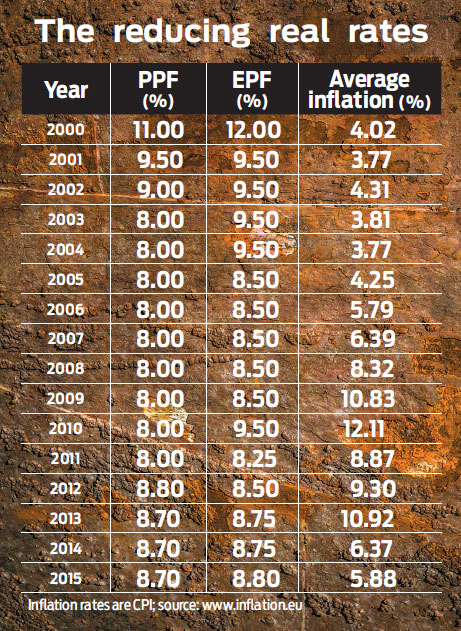

Interest rates on small saving instruments have been steadily spiraling downwards, which is a move that has deep impact for your money and future. In little over a decade, we have come a long way from high assured return and low inflation rate regime to its reverse—returns are falling and inflation is on the rise. The net impact of the two is that for most of us, there is little money in hand, even as life’s demands go up. So, on March 18, when the government announced that the interest rates for various small savings schemes will be cut from April 1, 2016—it effectively sealed the fate of those looking for some comfortable time in their retirement years.

Says Kolkata-based Avijit Banerjee (66): “The policy of decreasing interest rates on an ongoing basis is actually hitting the senior citizens below the belt. As the banks cut repo rates, interest rates on small savings will fall even further.” His fears are for real and although he is a relatively new retiree, there are many others whose retirement budgets are going completely awry, forcing them to think of several drastic steps. Although rates on small savings have been going down over the years, the frequency of the changes was less. However, since 2011, the interest rates on small savings have been linked to 10-year G-sec yields and reviewed once every year.

Today, interest rate on Public Provident Fund (PPF) has come down to 8.1 per cent from 8.7 per cent, interest rates for the National Savings Certificate has come down from 8.5 per cent to 8.1 per cent, while that on the senior citizens scheme has been reduced to 8.6 per cent from 9.3 per cent. Post Office Term deposits have been hit the hardest with interest rates on 1- to 5-year deposits falling to 7.1-7.9 per cent from 8.4-8.5 per cent. Now on, the small savings rates will be reset every quarter, which means they are as good as any market-linked product.

Crumbling fortress

For many investors, the new development is nothing short of a paradigm shift. Over the years, small savings schemes have consistently attracted their interest. The reasons are not hard to find. Being managed by the government, it was perceived to be secure. So much so that many people became reluctant to venture out of the secure cocoon of assured returns from post office schemes, despite witnessing higher returns from higher risk investments like equities and even mutual funds.

Moreover, tax savings options under Section 80C of the Income Tax has a fair share of small savings instruments—PPF, NSC, 5-year deposit and Senior Citizen Scheme. The hot favourite among the middle class and even the rich is the PPF, for the benefits of annual compounding resulting in a tidy sum on maturity, which is absolutely tax free. The fact that the tax deduction limit was upped from Rs1 lakh a year to Rs 1.5 lakh a year is a factor that made several people chase these instruments, in spite of the falling interest rates.

In the same period, Indians witnessed a period of high inflation, something that was new to them. The fact that inflation is taxation without any legislation hit people only when they started to feel the pinch of their money’s worth, which was no more enough to maintain their lifestyle. Accepting this reality is what one has to face up to, and no, it is not the end of your miseries if you have been banking on small savings. “Small savings rates can fall further as the government is going to align small savings rates on a quarterly basis now,” says Yadnesh Chavan, fund manager, fixed income, Mirae Asset Global Investments India.

Coping with change

The lower interest rate for small savings has a dramatic impact on your finances, leaving you with little choice but look at options outside its comfort. Says R.P Tulsian, Professor, Delhi University: “A lot has changed since the late 1980s, when post office term deposits were as high as 14 per cent. One has to change their investment approach with times and I have done so by putting money in equities, mutual funds and even FDs.” Not everyone is as astute as him; but, there is also a slow shift towards exposure to more marketlinked products. These do not come with any guarantees, but if smartly used, can be tax efficient and also post significant real returns.

“Investors should understand the interest rate cycle. They have historically been cyclical in nature,” says Hemant Beniwal, principal financial planner, Ark Financial Planners. In the past, PPF rates were not market linked, but if we look back at interest rates, they have followed a cyclical nature. 10-year G-sec rates had gone up to 12.3 per cent in February 1999 and then touched a low of 5 per cent in October 2005. If linked, PPF rates would also have been as high as 12.55 per cent and as low as 5.25 per cent. Now that it is linked to the market rates, going ahead, PPF rates are expected to be volatile. "But due to a cyclical nature of interest rates, the returns are still going to average out over a long time," adds Beniwal.

However, those servicing a home loan would accept that the dreams of falling interest rates have remained a dream. So, to assume that the interest rate cycle will emerge when PPF rates will go up is a distant dream. However, the logic does hold good for those with monies in Senior Citizens Savings Scheme and Sukanya Samriddhi Yojana that are still good investment options for the respective demographic profiles.

For corporate India, those who drive the stock markets, the fall in interest rates is a welcome sign of the economy finding the booster shot. Says Rudrani Bhattacharya, assistant professor, National Institute of Public Finance and Policy: “The effect of lowered interest rates will be set off by the economic growth it should result in. Lowering of policy rate will reduce lending and deposit rates of banks. Fall in lending rate will help in boosting investment, especially by small and medium enterprise owners.” The argument is good, but, the lag in passing the benefits of rate cuts is something for all to see.

Changing perceptions

The developments that may impact small savings will also bring about profound changes in your approach to investment. As you get used to interest rate fluctuations, your risk perception will change. If you have not already realised, you will soon realise that there is no risk-free investment option. “The definition of ‘risk-averse’ will change. What you consider risk-free today could put your future at risk,” says Vikaas Sachdeva, CEO, Edelweiss AMC.

Effectively, the so-called low-risk options will face interest and inflation risk, high-risk options will face market risk. The process will be aided by investor education, which is mandated for the mutual fund industry, which is doing its share in creating awareness among investors. The impact of this awareness will be felt in the medium- to long-term. For some investors, that learning curve may have begun to take shape.

Says Mumbai-based Dr Praveen Kumar: “As I have invested in mutual funds through SIPs, I have not felt the pinch of falling interest rates as my investments hedge the effect of falling rates.” His investments are in mutual funds, FDs and the NPS, which is a good mix that is not dependent on the fate of interest rates alone. He plans to stay invested in mutual funds, with the mandatory contribution to the NPS to continue as he is a central government employee.

As is evident, fluctuating interest rates will force you to manage risk for debt investments too. In the future, you will have a portfolio of debt investments. “You will not be able to avoid risk; you will have to manage it. Risk management will be the name of the game,” says Sudipto Roy, managing director, Principal Retirement Advisors, India.

Ripple effect

The effect of these changes is not just on your savings and investments; they impact your personal finances. For instance, the returns on traditional insurance plans have been on the way down, and insurers have changed their product offering between pure risk cover and those with some form of returns. These returns are market linked. Says Aalok Bhan, director and head—product solutions and customer marketing, Max Life Insurance: “Savings linked insurance plans are long-term savings instruments coupled with death benefits. The value they provide is much more than the interest rate fluctuations or the prevailing interest rate regime.”

The impact is more in case of health insurance, where the cost of treatment has been only going up. “The cost of treatment for most prevalent medical conditions like cardiac ailments, cancer, diabetes, and kidney stones has increased manifolds in the past few years because of medical inflation,” says Antony Jacob, CEO, Apollo Munich Health Insurance. Medical inflation is almost twice the general inflation rate, which is a bigger challenge. If you have been to a hospital in recent times, you will realise not only the proliferation of health insurance, but also the fact that you cannot think of being treated without one, a few years from now.

“Without a safety net like a health insurance, it will be a daunting task to cope up with the rising medical costs,” warns Rajiv Kumar, head—corporate planning, strategy, customer service and product development, Universal Sompo General Insurance. The impact of inflation on rising healthcare costs is something that has not been factored in easily, until someone is hospitalised. And, among the salaried class, the dependence on employer provided health insurance needs to move towards self funded health plans.

Options for the riskaverse investors

No doubt falling rates have made assured return instruments less attractive; after accepting the presence of risk on investments, risk-averse investors still have some options. One of them is debt funds as bond prices are inversely proportional to interest rates. Debt funds would include gilt funds, income funds and dynamic funds which typically take duration calls based on outlook on the interest rates. Income funds invest in a variety of fixed income securities such as bonds, debentures and government securities.

“It may be worthwhile for investors to invest in Fixed Maturity Plans (FMP) in order to lock into higher yields. Investors with more aggressive return expectations may also look at funds which will react to the falling interest rates such as dynamic funds and bond funds,” says Killol Pandya, head—fixed income, Peerless Funds Management Company.

“In falling interest rate scenario, the investors can use debt funds as hedge against fall in the small savings rates. The fall in the interest income on PF/PPF and other small saving schemes can be compensated by way of potential capital gains in the long duration debt schemes,” says Chavan. Since all debt funds have linkages with interest rates, investing in an income fund is a good alternative in the short- to mediumterm. “If you look at the long term average category returns, income funds have given 100-200 basis points returns above the repo rate. One can expect reasonable returns in the medium term as interest rates may go down further by 25-50 basis points in FY17,” adds Sachdeva.

For those still invested in the PPF, there is no need to rush an exit. “PPF is still a fantastic investment, especially for those in the 30 per cent tax bracket. Because of its Exempt-Exempt-Exempt nature, the real returns of PPF investments are actually much higher,” advises Renu Maheshwari, CEO, Finscholarz, a Chennai-based financial advisory firm. She says one should treat the PPF contributions as the overall debt component of one’s portfolio.

However, for the retired people, especially ones with a limited corpus, there is little to choose from . “They should revisit asset allocation and put certain portion into equity, otherwise inflation will eat into their returns,” stresses Maheshwari. For those who have solely depended on fixed return instruments as their only investment option, they not only lose out on the possibility of earning higher returns, but also fail to benefit from economic boom in times of low interest rates.

The lesson for risk-averse investors is to change their investment style and use the role of small savings as allocation to debt in their overall asset allocation. They also have a window open to a world of new opportunities that will allow them to put their money into instruments that will help meet their financial goals. The message is clear: there are no safe havens any more. If you trim your sail, you can ride the wind and go on to the shores of greater wealth. No one can promise it’ll be smooth sailing, but that way you’ll never be adrift at sea. What you have glimpsed in the present cut is just the trailer. The real show is yet to begin.