Even small estates can trigger fights over inheritance without documents.

Nominations help receive money, but only wills decide who owns it.

Planning early avoids blocked accounts, court delays and guardian issues.

Why Middle-Class Families Need Estate Planning More Than They Realise

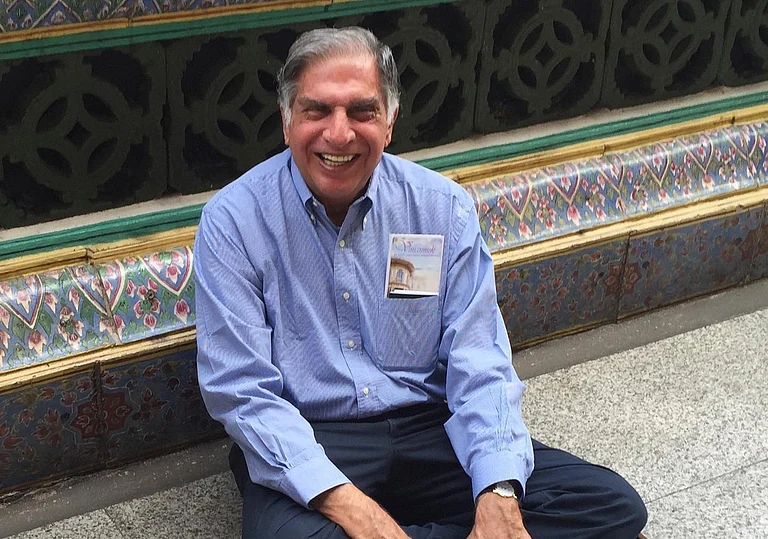

Inheritance disputes can often arise from ordinary households with modest assets, reflecting why clear documentation matters long before wealth accumulates

For most middle-class households, estate planning still seems like a very remote concern. Today, any average family has a portfolio of the following assets: a flat, a car, deposits, life insurance, and retirement savings, but these may not be considered big enough to curate detailed estate planning. Nevertheless, even modest estates could become very complicated if there is no written clarity on ownership, distribution, or guardianship.

Without the basic documents, the family often cannot access routine funds, settle claims, or even identify all assets. Shraddha Nileshwar, head of will and estate planning, 1 Finance explains, “Courts in major cities report that 60 to 70 per cent of inheritance conflicts now come from estates worth under Rs 5 crore, and many stretch for years and drain wealth that families meant to pass on.”

Why Guardianship Becomes A Point Of Conflict

The situation is even more fragile when minor children are involved. Without a will, the court decides who becomes the guardian and how the child's money should be handled. During this process, access to the accounts, insurance proceeds or deposits of the deceased usually stay blocked.

As Nileshwar says, "Families assume that someone close will automatically take over, but courts do not work on assumptions. Until guardianship is settled, funds may remain frozen, and everyday expenses become difficult to manage."

Why Nominations Are Not Enough

A common misconception is that nominations solve issues of succession, all that nominations do is facilitate the nominee to receive money from an institution. The nominee is not the owner. Ownership follows the succession law.

"People think nomination equals inheritance, but it simply does not. A nominee collects. A legal heir inherits", says Nileshwar. When the nominee is a minor, access becomes even more challenging, with banks refusing to release funds until legal heirship is formally established, according to Nileshwar.

Court Rulings Reveal The Risks

Here are two cases that underline how confusion over nomination and heirship affects ordinary families.

In the Supreme Court of India, the 2009 case of Shipra Sengupta vs. Mridul Sengupta dealt with a bank deposit of just Rs 3 lakh. Mr Shyamal Sengupta, an SBI employee, died intestate. He had nominated his mother for his provident fund, gratuity, and insurance dues. On his death, both his mother and his widow staked claim over the same amounts. When the mother died during the pendency of the case, her legal heir was impleaded. The Court stated that a nominee is only a trustee and that legal heirs inherit as per succession law.

In 2024 the case of T. Vishwanath Setty and others was presented before the Kerala High Court. Mr T. Thippanna Setty had several accounts, deposits, and insurance policies with nominations. On his death, banks refused to release funds only based on nomination. His sons had to obtain a Succession Certificate to prove their right of inheritance. The Court said that nomination does not confer ownership and entitlement must follow succession law.

Documents That Decrease Uncertainty

A basic will updated every few years remains the surest way to ensure smooth transfer of assets. It clearly stipulates who gets what, appoints guardians for minors, and reduces the possibility of disputes. Supporting documents make this process even smoother.

"A will is the backbone, but the family also needs clear records. Many assets today exist only in digital form, so heirs must know how to trace them," says Nileshwar. One useful addition is a 'Letter of Intent' kept alongside the will. This document lists passwords, locker keys, account details, insurance policies, debts, and any intellectual property rights. It works like a roadmap that helps a family trace everything without confusion.

Why Early Planning Matters

A middle-class household can see its estate grow much faster than expected. Real estate values appreciate, retirement savings rise steadily and insurance payouts add to the final corpus. When there is no planning, these assets often get locked in litigation or administrative delays.

"Estate planning is really about reducing stress for the people you leave behind," Nileshwar summarises. "When instructions are clear, families do not have to fight or guess." The problem for many households is not the size of the estate but the silence around what happens after.

Clear documents bring certainty, prevent avoidable disputes, and ensure that wealth, however modest, reaches the people it is meant for.