Global markets are at an all-time high, with most major indices hovering near their peak, leaving limited room for further upside. In such a case, two strategies work best: sticking to asset allocation and following value investing strategy. Even when the market is at its peak, there are periods of underperformance in individual stocks, creating attractive entry points for long-term returns. This makes value investing relevant in today’s environment. For investors planning to explore value investing, the ICICI Prudential Value Fund can be a decent choice in this category.

ICICI Pru Value Fund: Eyeing Value Opportunity

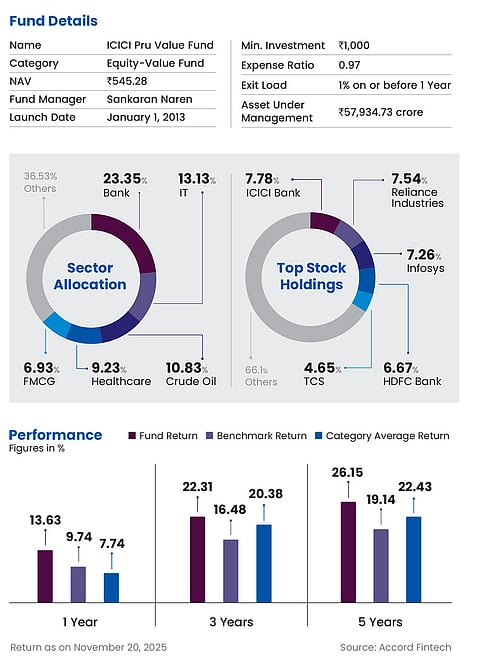

An analysis of ICICI Pru Value Fund. It invests in stocks that are currently undervalued. The idea is to identify stocks across market capitalisation and conserve cash in the absence of value opportunity

Portfolio

The fund follows a value investment style, offers a diversified portfolio with potentially good stocks that are currently undervalued.

“The idea is not to buy cheap stocks, but to identify sound companies with durable models, improving fundamentals, and credible management teams that are temporarily mispriced as the market is extrapolating near-term concerns or overlooking structural strengths,” says Sankaran Naren, executive director and chief investment officer, ICICI Prudential AMC.

This has helped the fund to avoid deep-value traps, keeping the emphasis on quality. It picks up value stocks across market capitalisation and sectors, and conserves cash in the absence of value opportunity. In terms of market capitalisation, it majorly invests in large-cap stocks, while swiftly moving to mid- and small-caps when there is an opportunity.

Currently, the fund’s 80 per cent corpus is invested in large-caps, the remaining in mid- and small-caps.

Performance

The fund is one of the largest and best performing funds in its category. On a five- and seven-year performance basis, it has held the top position in its category, delivering 26.15 per cent and 20.09 per cent compounded annual returns, respectively. On a one-year basis, it delivered 13.63 per cent, the highest in the category.

OLM Take

The fund is managed by Naren, one of the most seasoned fund managers, known for his value style of investing, which bodes well for the fund. This fund is a decent choice for investors looking for capital appreciation, as it invests primarily in well-diversified portfolios of value stocks.

kundan@outlookindia.com