With “eco-friendly” and “smart” becoming the new buzzwords in real estate, developers across metros are touting technology-driven, energy-efficient homes as the next big lifestyle upgrade. Smart sensors, internet of things (IoT)-enabled security, and solar-powered utilities are being pitched as must-have features for the modern buyer.

Smart Green Homes Or Smart Sales Pitch?

Green and smart homes promise environmental benefits and digital convenience, respectively. They come at a premium, which also means a higher resale value. But since no authority takes responsibility for maintaining green systems, and buyers have to bear the cost when smart gadgets inside the house don’t work as expected, you must evaluate real costs

Demand is up despite the fact that green and smart homes often come at a higher price, typically 10-15 per cent more than regular homes, according to experts. Data for 2025, from ANAROCK Group, a property consultant, shows that around 65 per cent of homebuyers now prioritise energy efficiency, and nearly 68 per cent of buyers in cities like Pune prefer smart features that cut costs and improve health. Millennials and non-resident Indians (NRIs) are leading this shift and are willing to pay a premium for it.

“Developers are responding, though greenwashing in marketing remains a concern. Even so, there is clear demand for authentic, well-designed solutions among informed buyers,” says Santhosh Kumar, vice chairman, ANAROCK.

Yet, the sector stands divided between genuine sustainability and clever branding. As the need for certifications for developers rise and buyers become more conscious of savings on utility bills and the environmental impact, the real test lies in whether these “green” features work consistently beyond handover, or fade once the marketing spotlight moves on.

What’s Driving The Demand?

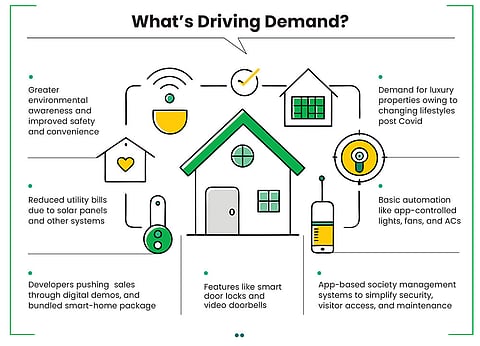

Industry experts say eco-friendly and smart homes are gaining momentum in major urban centres, driven by greater environmental awareness, improved safety and convenience, technological advancements, and supportive government policies.

Premium Push: Younger professionals, sustainability-aware corporate employees, and premium home buyers increasingly seek lower utility costs, better environmental performance, and solar-linked savings, especially as Rs 1 crore-plus homes now account for 62 per cent of H1 2025 sales, according to data from JLL India.

Post-pandemic life-style shifts like work from home (WFH) is also contributing to the trend.

Government Push: “Key factors contributing to this trend are the rising demand for luxury properties and the incentives provided by the concerned authorities, such as the Ministry of Environment, Forest and Climate Change (MoEFCC) and some state governments,” says Heena Chheda, partner, Economic Laws Practice, a full-service Indian law firm.

Clarifying further, she says that MoEFCC offers fast track environmental clearance for green building projects which are pre-certified/provisionally certified by the Indian Green Building Council (IGBC). Further, incentives for rooftop solar schemes, income-tax relief and cheaper loans by various central government agencies are also offered.

Various state governments like Punjab, Maharashtra, Uttar Pradesh, and Karnataka offer additional floor area ratio (FSI)/ floor space index (FAR) ranging from 3 to 10 per cent for green buildings and reduced property tax.

Smart Features: According to industry experts, smart home features that solve everyday problems see the highest usage. Smart door locks, video doorbells, and app-based society management systems simplify security, visitor access, and maintenance tasks, making them part of daily routines. Basic automation like app-controlled lights, fans, and ACs also remains popular because it saves time and energy without complexity.

“With tech becoming cheaper and developers seeking differentiation, sustainable and tech-enabled features are being marketed as premium, future-ready living options, even though what’s offered varies widely across projects,” says Amit Agarwal, co-founder and chief executive officer, NoBroker, a proptech company.

Energy-monitoring dashboards, especially with rooftop solar, are another highly-used feature, as they help homeowners track consumption and reduce bills in a tangible way.

“In contrast, many ‘wow factor’ features remain underutilised. Full-home voice control, advanced automation routines, smart mirrors, panels, and automated curtains are often ignored after initial curiosity. They either add complexity, require maintenance, or don’t solve an immediate need,” informs Agarwal.

Ultimately, smart features that are simple, convenient, and tied to security or long-tem savings see regular use, while novelty-focused or high-maintenance features mostly remain cosmetic.

Developer Push: Demand for green and smart homes today is driven by both informed buyers and developer-led awareness. “Developers are accelerating this shift by using model homes, digital demos, and bundled smart-home packages to familiarise buyers with these features. As a result, what began as a marketing push is evolving into genuine buyer interest, with both sides reinforcing the momentum,” says Agarwal.

The Costs

Green Homes: They are costlier but some costs get balanced later.

Says Kumar: “Around 30-50 per cent savings on energy and water usually offset 50-70 per cent of this premium (in unit cost), thanks to a 3-5-year payback period and lower maintenance costs. Buyers also report better returns on certified green projects (such as those with IGBC) through higher resale values and rental demand.”

Homes with rooftop solar panels (often supported by central and state subsidies), rainwater harvesting, efficient heating, ventilation, and air conditioning (HVAC) systems, or high-performance windows reduce electricity and water bills significantly. Solar systems can pay for themselves in 3-7 years, depending on the city and system size, after which owners benefit from savings throughout the 20-25-year life of the panels.

With India’s green-building market projected to reach $85 billion by FY32, according to an Equirus Capital report released in October 2025, buyers’ willingness to pay more for sustainable design is steadily rising. Increasing awareness of long-term cost benefits and environmental impact is strengthening this shift.

However, there are maintenance costs. Solar panels require periodic cleaning, while inverters or batteries need attention every few years, which can be offset by lower utility bills. The maintenance of green technologies like rainwater harvesting, efficient HVACs, and insulation vary, but it is largely low-touch for many elements, such as windows and insulation.

Smart Homes: Smart features rarely offer financial returns. “Gadgets such as voice-controlled lighting or app-based locks add convenience and a modern lifestyle appeal, but they usually do not produce measurable savings. Buyers see real value only when sustainability features are integrated at the building or community level, rather than through superficial “smart” add-ons that don’t reduce costs,” says Agarwal.

Smart home systems need occasional updates, battery changes, and network fixes, which makes their upkeep slightly higher than traditional switches or locks.

Certified green buildings have started to see a resale premium due to better amenities and lower utility bills. But lack of maintenance can play spoilsport

“Overall, smart and green homes demand marginally more maintenance than traditional ones, yet they usually deliver lower long-term utility costs and better resale value,” says Agarwal.

According to Kumar, smart systems can cost 20-30 per cent more per annum to maintain than regular setups. Solar and green technologies, by contrast, have low long-term costs—typically just basic cleaning of around Rs 5,000 a year—and their 25-year lifespan delivers returns within 4-6 years, with 15-30 per cent savings thereafter.

In short, green features tend to pay for themselves in the long run through savings on utility bills, while smart features can raise costs unless they’re actively used and add real functional value to your life.

Is The Resale Value Better?

Data suggests that certified green buildings have started to see a resale premium due to better amenities, smart features and lower utility bills. A report by Housivity, a real estate platform, estimates a 10-15 per cent price premium in certain markets, along with faster sales in locations where buyers understand the benefits.

Shankey Agrawal, partner, BMR Legal, a boutique law firm specialising in tax matters, says, “This premium comes from overall building design and efficiency, not from individual smart gadgets. Studies show most smart features can be easily replaced, so they don’t add lasting value on their own. The emerging trend is that credible green ratings enhance asset value, while smart-home devices are largely used as marketing tools.”

However, lack of maintenance can play spoilsport.

What To Watch Out For

Marketing Gimmicks: Despite their rising popularity, green and smart homes continue to spark debate: are they truly transforming Indian housing, or are they just another marketing gimmick?

“The market shows both genuine progress and superficial marketing, and the burden is on buyers to separate real performance features from branding,” says Shankey.

“The green shift is mostly real, thanks to real savings of 20-30 per cent on utility bills and strict certifications via IGBC and GRIHA (Green Rating for Integrated Habitat Assessment). However, ‘smart’ features often seem like marketing gimmicks, showing up as extras such as basic voice control instead of fully integrated automation. This is mainly to justify high prices, even though there are still problems with reliability,” says Kumar.

The difference sometimes lies in the segment you choose. Agarwal points out that at the premium end, developers are investing in real sustainability, energy-efficient design, solar capacity, and automation that cuts long-term costs, supported by rising buyer expectations and government incentives.

However, “in the mid-segment, much of the ‘green’ and ‘smart’ branding is still superficial, limited to minor fixtures or basic app-controlled features,” he adds.

IGBC And GRIHA Certifications: Green homes often carry certifications like IGBC and GRIHA. According to ANAROCK, these certifications are voluntary. Most private green homes in India don’t have to get these certifications, but government-funded and public sector projects do. Some states, like Rajasthan, require large buildings (bigger than 10,000 square meters) to be certified. Private developers seek certifications to show that their properties are eco-friendly. This not only increases the value of their properties but also qualifies them for incentives. While certifications are not always required, they do give green homes third-party credibility. This is why they are becoming more common in the market.

However, many homebuyers wonder whether these ratings truly reflect a building’s sustainability performance or if there’s a gap between certification and their on-ground implementation.

Some legal experts say green certifications look great on paper, but their real value in the resale market depends entirely on long-term maintenance. Most certifications are awarded when the building is newly completed. After 2-3 years, however, if the society fails to maintain the solar panels, rainwater harvesting system, or sewage-treatment plant, the promised savings disappear.

“Because of this gap between design-stage promises and on-ground performance, the resale premium varies. Buyers increasingly prefer certified buildings, but they check whether the systems are still functional before paying a premium. A certificate alone won’t guarantee higher resale value; sustained maintenance of the property does,” says Darshna Velani, principal associate, IndiaLaw LLP.

Lack of maintenance can spell disaster. “There is no requirement for an annual audit. Research shows that solar panels, sewage treatment plants (STPs), and rainwater collecting systems don’t always behave the way they are supposed to,” says Shankey.

Limited Recourse: Legally, developers are not required to share real-time performance data for smart or green features. The Real Estate Regulatory Authority (Rera), however, requires them to deliver everything they advertise in marketing materials and contracts.

If solar panels, electric vehicle (EV)-ready parking, sensors, or water systems fail to perform as promised, buyers can approach Rera or consumer courts for refunds or fixes.

The core issue, Shankey says, is that most contracts list features without defining measurable performance standards, leaving buyers to prove the gap between what was promised and what was actually delivered. Once a project is completed, regulatory scrutiny often drops sharply.

Amrutha Varshini Sreedhar, partner designate, King Stubb & Kasiva, Advocates and Attorneys, says, “Long-term regulatory oversight is limited; once certification is granted or possession is handed over, the responsibility of sustaining performance often shifts to resident associations, highlighting the need for stronger post-occupancy audits and accountability mechanisms.”

As resident welfare associations (RWAs) often lack the expertise to manage these systems, STPs, solar panels, and rainwater-harvesting pits can fail without accountability.

Shankey points out that currently, India has no law mandating lifecycle monitoring of properties’ green features, and regulators are still debating how to set long-term performance standards.

Green and smart homes come at a premium, which also translates into a higher resale value. However, given that there’s no authority to take responsibility for the maintenance of equipment and green systems, any breakdown can affect the resale value adversely. Plus, there will be additional cost to bear if smart gadgets inside the house don’t work as expected if they don’t come under the RWA ambit. Opt for them only if you are willing to take the risk and truly aspire to live in an environment-friendly home.

The Risks

Solar panels, sewage treatment plants and rainwater collecting systems don’t always behave the way they are supposed to

Smart features are often not as promised, especially in the mid-segment. For example, you may get basic voice control instead of fully integrated automation

Energy-efficient design, meaningful solar capacity, and automation that cuts long-term costs available mostly in premium properties

Once a project is completed, regulatory scrutiny drops sharply

Green home certifications, IGBC and GRIHA, are awarded when the building is completed, but there is no requirement for annual audit

Once certification is granted or possession is handed over, the responsibility of sustaining performance often shifts to resident welfare associations, who may lack the required expertise

Legally, developers are not required to share real-time performance data for ‘smart’ or ‘green’ features