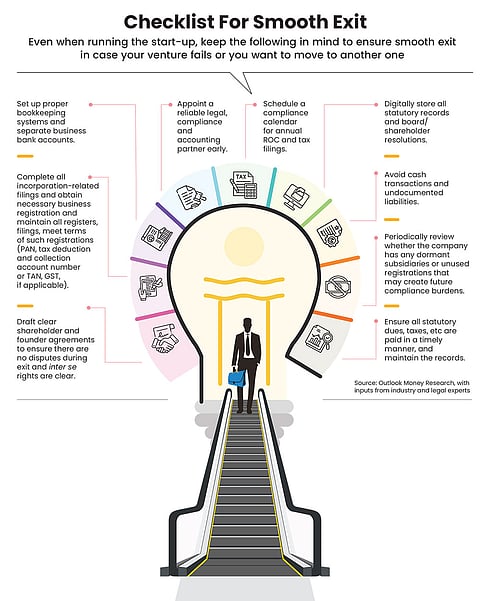

Shutting down, therefore, needs to be an intrinsic part of start-up planning. “From Day 1, founders should operate with the assumption that both entry and exit are part of the company life cycle,” says Shrijay Sheth, founder of Legalwiz.in, a Indian legal tech platform that simplifies legal and compliance tasks for start-ups.

Moreover, many founders make mistakes in their first ventures, but come out winners in the next. For them, easy exit is as important as easy entry. We have a ready reckoner on how to launch a start-up, and how to wrap it up as well.

Smooth Start

The transition from being an employee to becoming an entrepreneur remains a gruelling yet rewarding task for those who dare to dream. And this journey has been significantly eased, thanks to government initiatives and the overall drive for digitalisation.

“Entry barriers have been lowered through the Jan Dhan-Aadhaar-Mobile (JAM) trinity-led super simplified Udyam registration and goods and services tax (GST) onboarding,” says Bhardwaj.

In order to ease compliance burdens for companies in the nascent stages, the Budget announced the launch of modular courses to develop a cadre of accredited “Corporate Mitras”. These professionals are expected to assist Micro, Small and Medium Enterprises (MSMEs) in tier-II and tier-III towns with compliance requirements at affordable costs.

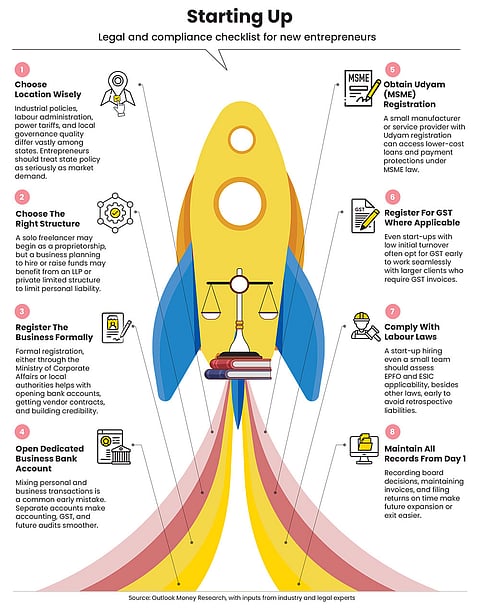

Registration: To start with the basics, when you decide to open your venture, however small it is, you need to get it registered under the right structure, such as proprietorship (which is beneficial for solo freelancers). A business planning to hire or raise funds may benefit from limited liability partnership (LLP) or private limited structure to limit personal liability.

Most major licensing and registration processes for start-ups were digitalised as part of the Startup India Initiative in 2016.

Says Susmita: “In my experience, licence-related issues did not become a major problem because most processes today are online and clearly documented.”

Funding: If you need a loan for the business you can take the conventional route by applying for a business loan. However, now there are other new options, such as pitching your business idea to angel networks or opting for structured government schemes.

For example, to boost entreprenuership in rural India, the Budget has announced the launch of SHE (self-help entreprenuer) Marts. These stores will run as community-owned retail outlets to help rural women transition to becoming enterprise owners.

For ventures which are at an extremely early stage, the Startup India Seed Fund Scheme (SISFS) is the primary option, as it offers up to Rs 20 lakh for proof of concept and Rs 50 lakh for commercialisation. However, for more capital expenditure-heavy start-ups, entrepreneurs can consider the Credit Guarantee Scheme for Startups (CGSS), which offers collateral-free loans up to Rs 20 crore through banks and non-banking financial companies (NBFCs).

To apply for the Startup India Seed Fund, entrepreneurs must make sure that their start-up is recognised by the Department for Promotion of Industry and Internal Trade (DPIIT) on the Startup India portal. The process can be initiated online by logging into the Seed Fund portal, post which entrepreneurs are allowed to choose up to three incubators who will evaluate their pitch and handle the disbursal of funds.

A small manufacturer or service provider with Udyam registration can also access low-cost loans under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006.

Susmita, who plans to expand her cloud kitchen to different geographies, is now exploring government-backed schemes for funding. “By 2026, we would like to be present in at least three states across five cities. We are exploring government-backed schemes such as the Startup India Seed Fund and women-specific credit schemes,” Chakravarty said.

Other Compliances: Once you have the funding and you start the business, there are other follow-up tasks that you need to do consistently. You must have a dedicated business account and never mix personal finances with your business needs. Register for goods and services tax (GST), wherever applicable.

Vaibhav Agarwal, CFA, says that entrepreneurs must register for GST even before the turnover crosses the GST limit for the category of their business.

“Entrepreneurs should register for GST, before the turnover crosses the GST limit, which is around Rs 40 lakh for businesses selling goods and around Rs 20 lakh for service-based businesses,” Agarwal says.

While these limits exist, businesses conducting inter-state sales, exports, or selling through online platforms, regardless of turnover, have to register for GST from day zero itself, he adds.

Start-ups also need to comply with basic labour laws when hiring begins. A start-up hiring even a small team should assess Employees’ Provident Fund Organisation (EPFO) and Employees’ State Insurance Corporation (ESIC) applicability early to avoid retrospective liabilities.

Sheth says that founders who focus on compliance right from the beginning tend to reach the market faster. Some instances of this may include choosing the right structure, proactively taking care of registrations, getting Udyam certification, and getting due clearances, such as FSSAI licenses for food and beverage businesses and no-objection-certificates (NOCs) for other ventures.

He says: “Founders who treat policy as an enabler rather than a hurdle face fewer regulatory surprises. Start-ups that align with MSME and startup-friendly frameworks from the beginning typically spend less time firefighting compliance issues and more time building their businesses.”

Susmita did just that. “The compliances are there for anyone who is willing to understand and follow them, so we structured the business to be compliance-first from the start,” she says.

Challenge Of Sustaining

Government initiatives help, but entrepreneurs must understand the everyday challenges involved in the process which begin once the start-up journey commences and may even continue beyond the closure of their venture.

Says Bhardwaj: “Starting is only the first step. The real challenge begins once the enterprise tries to grow beyond the micro stage—hiring people, taking a factory licence, accessing finance, or complying with labour, pollution, or municipal laws.”

Yuvraj Mehta, a strategic communications veteran-turned-entrepreneur, who runs his own reputation and policy advocacy firm, StrateRise Consulting, says that while government initiatives need to further ease the regulatory hurdles around entrepreneurship, the real difference will be made by the private entities who can support new ventures by putting their trust and giving them businesses.

“If you’re a part of Startup India or an MSME Udyam registered company, there are benefits that the government passes to you, such as exemptions on requirements like the turnover limit or years of experience, and there is a certain ease of paperwork, provided you meet other criteria. But when it comes to the private sector, either the firms will go with established large companies or they will give smaller-sized business with thin margins to new vendors,” says Yuvraj.

The government often encourages new start-ups by exempting their own requirements for tenders, but that’s not the case with private companies, who do not want to take a chance with newer or smaller players, he adds.

As a result, for some, the start-up dream can turn into a nightmare. According to data by the Ministry of Corporate Affairs (MCA), as many as 197,692 businesses were recognised as start-ups under the Startup India initiative as on October 31, 2025, of which 6,385 were recognised as closed. The number is likely to be higher as this reflects only those start-ups which were registered with the ministry.

Lack of market validation, poor investor interest, and lack of profitability are among the key reasons because of which entrepreneurs end up shutting shop.

Says Bikhchandani: “In my experience as an investor, lemons ripen early. Bad news arrives within 2-3 years, while successes take much longer. Persistence becomes denial when I see no market validation, nil investor interest after years of pitching, no path to profitability after 5-7 years, or founder fatigue.”

Lack of financial preparedness is another reason that often leads to shutdowns. Sometimes, entrepreneurs end up mixing finances, by either financing their personal expenses through the profits of their business, or taking out money from their personal account to fund the business when things look bleak.

Agarwal points to the perils of mixing business and personal expenses, highlighting that doing so can lead to a situation where tax filings become messy. This ultimately affects the future of the business, as both private and government investors view this as bad financial hygiene and, thus, lose confidence.

“It becomes difficult to know whether the business is actually making money. Tax filings get messy, increasing the risk of errors, disallowances, or questions from the tax department. It weakens the boundary between you and the business, which can create legal and compliance issues later. Banks or investors may find the numbers unreliable and lose confidence,” Agarwal adds.

Tricky Shutdowns

While a plethora of reasons can lead to the closure of a start-up, the decision is difficult given the time and effort invested. What adds to the complexity is the legal process involved in closing a start-up.

In a viral post re-posted on r/startups, a sub-reddit on social media platform Reddit, Arjun Paul, founder of Zoko, a B2B SaaS platform, shared his tribulations when he decided to shut down his previous India-based start-up. Paul humourously compared the process of shutting down his start-up in India to a never-ending divorce battle. But the process of shutting down a business in India is no laughing matter.

Paul detailed several processes, such as empty GST filings, board meetings documentation, and annual tax filings for a business that has already become defunct, which exit-bound entrepreneurs are burdened with.

“It’s a NIGHTMARE shutting down an Indian company! I’ve been trying to shut down our old Indian company for over TWO YEARS…,” Paul wrote in his post.

The legal process to close a start-up typically begins by shutting all operations for two consecutive financial years and being free from all liabilities and litigations

What complicates the situation further is that these challenges arrive at a time when entrepreneurs are grappling with feelings of loss, grief and financial stress. Paul added that for him things escalated to another level when he was asked to show a photo of himself in front of his office which had been closed for 18 months, indicating that he was expected to pay rent for a business which he had already shut down.

Despite completing over 24 filings and spending over Rs 2 lakh on chartered accountants and legal fees, his company was still not shut down.

Paul’s case points towards the kind of delays an entrepreneur can face while exiting a business. Broadly speaking, shutting shop in India is governed by MCA and the Insolvency and Bankruptcy Board of India (IBBI) depending on the status of solvency of the business.

Businesses with nil assets and debt can file their applications through the Centre for Processing Accelerated Corporate Exit (C-PACE) on the MCA portal. On the other hand, businesses which are solvent, but want to close and distribute remaining assets to the shareholders can do so via IBBI and the National Company Law Tribunal (NCLT) under Section 59 of the Insolvency And Bankruptcy Code, 2016.

According to a press release issued by MCA, entrepreneurs can use C-PACE to have their applications processed within an average time of less than 2 months compared to an average time of more than 2 years prior to the introduction of this route. Outlook Money’s queries to Sanjeev Singh, joint secretary, DPIIT, went unanswered.

On paper, the process essentially involves getting the name struck off from the MCA’s list by getting Striking Off (STK) forms cleared. The process, typically, starts with entrepreneurs contacting advisors to check if their company is eligible to wind up, i.e., it has ceased all operations for at least two consecutive financial years and is free from outstanding liabilities and litigations. Such companies can apply for the STK 2 form after getting requisite shareholder approvals. Once filed, C-PACE processes the application and the owner receives updates of the business being struck off.

The process may be different for different businesses depending on the industry and the nature of solvency. However, the timeline on-ground appears to be different for those who decide to part ways with their entrepreneurial ventures. While the ventures mentioned in the story are not exhaustive, the problems faced by these founders are common across businesses.

Devarsh Saraf, founder, Bombay Founders Club, underwent the same process when he shut down his legaltech firm. He says: “We were taught in law school on the first or second day of (studying) company law that in theory you can start a company in a day. In India, that practice obviously is never a day because of MCA approvals. But in theory you cannot shut down a company for at least 2-3 months. There is a host of procedures that you have to go through.”

While he was able to sell off his legaltech start-up, most people are not able to do the same and end up leaving their business dormant due to legal complexities.

“Since I was a lawyer, I knew how I could sell off a private limited company which has already been registered because there’s some salvage value to it. Unfortunately that is something which most people don’t know about,” says Saraf.

But leaving a business dormant can have severe financial and legal consequences. Financially, it could mean lakhs of rupees in the form of fees and penalties when you are possibly already in a financially precarious state. Legally, it could even result in getting debarred from becoming a director of any company, Saraf explains.

The process becomes even more complex for licence-heavy businesses, such as cafes, cloud-kitchens and restaurants in the food and beverages space. While regulations for licensing vary between different states, fire safety, food safety and liquor licences are crucial for most F&B outlets.

Start-up mentor and restaurant and F&B business specialist Ravi Wazir says that simply abandoning a failing venture and not surrendering crucial licences can have severe legal consequences. Says Wazir: “The first licence or NOC or permit that must be surrendered when an F&B operator exits business is the fire safety permit. If you don’t surrender the fire safety permit, and if another F&B operator makes a lapse in terms of fire safety, it can trigger an investigation on the previous operators.”

Not surrendering the liquor license can have similar consequences. “Many people sell liquor illegally. So if someone misuses the licence in the exiting F&B operator’s location, then huge penalties can arise from that and proceedings can begin against the person in whose name the liquor licence is issued,” explains Wazir.

In the case of a food licence, if incidents of food-poisoning or other health hazards occur in the same outlet, then the entrepreneur may face trouble even after exit.

Navigating the Exit Maze

Despite the complexity, the exit maze for businesses can be navigated. However, doing so requires a blend of pragmatism and optimism. While no entrepreneur even wants to think about the idea of his or her business closing, that’s exactly what they should be doing on the very first day of their operations, says Sheth of LegalWiz. “Entrepreneurs should focus on statutory hygiene right from the start. To be C-PACE ready, focus must be on clean statutory hygiene rather than volume of business.”

Clean statutory hygiene includes forming a consistent compliance trail and ensuring no filings are pending. Says Sheth: “Companies that have a consistent compliance trail and no pending filings are the ones that move through C-PACE smoothly… This means filing all registrar of companies (ROC) forms on time, even during periods of no operations, maintaining proper books of accounts and statutory registers, and ensuring Permanent Account Number (PAN), GST, bank accounts, and director know your customer (KYC) details are always in sync.”

Filing gaps cannot be rectified later. Says Akhoury Winnie Shekhar, partner at CMS INDUSLAW, a full service law firm: “Filing gaps cannot be rectified after one decides to explore STK 2. Incomplete financial statements, or unpaid government dues will delay the process and can also immediately disqualify companies from the Fast Track Exit route and push them into longer liquidation processes.”

Sheth advises investors to avoid mistakes, such as keeping bank accounts active after applying for C-PACE and delaying closure of GST. For STK 2 eligibility, the company must not have carried on any business or operations for the preceding two financial years.

“The most common mistake is continuing transactions, when the decision to close has already been taken. Founders often keep bank accounts active with small inflows or expenses, delay closure of GST, fail to file nil returns, miss ROC filings assuming the company will be closed anyway, or show revenue or expenses in financials close to the exit timeline,” says Sheth.

Bikhchandani urges entrepreneurs to view the various regulatory stakeholders during the exit process as allies and commit to ensuring all statutory compliance for a smoother exit. “Commit to a dedicated team ensuring all statutory compliance (GST, PF, and legal needs),” he says.

For F&B ventures, it is pertinent to acquire licences legally and surrender them by hiring the same legal resources, says Wazir, adding that a clean paper trail is crucial for surrendering the licences easily.

India has mastered the art of embracing those who dare to dream, but as entrepreneurs continue to grapple with the exit maze, the door out seems narrower than the door in. On one hand C-PACE and Startup India initiatives are steps in the right direction, but beyond the ease of doing business, the ease of closing business is a crucial requirement for India’s start-up story.

Ultimately, entrepreneurship is a cycle of experimenting, inventing and re-inventing new solutions and legal hurdles of shutting down shop should not weigh down the spirit of innovation.

ayushkhar@outlookindia.com