The government contemplates a proposal given by the Employees' Provident Fund Organisation (EPFO) to make employee provident fund (EPF) withdrawal rules more flexible. EPF withdrawal rules may become less stringent by relaxing the partial as well as full withdrawal rules. According to a Moneycontrol report, the government may allow EPF subscribers to withdraw their EPF money partially or fully once every 10 years. As of now, EPFO allows partial withdrawal for a certain percentage of the corpus and only for certain reasons, whereas full withdrawal is allowed only after a subscriber turns 58 years old or after remaining unemployed for two months.

EPF Withdrawal: Government Considers Proposal To Allow Partial Or Full Withdrawal Every 10 Years

The Employees' Provident Fund Organisation (EPFO) has proposed a change in the EPF withdrawal rule to the government. The proposal, which is related to the changes in advance- and full-withdrawal rules of the EPF corpus, is under consideration

According to the report, the officials expect an enhanced experience of EPF members as they would be able to use the money for their different needs instead of the reasons stipulated by the EPFO. It says that the government may allow withdrawal every 10 years, however the limit may be kept at 60 per cent of the corpus. Changes in full withdrawal rules are also under consideration, but nothing has been finalised yet.

When Is Partial Withdrawal Allowed In EPF At Present?

Presently, a subscriber is allowed to withdraw EPF partially for reasons, including medical emergencies, children's education, marriage (of self, brother, sister, son, or daughter), or purchase of a house, flat, or site acquisition, or construction of a house. One can also take advance from his/her EPF funds for abnormal conditions such as damage to property due to a natural calamity, etc. A differently-abled subscriber can also take an advance for buying equipment to minimise hardships.

However, the withdrawal rules in terms of the amount and period of membership vary for different reasons. In addition to this, there are restrictions on the number of withdrawals, too. Overall, the rules are complex, and withdrawing advance from EPF is not an easy task.

Recent Measures Taken To Make EPF Services User-Friendly

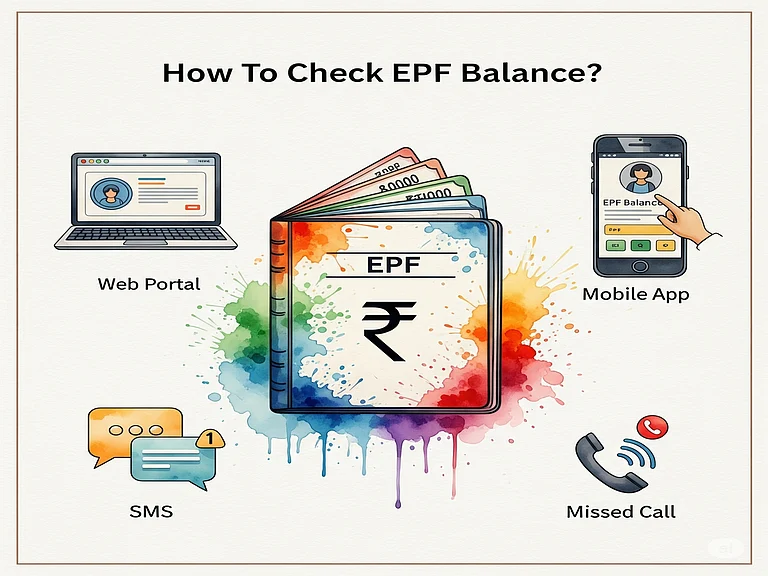

Lately, EPFO has taken measures to remove operational hurdles and made changes in a few rules, too. For example, it has allowed auto-settlement for different types of claims, and increased the limit from the previous Rs 1 lakh to Rs 5 lakh for advance claims. UAN application and activation is now possible through the UMANG mobile app through face authentication technology. It has added 15 more banks for contribution collection to streamline the process and improve efficiency.

Now, if the 10-year withdrawal rule is implemented, it may help subscribers withdraw money from the EPF in times of financial exigency. However, the flip side is that subscribers might use the EPF for various needs, leaving no substantial amount by the time they retire.