A major change was introduced in income tax in Budget 2025. It is the increase in the tax exemption limit for all taxpayers to Rs 12 lakh in the new tax regime. Union Finance Minister Nirmala Sitharaman said in her budget speech, “I am now happy to announce that there will be no income tax payable up to income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime. This limit will be Rs 12.75 lakh for salaried taxpayers, due to a standard deduction of Rs 75,000”.

Budget 2025 Income Tax Slabs: How Much Can Seniors Save With The Increased Tax Exemption Limit?

Budget 2025 has brought significant relief for taxpayers by increasing the tax exemption limit to Rs 12 lakh. How much can senior citizens save under this new provision? Read on to find out

The government is focused on the new tax regime. The old tax regime is gradually being phased out. The announcement to enhance the tax exemption limit of Rs 12 lakh aligns with the same objective and makes the new tax regime more attractive.

“Right after 2014, the ‘Nil tax’ slab was raised to Rs 2.5 lakh, which was further raised to Rs 5 lakh in 2019 and to Rs 7 lakh in 2023”, said Sitharaman in her speech.

However, seniors who are dependent on interest from fixed deposit and a rental income, have more reasons to be happy about. This is because the TDS deduction limit has been proposed to be doubled from Rs 50,000 to Rs 1,00,000. It will not only improve the availability of disposable income in the hands of taxpayers but also save seniors from the hassle of filing tax returns and waiting for income tax refunds if there is no tax liability.

How Much Can Seniors Save?

However, the key benefit is for the people, including senior citizens, who are planning to choose the new tax regime. With the enhanced limit for tax exemption, anybody earning up to Rs 12 lakh annually who is liable to pay Rs 80,000 tax under the existing tax provisions, will need not pay anything. Someone earning an annual income of Rs 18 lakh will save Rs 70,000 and similarly, a person with a Rs 24 lakh annual income will benefit with a tax saving of Rs 1.10 lakh.

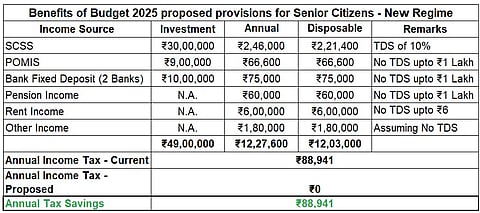

According to Anuj Kesarwani, a certified financial planner, chartered trust and estate planner, and founder of Zenith Finserve, "The recent tax changes in the Union Budget 2025 have brought some much-needed relief to senior citizens. This addresses the safety and post-tax returns concerns from investments. With the proposal of no tax up to an annual income of Rs 12 Lakhs, a senior citizen can simply invest in government schemes like Senior Citizen Savings Scheme (SCSS), Post Office Monthly Income Scheme (POMIS), bank deposits”.

Courtesy Anuj Kesarwani, CFP and CTEP

He adds, "They may have rental income and pension income. If their total income is up to Rs 12 lakh, they do not have to pay any tax".

How Will This Benefit Seniors?

Those who don’t have income or expenses that can be claimed for a tax deduction or exemptions, such as home loan interest, may opt for a new tax regime and benefit from the enhanced limit.

Binod Kumar, MD and CEO, Indian Bank, commented, "The increase in tax exemption to Rs 12 lakh is a significant step in boosting disposable income and strengthening consumption. Indian Bank remains committed to supporting these initiatives, driving sustainable economic progress, and financial inclusion”.

Anand Vardarajan, Chief Business Officer, Tata Asset Management, says, “The increase in tax exemption limit up to Rs 12 lacs undoubtedly puts more money in the pockets of the individual. This is now nearly 6 times the per capita GDP up from nearly 3 times in the past. This may possibly find its way into either spending or investment".

Kesarwani emphasises that the enhanced tax exemption limit will enable people to have more disposable income and that’s why they do not need to take any risks on their investments and yet enjoy decent returns and safe returns. However, sustainability of the corpus till retirement will still be a challenge as none of these investment generally grow more than inflation.