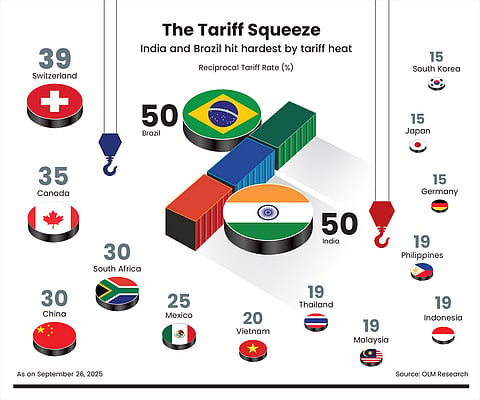

For the past few months, what has dominated the collective imagination of the country, particularly equity investors, is US trade tariffs. US President Donald Trump dropped the first bomb on July 30 when he announced to impose a 25 per cent tariff on India. Barely a week later, on August 6, came the second strike: a “punitive” tariff of another 25 per cent for India’s continued purchase of Russian oil. This second tranche of tariff came into effect after August 27, 2025, the interim serving as a warning period for India. The steep cumulative tariff of 50 per cent has affected a range of export-oriented sectors, such as textiles and gems and jewellery.

Trump's Tariff Bomb

India’s once-cozy relationship with the US is turning complex, with the Donald Trump administration slapping restrictions like steep tariffs and H-1B visa fees. Is India ready to weather the storm?

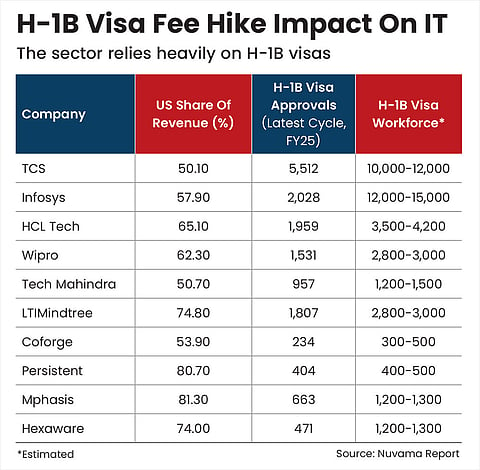

The dust from the tariff hike was yet to settle when Trump dropped another bombshell on September 19—a massive increase in H-1B visa fees to $100,000, making it prohibitively expensive for companies to hire Indian professionals in the US. The increase in visa fees has sent a wave of panic among Indian employees aspiring to work in the US and lent a body blow to the Indian information technology (IT) industry, a major beneficiary of the programme. From October 2022 to September 2023, Indians received 72 per cent of the 400,000 H-1B visas issued, making them one of the largest beneficiaries.

The H-1B visa fee shock has only deepened uncertainty, which may continue with newer announcements coming in. For instance, just before going to press on September 26, came in another shocker on September 25. Trump has declared 100 per cent tariff on branded pharma imports effective October 1, jolting the market.

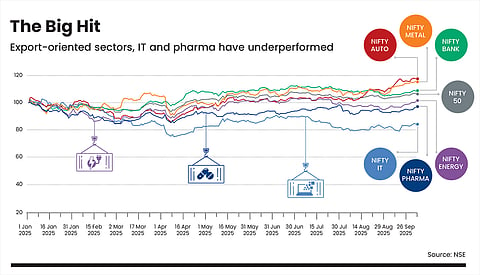

Earlier, the announcement of the H-1B visa fee hike dragged the Nifty IT index down by 3 per cent points on September 22, 2025. Shares of IT majors, such as Tata Consultancy Services (TCS), HCL Technologies, Tech Mahindra and Infosys declined the most, closing lower by as much as 4-6 per cent. Note that IT stocks make up a little over 10 per cent of the broad market indices, the BSE Sensex and the NSE Nifty.

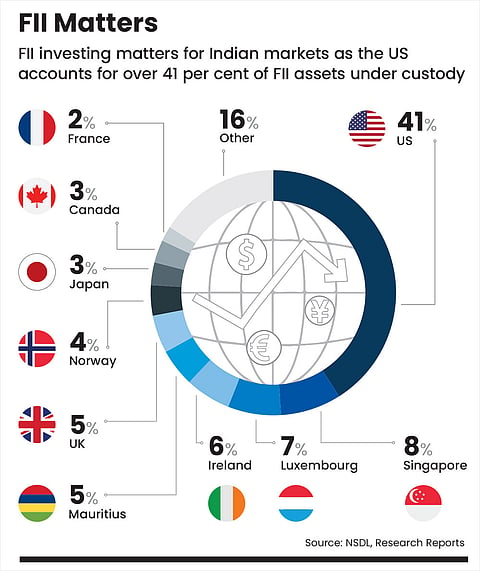

In any case, over the past few months, Indian equities have been underperforming major global peers, weighed down by persistent selling from foreign institutional investors (FIIs) and lingering geopolitical risks.

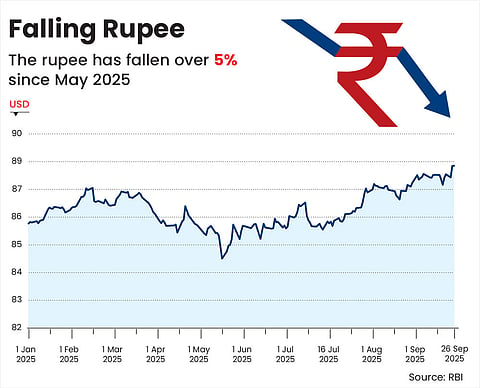

The Indian rupee has also been impacted. It has fallen over 5 per cent since May 2025 (see Falling Rupee). This has worked like a double-edged sword. Typically, a weaker rupee benefits export-oriented sectors, as they earn in dollars. But this time, due to the tariff shock, the order books of export-driven industries have already taken a hit, limiting the currency advantage. At the same time, a weaker rupee also makes imports costlier, which has added pressure on the economy.

What’s worrying policymakers, businesses and investors alike is that all this has had a ripple effect on the stock market and the larger economy, and how things will play out in the days to come. Trump being Trump, and new announcements flowing every next day, even if the decision changes, the overall tariff is unlikely to reduce by a wide margin. Even if that happens, the affected sectors will experience only marginal relief.

Where Did It Start?

The decisions have been long in the making. Trade protectionism and “America First” policies were key talking points of Trump’s election campaign in 2024. So, the imposition of higher tariffs on certain imports was a logical continuation of the promises he had made to US voters. It was a political strategy to appeal to domestic industries and negotiating lever in international trade.

Says Nilesh Shah, MD, Kotak Asset Management: “It is true that economies grow on the strength of economics. But nations are not governed by economics alone—they are equally shaped by politics. To win elections, leaders need votes, and to secure them, they often resort to policies that signal protectionism, or a tough stance on trade. This is why protectionism is, at its core, a political tool rather than an economic one.”

In our December 2024 issue, we highlighted the issues of tariffs and stricter policies on outsourcing and restrictions on H-1B visas in the story, What Trump’s Election Victory Means For Indian IT, Pharma And Other Sectors? A lot of it has come true, but it was difficult to imagine the magnitude of the decisions, given the strong bonding between Prime Minister Narendra Modi and Trump. “The tariff levy that has happened is completely opposite to the market’s expectations,” says Shah.

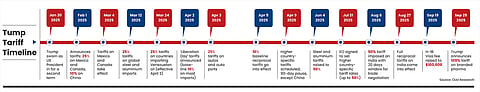

On January 20, 2025, when Trump was sworn in, he announced that revising current trade policies would be his top priority. Just 10 days later, on February 1, tariffs on Canada, China, and Mexico were announced, though they were subsequently put on hold (see Trump Tariff Timeline). In the following months, additional tariff was imposed on steel and automobiles.

The first major surprise came on April 5, with the announcement of baseline 10 per cent tariff on almost all countries, including India. This jolted the Sensex and the Nifty, both of which closed in the red, falling 0.43 per cent. Shares of IT majors, such as Tata Consultancy Services (TCS), HCL Technologies, Tech Mahindra and Infosys declined the most, closing lower by about 4 per cent.

After a series of other announcements (see Trump’s Tariff Timeline) came the 25 per cent tariff announcement, specifically for India, in July. The additional 25 per cent “punitive” tariff followed in August.

The US has time and again lambasted India for buying oil from Russia. On August 28, the day the extra 25 per cent tariff came into effect, the Trump Administration ramped up its attack. US trade advisor Peter Navarro framed the Russia-Ukraine conflict as “Modi’s war” and cautioned India against drifting closer to Russia and China.

There is no doubt that India is buying oil from Russia and India’s oil import has gone up manifold in the last five years. From merely 1.70 per cent share in total oil imports in FY20, Russia’s share has increased to 35.10 per cent in FY25 and it is now the biggest oil importer for India.

Experts look at buying oil from Russia as a pure business move. “India turned to purchasing Russian oil sold at a discount (capped at $60 per barrel) to ensure its energy security, after Western countries imposed sanctions on Moscow and shunned its supplies over its invasion of Ukraine in February 2022,” writes Soumya Kanti Ghosh, group chief economic adviser, State Bank of India, in his report Tariff Diplomacy, which was released on August 8. The report highlights that if India stopped oil imports from Russia during the rest of FY26, then its fuel bill might increase by $9 billion in FY26 and $11.70 billion in FY27.

Moreover, Russia accounts for 10 per cent of the global crude supply, and if all the countries stopped buying from Russia, crude price may increase by 10 per cent, if other countries do not increase their production, the report highlighted.

The Impact Of High Tariff

The exorbitant cumulative tariff of 50 per cent has hit export-oriented sectors, especially textile, aquaculture, gems and jewellery, and handicraft, among others (see Testing Times For Export Engines, pg 44).

But how will that affect the Indian economy? Economists estimate that the newly imposed US tariffs could shave 50-80 basis points (bps) off India’s gross domestic product (GDP) growth. Some domestic measures, however, may mitigate the risk by stimulating household spending. Recently, the government cut GST rates on several essential items, white goods, and others, to boost consumption and provide relief to industries under stress. The Reserve Bank of India (RBI) may cut the policy rate yet again in October, which too is expected to put more money in consumers’ hands.

According to a report by Antique Stock Broking, titled the Impact of US Reciprocal Tariff: “Roughly 30 per cent of India’s $90 billion exports to the US are likely to be exempt, but the remainder faces a steep climb. The potential export loss, pegged at $20-30 billion, won’t necessarily translate into a straight hit. Part of the blow could be absorbed at home, where fiscal cushions, such as the Rs 1.20-1.50 trillion GST cut and a tax multiplier of 1.52-3.00 times may boost consumption by as much as Rs 1.80-3.50 trillion.”

Some of the displaced exports could also find their way into other geographies, given that India’s export share in the GDP remains relatively modest. Says Shah: “The reality is, India has not become a fully export-focused country. With a domestic market of 1.40 billion people, most of our focus goes towards serving internal demand. That leaves us with less emphasis on exports.”

Textiles: One of the sectors most exposed to high US tariff is textiles. As a highly labour-intensive industry, the textiles sector employs millions across India, particularly in clusters, such as Tiruppur in Tamil Nadu, Surat in Gujarat, and Panipat in Haryana. The sector not only drives exports, but also sustains a wide network of ancillary industries, from cotton farming to logistics.

Says Aditi Nayar, chief economist and head-research and outreach at ICRA, a credit rating agency: “Textiles and apparel, where the US accounts for a third of Indian exports, are among the hardest hit, as switching between suppliers isn’t too difficult. The sector’s initial resilience—thanks to advance orders and the ability to pass on the first 25 per cent tariff—has given way to concerns about the additional penalty.”

With tariffs threatening India’s competitiveness in global markets, export-dependent segments—especially home textiles—are likely to face margin pressure and slower order flows.

The ripple effect will be felt by the broader economy, straining employment, household incomes, and regional growth in textile hubs. The mood among factory workers and owners in Tiruppur, for instance, is heavy. “It is difficult to survive in this current high tariff environment,” says Dinesh Babu, executive secretary of the Tiruppur Exporters’ Association.

However, the picture is not entirely bleak. Strong domestic demand for readymade garments offers some relief, while policy support, market diversification, and India’s integrated textile value chain provide a cushion over the medium term. Still, the near-term adjustment will be painful.

“Entities with diversified manufacturing bases in countries, such as Bangladesh and Vietnam are better positioned to weather the storm, but the overall outlook is one of shrinking US market share and increased competition from lower-tariff nations,” says Nayar.

Experts see a way out in diversifying and seeking opportunities in other destinations. Says Priti Arora, president and business head, Crisil Intelligence: “A small fraction of exports to the US can be diverted elsewhere, including the domestic market, in the short term. But, in the long term, it is viable to have strategic partnerships between Indian readymade garment players and international retailers in diverse geographies. Indian exporters can seek opportunities in Poland, Mexico and Croatia, which have seen rapid growth in apparel imports.”

Pharma: India’s pharmaceutical industry is the latest victim after the US announced a 100 per cent tariff on branded and patented pharma imports on September 25, which will be applicable from October 1.

Following this announcement, the Nifty Pharma index fell by 2.17 per cent on September 26. With this decline, the Nifty Pharma index became the second-worst performing index of the calendar year (as of September 26), posting a return of -8.35 per cent. The sector earns a significant share of its revenue from the US market, particularly through the supply of generic medicines.

“Given the duties announced are on branded or patented drugs, there would be no impact on the generics exports done by Indian pharma companies. The major portion of exports to the US is generic medicine and to some extent API. So, we believe it is business as usual for generic pharma companies,” says Sujan Hajra, chief economist, Anand Rathi Institutional Equity.

He adds: “In the case of pharma, the price elasticity is 0.3, which means a 10 per cent increase in price will reduce demand by only 3 per cent. Looking at India’s supply, over 40 per cent of generics used in the US (by volume) come from India, and the country accounts for about 24 per cent of the US-approved labs located outside America. This makes it extremely difficult for the US to replace Indian generic medicines.”

Impact Of Higher H-1B Fee

The higher H-1B visa fees of $100,000 is applicable to new company-sponsored skilled foreign workers entering through the FY26 lottery cycle, whose rules are up for discussion. This fee will apply to all firms, Indian or American.

For decades, the visa has been the lifeline of India’s tech sector, which allowed companies to send their skilled professionals to serve US clients and drive the outsourcing business. The massive hike, from about $1,500 to $100,000 per new application, threatens to upend cost structures, squeeze margins of IT companies, and erode competitiveness.

Due to global uncertainty, IT companies are struggling with their order books. This new announcement will aggravate their pain on the margins front. “The effective impact may remain moderate and may kick in from FY27, given only new visas are covered and FY26 lottery is already concluded. Our initial assessment indicates that the impact on margins is likely to be around 40-200 bps, assuming the similar new H-1B filings, (which may come down drastically),” says Pankaj Pandey, head research, ICICI Securities.

Also, the exposure of various companies to H-1B visa work force will matter (see H-1B Visa Fee Hike Impact On IT). The top five Indian IT firms derive roughly 55 per cent of their revenue from the US.

But the sector is likely to withstand the impact in the long term. According to a report by Nuvama, released on September 21: “Indian IT companies shall mitigate this impact by higher nearshoring/offshoring and/or hiring local talent. Over the last eight years, the industry has anyway reduced its reliance on H-1B visas significantly. However, some near-term impact on operations and financials shall have to be borne by the companies. In the long term, higher offshoring is likely to mitigate a large part of the impact.”

According to the Nuvama report, global or European IT companies would face greater challenges compared with Indian IT firms over the long term as they operate on much lower margins, a significant portion of their workforce is based in high-cost European regions and they need more time to restructure their models to increase hiring in India and other offshore areas.

It may be noted that the sector was under pressure even before the announcement. Concerns around potential tariff on IT services had resurfaced after US political activist Jack Posobiec wrote on micro-blogging site X (formerly Twitter) earlier this year that “all outsourcing should be tariffed”, arguing that foreign countries must “pay for the privilege of providing services remotely to the US the same way as goods.” The post gained traction when it was reposted by Peter Navarro, senior counsellor for trade and manufacturing to Trump.

The sector is among the worst performers this calendar year, dipping 17 per cent year to date (YTD) as on September 23. This also means that it has priced in some of the shock.

Notably, tariff was never imposed on the IT sector earlier because it comes under the service sector, but there is a catch. Says Abhishek Kumar, analyst at JM Financial: “To impose something akin to a ‘services tariff’, the US would need new legislation, which cannot be unilaterally enforced by the President without Congressional approval… (but) the US President has several executive levers to influence cross-border flows. This can be done by tightening H-1B/L-1 visa rules, invoking the International Emergency Economic Powers Act (IEEPA), or imposing sanctions to restrict payments to foreign service providers, and deploying regulatory tools in sectors such as telecom, data, and financial services through federal agencies.”

Impact On Equity Market

In the current year, stock markets have seen considerable volatility given the ever-changing tariff landscape and the ongoing geo-political tensions. In the initial months of the year, significant selling by FIIs added fuel to the fire. That’s because even though there’s higher participation from domestic institutional investors (DIIs) and retail investors (see FII Matters), FIIs still own a little over 41 per cent of free float market cap.

Between April 25 and September 18, stock indices rebounded sharply, making significant gains. This rebound could be attributed to the 90-day pause announced by the US in April, the number of bilateral trade deals negotiated with some countries like the UK, Japan, Indonesia and Vietnam, and expectation of a similar trade deal with India. The markets remained rangebound through August despite the two tariff announcements in the month, on the back of expected government relief. post Modi’s August 15 speech.

Then, the GST booster brought back confidence. However, the steep hike in H-1B visa fees later in the month turned market sentiment sour and put it on a slippery track. Since then, the market has been on a downward spiral. The pharma tariff seems to have added to the negative sentiment. Both the Sensex and Nifty fell around 1 per cent, while export-oriented sector indices Nifty IT and Nifty Pharma fell 2.45 per cent and 2.14 per cent, respectively. The sectors are among the worst performers this calendar year, IT dipping 22.30 and pharma 8.32 per cent year-to-date (YTD) as on September 26.

Says Sonal Badhan, economist, Bank of Baroda: “Indian markets fared well, until the additional 25 per cent tariff was imposed by the US on Indian imports. However, the impact of this was cushioned by strong domestic fundamentals, which have been supported by robust domestic consumption and announcement of GST 2.0 to provide further boost to growth.”

The Way Forward: The India equity market will not solely rely on global factors, including the US restrictions; domestic factors will also play the crucial role.

“We believe markets have now priced in the uncertainty around tariff-related decisions,” says Badhan.

Earnings outlook and valuations remain crucial for India, and the long-term performance of Indian equities is more influenced by the domestic economy than by global factors. “Despite escalating global trade tensions and the threat of steep US tariffs, India’s diversified exports, rising domestic demand, and institutional investor base leave its macroeconomic stability and corporate earnings largely intact. The fallout may dent growth and employment modestly, but the long-term India equity story remains firmly on track,” says Hajra.

According to Hajra’s calculation, even if Indian exports to the US fall by 70 per cent on a permanent basis, listed companies will see little impact. According to this calculation, the profitability of Nifty 500 companies will fall by 1.60 per cent due to 50 per cent tariff.

Long-term investors will do well to continue with their investments.

kundan@outlookindia.com