Summary of this article

Retirement tops priorities but only 37 per cent have actual retirement plans.

There has been a mindset shift, from fear-driven to aspiration-driven for investment.

Mutual fund distributors (62 per cent) top source for advice.

Retirement planning has become the top financial priority for Indians for the first time; however, only 37 per cent actually have a retirement plan in place, compared to 67 per cent in 2023, according to the Retirement Research Report 2025 by PGIM Indian Mutual Fund. This is the third edition of the retirement readiness reports. The previous reports were published in 2021 and 2023. According to the report, psychological distance, knowledge gaps, and present-day pressure are leading people to delay retirement planning or avoid it altogether.

The report took responses from 3088 Indian adults aged between 26 and 60 years in 19 Indian cities, including metro, tier I, and Tier II cities.

Shift In Priorities

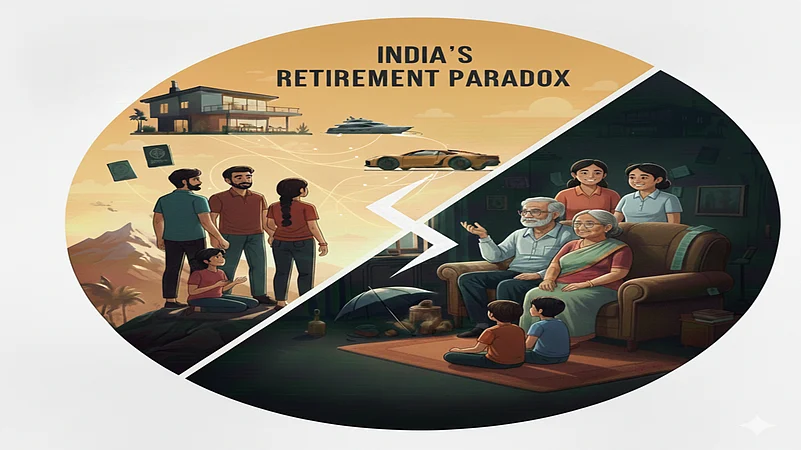

For decades, Indian financial planning has been family-centric with a catch-all approach and no specific goal. But now the trend is changing. The new data shows a flipped mindset for money. Family security, children's education, and health emergencies, which were once primary goals of people and the main motivation for saving money, are now being superseded by desires for lifestyle upgrades, entrepreneurial aspirations, and personal fulfillment.

Ajit Menon, Senior Advisor at PGIM India Asset Management, “This is a profound mental evolution: from security-first thinking to aspiration driven planning. The emergence of “self-oriented” goals as a priority seems to run parallel to the traditional priority given to “family oriented” goals. In the aftermath of COVID, and the random loss of lives, there seems like a strong undercurrent and shift from “its all about the family” to also “what about me.”

Abhishek Tiwari, CEO, PGIM India Asset Management, views the decline in readiness not as a setback, but as a sign of positive evolution. He says, “People are beginning to distinguish between safeguarding against risks and building a future for themselves. Another driver of this shift is a rising sense of surpluses, and a shift towards lifestyle priorities seems to be enabling families to move beyond providing for children and toward planning for their own retirement. Goalsetting for retirement has matured—it is not just financial planning, but a mental evolution toward self-focused security and dignity.”

Mindset Shift: Fear-Driven To Aspiration-Driven

The report highlights that Indians are beginning to disassociate risks from wealth creation. According to the report, the mindset is shifting from fear-driven to aspiration-driven. Mutual fund adoption has risen from 24 per cent in 2023 to 35 per cent in 2025, reflecting trust in the market-linked investments. The preference for mutual fund distributors (MFDs) has jumped to 62 per cent. Further, there is more acceptance and traction towards the National Pension System (NPS), Public Provident Fund (PPF), and even for new-age products like exchange-traded funds (ETFs), Real-Estate Investment Trusts (REITs), among others.

Per the data, nearly half of the respondents (47 per cent) now feel anxious about their finances, which is higher than in 2021 (32 per cent). The primary reason for financial anxiety is the rising cost of living (75 per cent), followed by health expenses (63 per cent), family responsibilities (62 per cent), lack of emergency funds (51 per cent), and job insecurity (48 per cent).

Planning For Retirement

The report also highlights that nearly half of those earning over Rs 1.5 lakh per month plan for retirement and prefer investing in retirement funds. Contrary to this, among those earning less than Rs 50,000, only one in three has plans for retirement.

Some of the reasons for not planning for retirement include income only covering basic needs, the future feels unclear, no plan to retire at all, lack of financial knowledge, and people in joint families feel less urgency to plan.

Retirement Corpus

The data shows that less than half (48 per cent) of Indians know how much money they need for retirement. And those who know, feel Rs 74 lakh as the target retirement corpus for them. The feeling of financial security has decreased, and 42 per cent in 2025, compared to 24 per cent in 2023, rely on family support post-retirement.

Seeking Advice

Of the total, 37 per cent have their retirement plan in place, of which 30 per cent have consulted with the financial advisors and 70 per cent have done without consultation.

Most of them seek advice from MFDs (62 per cent), bank relationship managers (56 per cent), insurance agents (51 per cent), registered financial advisors (27 per cent), YouTube financial influencers (24 per cent), certified financial planners (22 per cent), and wealth managers (17 per cent).

The report stresses the gap between awareness and action and suggests employer-led programs to enable action towards retirement planning. Further, regulators and advisors can also drive retirement awareness to ensure actual action.