The thought makes most of us going for a health insurance policy cringe. What if I have a pre-existing condition? Will I get cover? Is it okay to skip the fine print? Your agent may tell you it is fine to stay mum unless there is something critical, largely due the fact that insurers will, in any case, cover all the pre-existing conditions after 48 months of taking a policy. The Insurance Regulatory and Development Authority (Irda) has provided a standard definition for pre-existing diseases (PED) that says: “Any condition, ailment or injury or related condition(s) for which the insured had signs or symptoms, and/or was diagnosed, received medical advice or treatment within 48 months prior to the first policy issued by the insurer.” But the devil is in the details.

“Non-disclosure is against the principle of utmost good faith on which any insurance contract is based, it may lead to the policy being treated as void ab initio (invalid from the outset),” says V. Jagannathan, chairman-cum-managing director, Star Health and Allied Insurance. A known and declared condition is treated differently by the insurer while only unknown ailments get the benefit of the PED clause. If a particular ailment has been diagnosed and is being treated or had been treated in the past, then that ailment or the complications arising out of it don’t qualify for a claim.

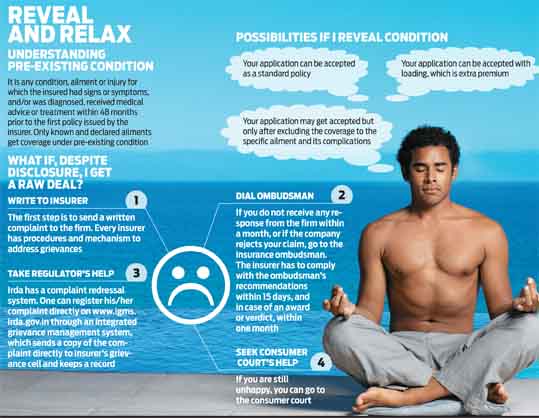

“It must be noted that only preexisting diseases that are disclosed and accepted by the insurer are covered after the PED waiting period as per the terms and conditions of the health policy,” says Sanjay Datta, chief-underwriting and claims, ICICI Lombard general insurance. It’s important to disclose even these PEDs as the insurer might accept such a proposal without considering it as an earlier illness, and then even complications arising from it would become acceptable. What if I tell all? Disclosing even the PED has three effects. First, it can still be accepted as a standard policy.

Second, it can be accepted with ‘loading’, which is extra premium and third, the policy might get accepted, but only after excluding coverage to the specific ailment and its complications. A known and declared medical condition is subject to the process of medical underwriting. Therefore, for the coverage to be available under the policy after the PED waiting period, the medical conditions should be declared. Should I stay mum then? If pre-existing ailments are going to be covered after 48 months in any case, then should one disclose them while buying a health plan? This is one question that plays in the minds of most buyers. As a buyer, one should disclose all the known ailments and let the insurer decide. “The insurer has the liberty to decide as to whether he/she can assume the risk or not. For evaluation of the risk, it is must that it should be declared,” says Jagannathan. The insurers underwrite the policy risk based on one’s disclosure. “Only pre-existing diseases that are disclosed and accepted by the insurer are covered after the PED waiting period,” says Datta. Besides, risk evaluation differs across firms.

Says Datta: “Underwriting a policy depends on various factors such as age of contracting the disease, severity of the disease, comorbidities and risks.” The insurer may decline altogether or ask the buyer to pay some extra premium called ‘loading’. If the ‘loading’ isn’t too high, one should go ahead and accept the charge. After all, there’s an extra bit of risk that is brought into the group isn’t hypertension common? Hypertension and diabetes are some of the conditions considered too ‘common’ to disclose. They should be disclosed with all the details as they could impact other organs. But mere disclosures aren’t enough. “Detailed analysis of other comorbid factors and parameters are checked by medical experts to decide such cases. Also, the age of the insured person, the number of years he has been diabetic would also be verified,” says Jagannathan.

At times one may disclose a specific ailment but find it permanently excluded by the insurer. Based on the underwriting, the insurer may exclude it altogether. In such a case, the buyer is informed and his consent is required to issue the policy after exclusion. Says Datta: “Exclusion might be done if the same is notified under the terms and conditions of the policy.”

What do insurers check for? There’s a defined set of steps undertaken by the insurer to establish whether the ailment is a PED or not. The pre-medical reports get scanned, hospital records are gone through. Datta says, “While processing the claims, the insurer, by examining the hospitalisation records, can determine the ailment’s pre existing nature.” The investigation undertaken by the hospitals could reveal what one tried to hide.

It’s always good to be sure where you are heading instead of making wild guesses. Even if a medical test is not warranted, one may get them done at own cost and attach the medical report while applying. This binds the insurer as far disclosures are concerned. As Jagannathan puts it, “Be patient with the company that is asking questions in the beginning, they are trying to understand the risks. Most likely they will not raise any questions at the time of settlement.”

OLMdesk@outlookindia.com