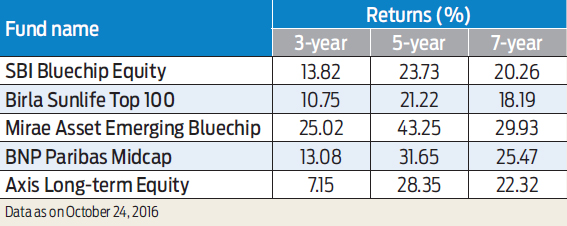

I am 35 and have just started investing in mutual funds through SIPs in SBI Bluechip Equity, Birla Sunlife Top 100, Mirae Asset Emerging Bluechip and BNP Paribas Mid Cap. I also have a lump sum investment in Axis Long Term Equity Tax Saver Fund as part of my tax savings this year. How is my fund selection?

Srikanth Reddy, Bengaluru

You have invested in a good mix of equity schemes, however, the selection of funds is a bit aggressive. As you are a first time investor, knowing your risk taking abilities would have been good before investing in these schemes. You should continue to invest in these schemes and review their performances once a year to evaluate their progress to continue investing or to make any change to fund selection. This kind of portfolio will be good to maintain for a 5-7 year investment time frame.