Mumbai, Aug 6: The Reserve Bank of India (RBI) on Thursday announced a loan restructuring window for corporates following bankers and industry demand.

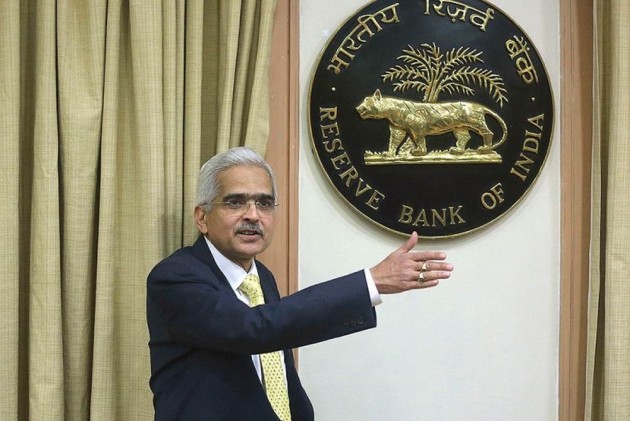

The restructuring will be allowed as per the prudential framework issued on June 7, 2019, RBI Governor Shaktikanta Das said.

Last week, Finance Minister Nirmala Sitharaman had said that the government is working with the RBI on the need for restructuring of loans to help the industry tide over the impact of COVID-19.

"The focus is on restructuring. Finance ministry is actively engaged with RBI on this. In principle, the idea that there may be a restructuring required, is well taken," Sitharaman had said.

In February, the RBI decided to extend the benefit of one-time restructuring without an asset classification downgrade to standard accounts of GST-registered Micro, Small and Medium Enterprises (MSMEs) that were in default as on January 1, 2020, in line with the Budget announcement.

Stressed MSME borrowers would be eligible for restructuring of debt, if their accounts were classified standard, Das added.

The governor also raised the Loan-to-Value (LTV) ratio against gold to 90 per cent from current 75 per cent, to mitigate COVID-19 impact on households.

“To further mitigate the economic impact of the COVID-19 pandemic on households, entrepreneurs and small businesses, it has been decided to increase the permissible Loan-To-Value ratio for loans against pledge of gold ornaments and jewellery for non-agricultural purposes from 75 per cent to 90 per cent,” RBI said in its Statement on Developmental and Regulatory Policies.

The said relaxation shall be available till March 31, 2021, the central bank said.

Priority sector lending status has been extended to start-ups, a move that will encourage banks to extend loans to such units.

However, the Governor did not give any indication on the loan moratorium which ends on August 31.

To help borrowers deal with liquidity crunch during the pandemic, the Reserve Bank had announced a three-month loan moratorium in March, which was later extended by another three months till August 31. Borrowers opting for loan moratorium can defer payment of the interest and principal component of the loan during this period.

However, bankers expressed reservations over the extension of the loan moratorium because it is being misused by even those who have the ability to pay.