Budget 2026 has retained income tax slabs under both old and new regimes; rates notified last year continue to apply.

Section 87A rebate ensures nil tax up to Rs 12 lakh, effectively Rs 12.75 lakh for salaried taxpayers after standard deduction.

Zero tax liability continues only up to Rs 5 lakh for eligible resident individuals under the old tax regime.

Tax deduction at source from April 1, 2026 will follow the same rates applicable for FY 2025-26, aiding financial planning.

Check Income Tax Slabs And Rates Under The New Tax Law Coming Into Effect From April 1

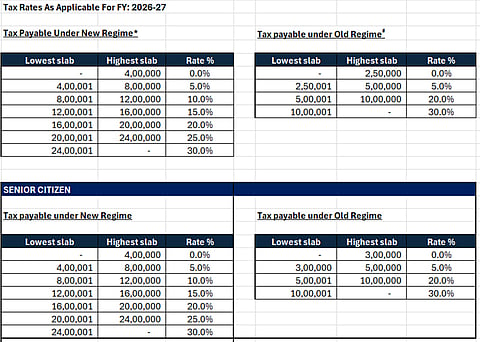

Despite the rollout of the New Income Tax Act, 2025, income tax slab rates under both the old and new regimes remain unchanged. Taxpayers will continue to file returns for FY26 using the slab structure announced in Budget 2025.

As widely expected, the Union Budget 2026 has kept income tax slab rates unchanged under both the old and the new tax regimes. As a result, the slab rate changes announced in Budget 2025 will continue to apply while filing returns for FY 2025-26.

Notably, under the new tax regime, the enhanced Section 87A rebate ensures no tax liability on taxable income up to Rs 12 lakh, offering significant relief to middle-income taxpayers. “For salaried individuals, this effectively makes income up to Rs 12.75 lakh tax-free after the standard deduction. Meanwhile, the old tax regime slabs and rebates remain the same, with zero tax applicable only up to Rs 5 lakh for eligible resident individuals,” says CA Abhishek Soni, CEO & Co-founder, Tax2win.

Tax experts say the Finance Ministry announced the adoption of the New Income Tax Act, 2025, leading many taxpayers to assume that tax slab rates or regimes may undergo a revision. However, the new legislation is largely modelled on the existing law, and the tax slab rates continue to remain unchanged.

“Further, the rebate introduced last year, ensuring non-taxability of income up to Rs 12 lakh under the new tax regime, has been considered sustainable by the ministry and will continue to apply. For salaried individuals, this means that tax deducted at source (TDS) will be deducted effective 01 April 2026 at the same rates currently in force for the financial year that began on 01 April 2025, providing much-needed certainty for financial planning,” informs Neeraj Agarwala, Partner, Nangia & Co LLP.

According to RSM India,

Under The New Tax Regime

* A resident individual would be entitled to a rebate under section 156 of ITA, 2025 (corresponding to section 87A of the ITA, 1961) of 100 per cent of tax payable or Rs 60,000, whichever is lower, (excluding health and education cess), resulting in NIL tax liability up to a total income of Rs 12,00,000. Further, such a rebate on income tax is not available on tax on incomes chargeable at special rates (excluding section 198 of the ITA, 2025 (corresponding to section 112A of the ITA, 1961)).

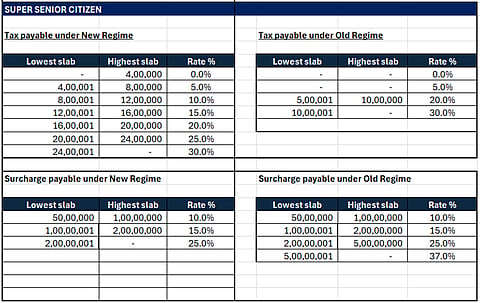

* Marginal relief is available to ensure that the additional income tax payable, including surcharge of 10 per cent, 15 per cent, or 25 per cent on the excess of income over Rs 50,00,000, Rs 1,00,00,000 or Rs 2,00,00,000, as the case may be, is limited to the amount by which the income is more than Rs 50,00,000, Rs 1,00,00,000 or Rs 2,00,00,000 as the case may be. No marginal relief shall be available in respect of the health and education cess.

Under The Old Tax Regime

* Basic exemption income slab in case of a resident individual of the age 60 years or more (senior citizen) and resident individual of the age 80 years or more (very senior citizens) at any time during the previous year continues to remain the same at Rs 3,00,000 and Rs 5,00,000, respectively.

* The tax rate is continued at rate of 5.20 per cent [tax rate 5 per cent plus health and education cess 4 per cent thereon] on the income exceeding Rs 2,50,000 but not exceeding Rs 5,00,000. However, a resident individual would continue to be entitled to a rebate under section 156 of ITA, 2025 (corresponding to section 87A of the ITA, 1961) of 100 per cent of tax payable [excluding health and education cess] or Rs 12,500, whichever is lesser, resulting in NIL tax liability up to total income of Rs 5,00,000.

* Marginal relief is available to ensure that the additional income tax payable, including surcharge of 10 per cent, 15 per cent, 25 per cent or 37 per cent on the excess of income over Rs 50,00,000, Rs 1,00,00,000, Rs 2,00,00,000 or Rs 5,00,00,000, as the case may be, is limited to the amount by which the income is more than Rs 50,00,000, Rs 1,00,00,000, Rs 2,00,00,000 or Rs 5,00,00,000, respectively. However, no marginal relief shall be available in respect of the health and education cess.