I have decided to invest Rs 2,000 each in SIP in HDFC Top 200, Franklin India Prima Plus, Reliance Vision, Sundaram Select Midcap and SBI Magnum Contra. Is my selection correct, or do I need to get rid of one of them and add another fund?

Paritosh Uttam, Bhopal

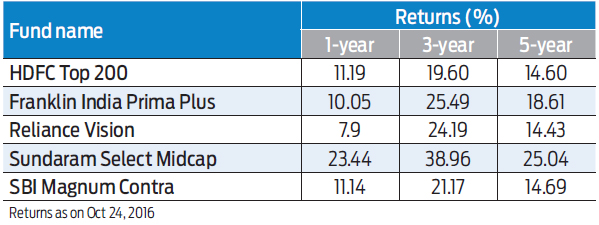

It is a good move to start investing in equity mutual funds through SIPs. Basically, you plan to invest Rs 10,000 every month through SIPs in a combination of five fund schemes. Nothing is wrong in this approach but you do not need so many fund schemes to invest in. You should plan a tenure for which you will be investing. Say, you plan to invest for the next five years then you could invest in just 2-3 fund schemes as it will still provide you with the necessary diversification that you seek. Although there is nothing wrong with the schemes you have shortlisted to invest in, you could stick to HDFC Top 200, Franklin India Prima Plus and SBI Magnum Contra than investing in all the five. Make sure you check the progress made by these investments at least once a year and whether they are serving your investment objective or not.