It’s not unusual for the common man—India’s investor, taxpayer and consumer—to expect a little something on direct taxes from the annual Budget. So when Finance Minister Nirmala Sitharaman didn’t announce any change in income tax slabs, deduction and rebate limits and tax rates on investment gains, Union Budget 2026 disappointed many. She did, however, make small tweaks here and there for the benefit of various cohorts.

What Budget 2026 Means For You

The FM made small tweaks to ease the lives of the common people, but income tax slabs, deductions and other tax benefits remain the same. Here’s how the changes will affect investors, taxpayers, consumers and seniors

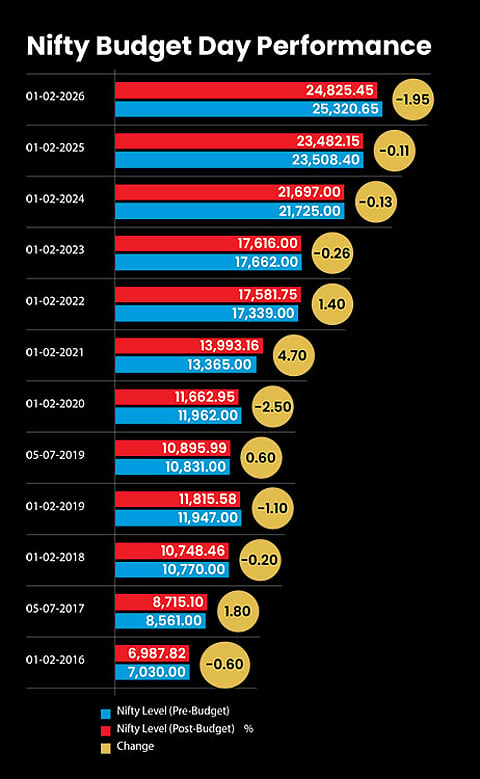

The markets, too, were disappointed, though for entirely different reasons. The Sensex closed in the red, down more than 1,500 points, on February 1, 2026.

Though changes in income tax slabs were not likely to happen this year as Sitharaman had announced deep cuts in the last Budget, markets were anticipating some measures to boost sentiment in the face of global uncertainty and persistent volatility since the beginning of 2026. On top of that, increase in securities transaction tax (STT) rates on futures and options, which will affect trading, came as a blow, though this step could curb high-risk trading by retail investors, who are known to burn their fingers.

Let’s look at the changes that will affect your personal finances.

Changes for Market Investors

Contrary to broader market expectation in the face of volatility, Sitharaman chose not to tinker much with policy, and instead opted for a more measured approach.

STT: The Budget has raised STT to 0.15 per cent on options and to 0.05 per cent on futures, effectively raising the cost of market trading. “The steep increase in STT on futures and options, coming on top of last year’s hike, is likely to raise impact costs for traders, hedgers, and arbitrageurs,” says Shripal Shah, managing director and chief executive officer, Kotak Securities. This could cool derivative market activity, reducing in volumes. The intent, therefore, appears to be volume moderation rather than revenue maximisation, as any potential revenue gain could be offset by lower derivative volumes.

On the back of the announcement, capital market-related stocks, such as BSE, Angel One, and others fell in the range of 10-15 per cent on February 1.

The announcement is also likely to encourage and give an impetus to long-term investing culture in India. For the last few years, many retail investors have treated derivative trading as a quick money making formula, not realising the inherent risk in such activity and have made significant losses.

Higher STT on derivatives will also affect the returns from arbitrage funds, balanced advantage funds (BAFs) and the newly-introduced specialised investment funds (SIF). “The recent 150 per cent hike in STT on futures (from 0.02 per cent to 0.05 per cent, effective April 1, 2026) will modestly impact arbitrage mutual funds. These funds generate returns primarily through cash-futures arbitrage, with monthly futures rollovers,” says Anup Bhaiya, founder of Money Honey Financial Service.

However, “arbitrage funds remain attractive for conservative investors seeking equity taxation with minimal volatility, though slightly compressed returns may prompt some reallocation,” he adds.

The government, meanwhile, will benefit from the additional tax collection, which has been projected at Rs 73,700 crore in FY27, compared to Rs 63,670 crore (revised) in FY26, according to the Budget document.

Share Buyback: The FM has proposed that the consideration received by shareholders when companies buy back shares shall be taxed as capital gains instead of being treated as dividend income. The cost of acquisition of these shares was treated as capital loss.

“This is a fair move given that non-promoters do not actively participate in a buyback decision, and taxing them at the higher dividend rate is against the principle of equity” says Bijal Ajinkya, partner, Khaitan & Co. Dividend income is taxed at slab rates.

The Budget has also permitted Persons Resident Outside India (PROI) to directly invest in listed equities, which is expected to boost market participation in the country.

Changes For Bond Investors

Corporate Bonds: Sitharaman also proposed a market making framework for corporate bonds. This could help boost liquidity in corporate bonds and effective price discovery on bonds and bond-derivatives, say experts. A proper market making framework will also reduce transaction costs for investors on entry and exit from the market.

“Small policy moves for the bond market with the market-making framework will enhance liquidity in the secondary market and the introduction of bond indices will bring in more transparency for pricing and hedging credit risk,” says Vishal Goenka, co-founder, Indiabonds, a Securities and Exchange Board of India (Sebi)-registered online bond platform provider (OBPP).

SGBs: The Reserve Bank of India (RBI) has discontinued fresh issuance of sovereign gold bonds (SGBs), but they still trade in the secondary market. The Budget has proposed to exempt the original subscribers (who bought SGBs from RBI) and held them continuously from paying capital gains tax.

Changes For Taxpayers

ITR Filing: While the last date for filing of income tax returns (ITR) for individuals eligible for ITR-1 and ITR-2 forms will remain July 31, business cases or trusts will have time till August 31. The timeline for revising returns has also been extended from December 31 to March 31 for a nominal fee.

In a move aimed squarely at cutting litigation, Budget 2026 allows taxpayers to update their returns even after reassessment proceedings have begun. Such updates will attract an additional 10 per cent tax over the applicable rate for that year. Once the revised return is filed, the assessing officer will rely only on this version during proceedings, closing the door on parallel calculations and disputes.

TDS Streamlining: In a relief to small taxpayers, the Budget has reduced the paperwork for obtaining lower or nil tax deducted at source (TDS) certificates. It will be an automated process based on the past history of the taxpayer. This will benefit cohorts, such as senior citizens and freelancers, who do not get steady monthly income. At present, even those whose tax liability is lower, need to pay TDS at a higher rate and claim a refund.

The Budget has reduced the customs duty on goods imported for personal use from 20 per cent to 10 per cent. However, this reduction does not apply to jewellery or precious metals

The Budget has also proposed to ease TDS compliance for investors. Currently, investors receiving dividends from stocks and mutual funds have to submit separate declarations to multiple entities. To streamline the process, investors will now be allowed to file a single declaration with the depository, which will share it with the respective income-paying entities. This centralised system would simplify compliance.

The government has also proposed to simplify the process for a resident buying property from a non-resident Indian (NRI). They will no longer be required to obtain a separate Tax Deduction and Collection Account Number (TAN) for TDS compliance. They can instead use their Permanent Account Number (PAN) to deduct and deposit the tax.

Sandeepp Jhunjhunwala, partner, Nangia Global Advisors, says: “The proposed amendment would bring compliance in withholding taxes using PAN of the resident buyer, on purchase of property from an NRI and other Indian residents. This clears the aversion that resident buyers had while buying properties from NRIs as obtaining TAN led to increased paperwork.”

Removal Of Deduction Against Interest On Dividend: The Budget has also proposed that no deduction shall be allowed in respect of any interest expenditure incurred by the investor on margin funding or any loan taken to invest in mutual funds or stocks. Currently, this deduction is allowed up to 20 per of the dividend income from such investments.

Says Rohit Jain, managing partner, Singhania & Co., a law firm: “Investors who use ‘margin funding’ or personal loans to invest in the equity market will now be taxed on the gross dividend, regardless of the interest they pay to the bank. For high-net-worth individuals (HNIs) in the 30 per cent or 39 per cent (with surcharge) bracket, the inability to offset interest payment will reduce the net post-tax yield on dividend-yielding stocks or real estate investment trusts (REITs)/infrastructure investment trusts (InvITs).”

Changes For Consumers

Foreign Travel, Education And Medical Expenses: The Budget has brought cheer to those who travel abroad or remit money for education or medical treatment.

With many Indians routinely taking trips abroad, cross-border shopping has become a norm. The Budget has brought significant relief for such individual consumers, with customs duty on goods imported for personal use reduced from 20 per cent to 10 per cent.

Tanushree Roy, executive director, Nangia & Co. LLP, a law firm, says: “It lowers the overall cost burden, simplifies compliance, and is likely to reduce disputes at the time of clearance. The move also reflects a balanced approach by easing the impact on consumers while maintaining a structured and transparent duty regime.”

But there are some exceptions. Says Atul Menon, partner, King Stubb & Kasiva, Advocates and Attorneys, “This rationalisation will make routine imports simpler and more affordable for individuals. However, it is important to note that this reduction does not extend to jewellery or precious metals, which continue to attract higher duties under existing customs rules.”

The FM has also proposed sharp reduction in tax collected at source (TCS) rate for education and medical purposes, from 5 per cent to 2 per cent under RBI’s Liberalized Remittance Scheme (LRS).

Says Sudhakar Sethuraman, partner, Deloitte India, “Lower TCS rates mean individuals now part with less money upfront, improving liquidity to meet other overseas expenses.” He said this is particularly beneficial for middle-income families funding foreign education, where remittances are often staggered over the year.

TCS is collected by banks or authorised dealers on overseas remittances under LRS. It reflects in Form 26AS and can be adjusted against the final income tax liability, with refunds available for any excess deduction. It is important to note that TCS represents only a cash outflow and is not a tax levy.

Compensation For Motor Accident Victims: The interest earned on compensations awarded by Motor Accident Claims Tribunals will not be taxed anymore.

These cases deal with claims relating to loss of life/property and injury resulting from motor accidents. Such claims typically drag for years and tribunals usually add interest on the compensation due to the delay. That interest, however, often comes with a TDS cut.

Says Paras Pasricha, head, motor insurance, Policybazaar: “This will ensure accident victims and their families receive the full interest amount upfront. It will improve cash flows at the time of payout and spare families the added burden of claiming refunds in ITRs.”

Changes For Seniors

The Budget has highlighted the growing demand for organised senior care services and suggested training 150,000 multi-skilled caregivers for geriatric and allied care services. A trained workforce can play an important role, given India’s increasing ageing population.

It also reaffirmed its commitment to mental health and trauma care, which will benefit seniors, given the high incidence of mental health issues among them. “There are no national institutes for mental healthcare in north India. We will set up a NIMHANS-2 and also upgrade National Mental Health Institutes in Ranchi and Tezpur as Regional Apex Institutions,” said the FM in her speech.

She said medical emergencies expose the poor and vulnerable to unexpected expenditure. “We will increase these capacities by 50 per cent in district hospitals by establishing emergency and trauma care centres.”

The TDS procedure has also been streamlined for the seniors, as mentioned earlier.

All in all, the Budget focuses on ease of compliance by introducing small benefits, instead of announcing any big changes.

nidhi@outlookindia.com