Summary of this article

The percentage of stock market investors in India aged 60 and above has fallen to 7.2 per cent of the total investor base.

According to an SBI Research report, as much as 47 per cent of all fixed deposits in India are held by senior citizens.

Amid a decline in fixed deposit interest rates, senior citizens can consider investing in assets with similar risk-profile such as debt linked mutual funds.

Interest in the Indian securities market is at an all-time high, with more and more people investing either in equities or mutual funds. However, amid this surge, the participation of individuals aged 60 years and above is dropping.

Data from the National Stock Exchange (NSE) released in August 2025 shows that the percentage of stock market investors in India aged 60 and above has fallen to 7.2 per cent of the total investor base from 12.7 per cent in March 2018.

On the other hand, the participation of senior citizens in investing in mutual funds is 10 per cent according to the Computer Age Management Services (CAMS) and the Confederation of Indian Industry (CII) Report 2025, the lowest among all age groups.

Amid this declining participation, there’s an increase in the money that senior citizens are investing in fixed deposits. According to an SBI Research report, as much as 47 per cent of all fixed deposits in India are held by senior citizens.

However, interest rates on fixed deposits have decreased for senior citizens since the Reserve Bank of India’s rate cut announcements. Notably, the RBI has slashed interest rates by 1 per cent so far in 2025.

Subsequently, several banks such as the Central Bank of India, Indian Overseas Bank (IOB) and DCB Bank, along with several other banks have lowered their fixed deposit interest rates

Amid decreasing interest rates, senior citizens can consider changing the way they expose their portfolio to debt by investing in debt-linked mutual funds. While depositing money in fixed deposits helps the depositor earn interest on the amount deposited, debt-linked mutual funds create a pool of money using the investors' funds to purchase fixed-income instruments like government securities, corporate bonds, treasury bills, and commercial papers.

Compared to other asset classes, debt-linked mutual funds have a profile that shares a lot of commonalities with investments in fixed deposits. Both the instruments have a relatively lower risk profile compared to equity-linked investments. The investment goal for both instruments is capital preservation and are suitable for investors who are conservative and risk-averse. Typically, senior citizens seek wealth preservation as such an investment can provide them with financial security in the later years of their life.

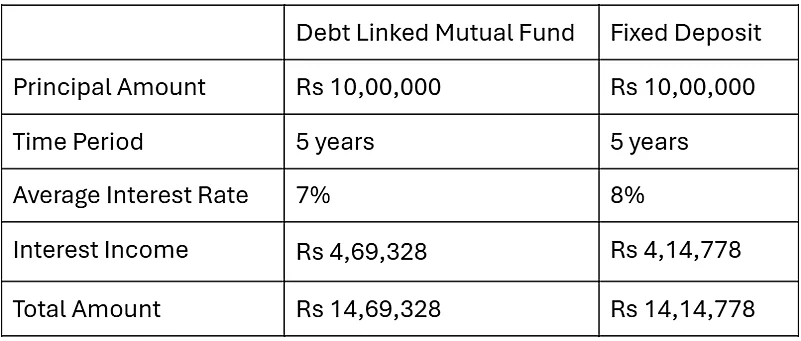

Debt Focused Mutual Funds Vs Fixed Deposits

Debt Mutual Funds can offer potentially higher returns to senior citizens following the rate cut. After the rate-cut the fixed deposit interest rates for tenures ranging between 1 to five years for senior citizens were reduced to 6.5 per cent to 7.5 per cent by most banks. On the other hand, debt-linked mutual funds such as Corporate Bond Funds or Dynamic Bond Funds, have historically provided returns in the range of 7 per cent to 9 per cent per annum in a five-year investment horizon.

Thus, the average rate of returns for a five-year fixed deposit for senior citizens would be around 7 per cent, and the average rate of interest for an investment in a debt-linked mutual fund scheme would be around 8 per cent. Let’s understand the same with an example:

Fixed Deposit (FD)

A fixed deposit of Rs 10,00,000 with a 7 per cent annual interest rate for 5 years will result in a maturity amount of approximately Rs 14,14,778. This includes an interest income of around Rs 4,14,778.

Debt-Linked Mutual Fund

If an investor invests Rs 10,00,000 in a debt linked mutual fund scheme in lumpsum with a 5-year horizon, with an average interest rate of 8 per cent the value of the investment would increase to Rs 14,69,328. Thus the investor would have an interest income of Rs 4,69,328.

Therefore, a 5-year lump-sum investment in a debt-linked mutual fund can potentially provide senior citizens with higher returns and also increase the participation of senior citizens in mutual funds, providing them more avenues to diversify their portfolios.

However, senior citizens should also keep in mind that debt fund returns are not guaranteed and can fluctuate based on market risks and interest rate fluctuations, while an FD offers a guaranteed return. Ultimately, senior citizens must evaluate their own investment goals and choose the asset class they wish to invest in accordingly.