Persistent Systems, for the first time, witnessed its revenue and profit crossing significant milestones of Rs 1,000 crore and Rs 100 crore within a single quarter. During the second quarter (Q2) of Financial Year (FY) 2021, this Pune-based mid-size IT firm’s revenue was at Rs 1,007.7 crore, with a Quarter-on-Quarter (Q-o-Q) growth of 1.7 per cent and a Year-on-Year (Y-o-Y) growth of 13.9 per cent. Its net profit stood at Rs 101.9 crore with a growth of 13.3 per cent Q-o-Q and 18.5 per cent Y-o-Y in Q2 FY2021.

Power-Packed Growth

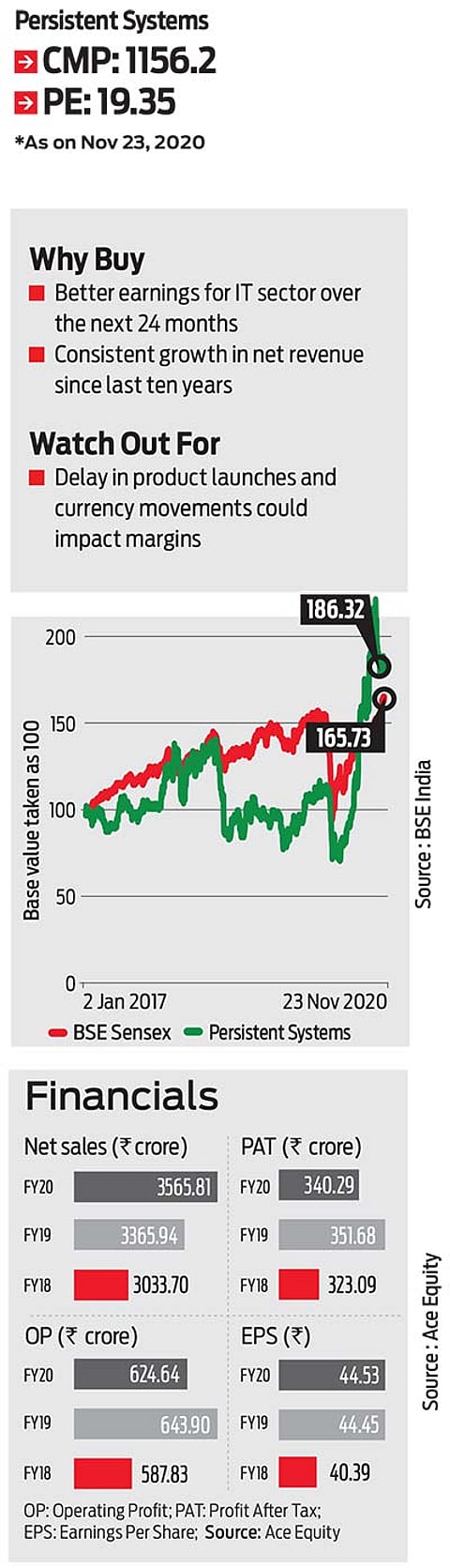

Brokerages are bullish on healthy outlook after a 63 per cent surge in the stock price

Two business verticals - Technology Services Units (TSU) and Alliance – contributed 77.3 per cent and 22.7 per cent to its total revenue in Q2 FY2021.Earnings Before Interest, Taxes, Depreciation and Amortisation (EBITDA) showed a growth of 36.3 per cent at Rs 165.8 crore Y-o-Y on the back of lower travel cost, higher utilisation and strong execution.

For its alliance business, the management expects to bag a large deal, and a number of multi-million, multi-year deals across other services. Banking, Financial Services and Insurance (BFSI) grew at 4.2 per cent Q-o-Q. Life Sciences grew at 1.8 per cent Q-o-Q, and Tech and Emerging grew at 4.5 per cent. Revenue from business offerings includes services at 83.7 per cent and Intellectual Property (IP) at 16.3 per cent. Market analysts have cautioned that execution challenge and volatility in IP portfolio have impacted the company’s performance. However, strategy change has led to a steady progress in the execution of IP business.

Persistent enjoys a spread of business across North America (80.2 per cent), Europe (8.8 per cent), and rest of the world (11 per cent). It recently announced the acquisition of Capiot Software in the US. This is expected to expand the company’s global footprint, integration capability and product offerings.

The management hopes to reach $1 billion mark over the next four years through organic and inorganic growth strategies. “The company has given a near term revenue guidance of 2-4 per cent Q-o-Q growth in Q3 and Q4. The confidence stems from 5 to 6 deals during Q2, which are $10-30 million in size,” says an analyst at Nirmal Bang.

The S&P BSE IT index has increased 39 per cent during January 1, 2020 till November 6, 2020. Over the same period Persistent’s stock has run up to 63 per cent. In fact, globally, IT has fared well with NASDAQ-100 Technology Sector index up by

25 per cent.

It is no surprise that some brokerages like HDFC Securities, ICICI Direct, Axis Securities, Nirmal Bang and others continue to remain bullish on the company’s healthy broad-based performance.

himali@outlookindia.com