Like any investor, Chennai based S. Krishnamorthy’s investment portfolio comprises a range of financial instruments including direct equity shares, mutual fund units (both equity and debt), bonds, bank savings account, and fixed deposits. He also uses a credit card.

Krishnamorthy, a retired Indian Railways officer, felt the need for a single tool with which he could manage all his investments and also know their status at any point of time, duly updated automatically in real time. After trying out several personal finance software, he settled for Perfios, which he found best suited to his needs.

If, like Krishnamorthy, you too want to sort out your personal finances and organise your financial life, then personal finance software is just what the doctor ordered. “Personal finance software should be able to provide a full view of one’s entire finances at any given point in time in the most automated way,” says Aditya Prasad, chief evangelist, Perfios.

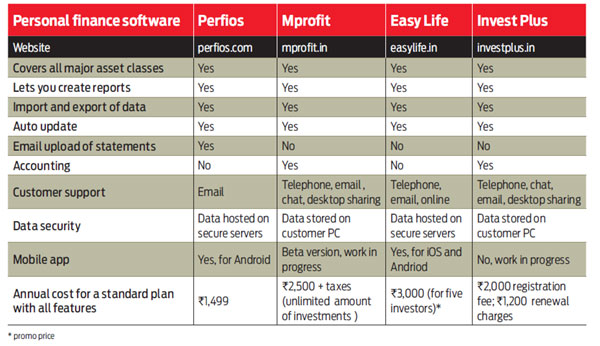

In this story, we discuss the four leading personal finance software from India—Perfios, MProfit, Easy Life and Invest Plus.

Get your finances in order

How does personal finance software help? “High-income individuals tend to be very busy and many of them are unable to stay organised in their personal finances. Many of them also take loans for various purposes. There are numerous cases where insurance agents do not give proper services for reminders and policies that are lapsing; matured deposits are not collected in time; post office savings, which have matured, lie unclaimed; and stocks are not bought or sold as per targets set, resulting in huge losses for investors. Hence, it is important to get organised,” says Biren Shah, managing director, Adit Microsys, developer of Easy Life.

Many of us use the services of professional financial planners to manage our finances. However, personal finance software does not replace the need of a financial planner and vice versa. “Even if you have a planner, this software is useful as many people fail to give all their financial details. With personal finance software, you can keep track of everything and, from time-to– time, sit with your planner to make sure your goals are being met,” says Manish Jain, co-founder, MProfit.

Varanasi-based engineer Anurag Gupta, who is using MProfit since 2010, says, “Usually, one has to maintain their transactions manually. Here, one entry goes into many places. So, if one is buying mutual fund units, it reflects in their bank account immediately. One also need not put in details like STT, broker charges and other fees when investing in a mutual fund, but can directly import the details from the contract note. It saves a lot of time.” The software also helps Gupta stay on top of premium payments and maturity dates. “I get alerts a couple of months in advance when investment is nearing maturity. The software also rings out an alarm when the final date approaches,” he adds.

Personal finance software is much easier to use than spreadsheets for managing your money. “Perfios helps me get a 360-degree view of my personal finance. Besides, it tracks the performance of my investments in an automated way, which has made my life easier.

Otherwise, I would have had to toil with an Excel sheet manually. Besides, several kinds of reports, such as for capital gains, can be generated in a jiffy to help you file income tax returns easily,” says Krishnamorthy.

Mumbai-based software engineer Yogendra Asher had been using accounting software Tally and other tools to manage his mutual fund investments. But, for the last three years, he has been using Invest Plus, which provides him with instant and updated information about his entire portfolio. “My life has become easier after using Invest Plus as information about my wealth is now on my finger tips,” says Asher.

Choose what best suits you

Here are some things to consider before you narrow down on the software that suits you best:

Features offered: While most of these software offer similar features, a close study of what’s on offer is recommended. First, make sure that the software covers all the major asset classes across which your investments are spread. Second, check if the software covers all the major financial institutions and lets you import data directly in the form of e-statements in different file formats. “Ask yourself if you need features like accounting and advanced reporting for income tax returns,” says Jain.

Third, check what the software lets you do with the data in terms of number of reports it lets you generate. It is suggested that you go for an India-specific product as international solutions might not work.

Data security: Your financial data is very sensitive and hence data security is a must. Invest Plus and MProfit store all data on your PC and do not use third-party servers. Perfios and Easy Life are hosted on servers. However, this does not make your data less secure. Perfios hosts on Amazon Web Services while Easy Life hosts on Microsoft Azure cloud. Security certificates ensure that your data remains safe.

Customer support: Such software provide support through one or more channels like phones, email support, and live training through desktop sharing. Ahmedabad-based businessman Mayur Parikh, who has been using Easy Life for over a year says, “Whenever I have any doubts, I avail of online customer support through TeamViewer, a desktop sharing program. The person at the other end takes control of my computer and guides me.”

Ease of use: The software should be easy to use and not require any special skills. “You don’t have to be finance or account expert to work on the software. Any person with basic computer knowledge should be able to manage their investments,” says Mitul Dadhania, CEO and managing director, Invest Plus.

Plans and pricing: In most cases, personal finance software offer a basic free plan, which comes with limited features, while there is an annual subscription fee for the more comprehensive plans. For example, in the free plan offered by MProfit, you can manage investments of up to Rs.50 lakh and a maximum of 16 portfolios. The MProfit Investor+ plan, which lets you manage an unlimited amount of investments, comes for Rs.2, 500 per year. Perfios offers a forever-free plan that comes with basic features, while the gold and platinum plans come for Rs.499 and Rs.1, 499 per year, respectively. MProfit and Easy Life offer all their versions free for a trial period of 30 days. After someone demonstrated Easy Life at his office, Parikh used the software for a week before deciding to subscribe to it.

Starting off with a free plan or a trial version is recommended. And, if you see it making your life easier, you might want to invest in a subscription. This is one investment you will not mind.

Picking the right one

- Try the free or trial version to measure the ease of using the software. It should not require you to be a financial expert

- Know if you are going to manage the finances of one person or several family members

- Check how many asset classes like banks, equity, insurance, and a mutual fund does the software support

- Check if majority of the financial institutions are covered under each asset class

- Your data can either be stored on your personal computer or company servers. If it is the latter, check for security certifications

- Find out how prompt and effective is the after-sales support n Check the availability of a mobile app, if you want to use the software on the move