There are two perspectives on how does the Union Budget impact us. One is that as a citizen, macro developments are relevant for us, as macro percolates in some way to make a micro impact. The other is, an immediate or obvious measure, such as changes in income tax rates or excise duties on your consumption items. Budget 2026 is more about the macro aspect.

How Budget Touches Your Life

As the country’s GDP grows, the size of the Union Budget grows as well. This time, the Budget announced no big-bang measures, like the previous Budget. Instead, Budget 2026 touches you subtly through small measures and a thrust on long term

As the Union Finance Minister rose to present her ninth consecutive Budget, the first from Kartavya Bhavan, there was little expectation that it would be a dream budget or offer tax benefits. Instead, there was curiosity on what is in store.

Earlier, the initial part of the budget speech used to be on ‘GYAN’ (garib, yuva, annadata, nari). This time, the initial part was about infrastructure and manufacturing. That was a welcome shift as the Budget focused to the issues affecting the economy.

The Macro Picture

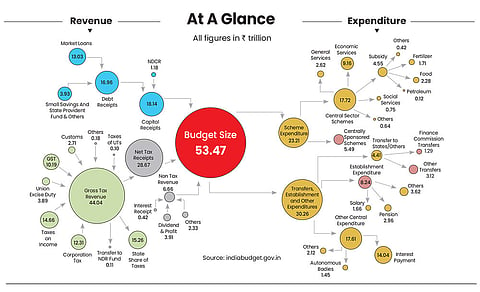

Every year, as the GDP of the country grows, the size of the Union Budget grows as well. For the forthcoming financial year, 2026-27 (FY27), the total size moved up to Rs 53.47 trillion, a 7.7 per cent increase from Rs 49.65 trillion in the current year, 2025-26 (FY26). However, what the market looks at is, not so much the size but the extent of fiscal deficit. Higher the fiscal deficit, higher is the supply of fresh government bonds hitting the market. Higher fiscal deficit is pro-inflationary. Hence, the market welcomes lower fiscal deficit.

The government is on a path of consolidation, ever since the forced profligacy of the Covid-hit year, 2020-21. In that year, fiscal deficit was 9.2 per cent of the GDP, the highest ever. Revenue was low, the government had to spend more to shore up the economy, and the GDP (the denominator) was low. Since then, fiscal deficit has been brought down to 4.4 per cent of the GDP in FY26 and the target is 4.3 per cent in FY27.

The market does not look at the size of the Union Budget so much, but the extent of fiscal deficit. Higher the fiscal deficit, higher is the supply of fresh government bonds hitting the market

The government has changed how it views fiscal deficit: from deficit (excess expenditure over income) for the year as a percentage of GDP to outstanding debt as a percentage of GDP now. As communicated in the previous budget (February 1, 2025), the target is to reduce it from 56.1 per cent of GDP to 50 per cent +/- 1 per cent, by 2030-31. The target for FY27 is 55.6 per cent of the GDP.

The bond market looks at the quantum of borrowing from the market, which is fresh supply of bonds. Net of redemptions (after taking into account maturities during the year), the estimate is Rs 11.73 trillion, which is in line with market expectations. However, on a gross basis (before redemptions), the estimate is Rs 17.2 trillion, which is much higher than market expectation. This would be a negative for the bond market, at least in the near term. Probably, for the higher-than-expected bond issuances, they would switch it for a bond scheduled to mature in another year, as the net quantum is in line with expectation.

The Macro Positive

Capital expenditure for FY27 has been estimated at Rs 12.2 trillion. In FY26, the budget estimate (BE) was Rs 11.2 trillion, but the revised estimate is Rs 10.96 trillion. It shows that various departments of the government did not spend as much as the outlay. From BE of FY26 to BE of next year, it is an increase of 9 per cent. The positive aspect is the capex outlay of Rs 12.2 trillion for next year, which is higher than the net market borrowing of Rs 11.7 trillion. This has happened for the first time. There is a concept of quality of fiscal deficit—how much of the budgeted expenditure is on revenue and how much is on capital expenditure. From approximately 11 per cent of the total budget outlay 12 years ago, it is now over 22 per cent. This means the quality of deficit has improved over the years.

Market Reaction

Post Budget, indices such as Nifty and Sensex tanked. What has spooked markets is the increase in securities transaction tax (STT) on equity derivatives. On futures, it has been hiked from 2 basis points (0.02 per cent) to 5 basis points (0.05 per cent) and on options it has been hiked from 10 basis points to 15 basis points. Here the perspectives of the government and the market are different. As per the Securities and Exchange Board of India (Sebi) data published earlier, more than 90 out of 100 retail people participating in equity derivatives lose money. So, the change is more about increasing the cost of participation in these derivative instruments than generating revenue. However, the market looks at it as an increase in the cost of participation in derivatives across categories, without any benefit.

Long-Term Positives

The Finance Minister has proposed to provide tax holiday till 2047 to any foreign company that provides cloud services to customers globally by using data centre services from India. It will, however, need to provide services to Indian customers through an Indian reseller entity. Then, there are measures to reform the banking sector through a standing committee, reform the public sector undertakings like Power Finance Corporation, Rural Electrification Corporation, and multiple other measures mentioned in the Finance Bill. Also, non-resident Indians (NRIs) have been provided a wider window for investing in India.

What It Means For You

There is no big-bang measure touching you directly like the income tax reforms in the previous budget. Measures have been taken outside of the budget, like goods and service tax (GST) reforms undertaken sometime earlier. The tax on investments including equity, bonds, or mutual funds remain the same and increased taxation on equity derivatives impacts you only if you are a participant in that segment.

This budget touches you subtly. It gives a push to growth at the margin, through multiple small measures. Foreign portfolio investors (FPIs) would not be enthused by the lack of tax benefit, but they are not the target audience. Instead, your job, business, or profession has either been nudged positively or left alone. Apart from the initial knee-jerk reaction of the equity and bond market, the long-term story remains intact.

By Joydeep Sen Corporate Trainer and Author