Summary of this article

Dual responsibilities to parents and kids make retirement planning tough for sandwich generation.

Balancing loans, education, and healthcare often strains monthly savings.

Keep investing steadily for retirement despite temporary cash crunch.

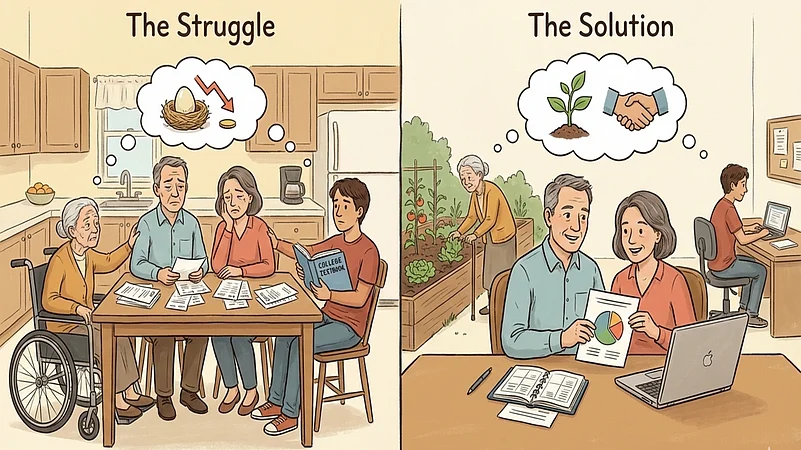

If you have financial responsibilities towards your retired parents as well as your dependent children, it shows that you are sandwiched between two generations. It’s not easy to manage two financial responsibilities simultaneously and focus on retirement planning at the same time, as it may lead to several financial woes, such as delayed retirement or a surge in debt.

Many people in the 35-50 age group have to take care of their children and parents simultaneously. Often, it becomes a daunting task for such people to manage their finances and focus on their retirement goal. Sandwiched between two non-earning generations, it becomes crucial to take care of long-term financial goals, such as retirement. Let’s first understand the financial challenges people may face when they are sandwiched between two generations.

What Are The Financial Challenges Of The Sandwich Generation?

The sandwiched generation may face financial challenges, like taking care of dual expenses for parents and children, higher debt obligations, such as towards home loans and education loans, higher usage of credit cards, and a strained credit profile. Greater financial responsibility may also put stress on work life, thus causing slower growth or delayed promotions. People who are in such a situation may often face liquidity issues, fail to focus on their own retirement goals, or retire with a smaller corpus.

What Steps Should You Take To Secure Your Retirement Planning?

People who are sandwiched between two generations need extra financial care. Instead of waiting to take a big leap, they should focus on smaller financial steps and try to maintain financial discipline. Segregating short-term and long-term financial goals can help in prioritising and achieving them comfortably. Lack of investment towards retirement may solve the short-term financial challenges, but spoil the retirement life. So, people must contribute regularly towards their retirement goals and try to meet their short-term financial challenges by other means, such as loans or by trying to increase their income. Better communication with both generations can help in reaching a consensus about financial limitations and thus taking steps to cut down unnecessary expenses and save money.

After a few years, financial pain may alleviate gradually as the children become financially independent. Adequate health insurance cover and a contingency fund also play a big role for people who are in such a situation.

People facing financial challenges due to a sandwich-like situation in their life must immediately consult a financial advisor, as they can help in taking appropriate steps to meet the short-term goals without compromising the retirement goals.

The author is an independent financial journalist