Does ELSS enjoy tax benefits on the full Rs.1.5 lakh deduction under Section 80C? Can I invest Rs.1.5 lakh in ELSS to get tax exemption in 2015-16? Please suggest an ELSS to invest in. - Dibyendranath Bose, Kolkata

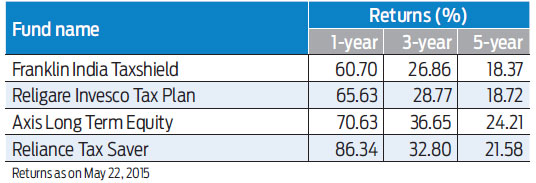

The enhanced sum of Rs.1.5 lakh available to claim tax deduction under Section 80C since financial year 2014-15 is available in financial year 2015-16 as well. You can invest the entire Rs.1.5 lakh in ELSS to avail the tax exemption. ELSS comes with a three-year lock-in on investments. You can invest in schemes like Franklin India Taxshield, Religare Invesco Tax Plan, Axis Long Term Equity and Reliance Tax Plan from the OLM Elite universe depending on your risk profile. While tax saving is a benefit when investing in these schemes, do treat them as long-term equity investments.