I have SIPs in three funds for Rs 5,000 each—HDFC Top 200, ICICI Prudential Bluechip and Tata Balanced. I have been investing in them for the past three years. I plan to invest in at least three more funds and invest Rs 15,000 through them each month. Which funds would you suggest? Do I need to readjust my portfolio?

-Suresh Kathuria, New Delhi

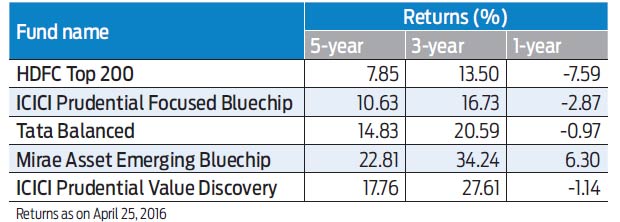

Your current selection of three funds provides for adequate diversification and has a proven track record and history. As you are considering increasing your monthly investments and including more fund schemes, we would suggest you stop further investments in HDFC Top 200 owing to its indifferent performance in recent times. Do not redeem the investment, but stop future SIPs in it. You could consider a couple or more funds to your existing portfolio like Mirae Asset Emerging Bluechip or ICICI Prudential Value Discovery as these are schemes that have evolved and made a mark for themselves over time. Your portfolio will be of five funds of which four will have ongoing investments, which will be easy to manage and also provide you with significant diversification.