Like most distant relatives, diseases come uninvited. Any chronic disease has the power to shake you to the core, and the price you pay at the end of it is often very high. At some point in your life, you may have to make a trip to the hospital, costing you somewhere around Rs 50,000 or more. In order to save yourself from the shocks of such unexpected expenses, health insurance is a must. Healthcare costs are on the rise making it necessary for you to have more than a single policy to manage the financial implications of hospitalisation.

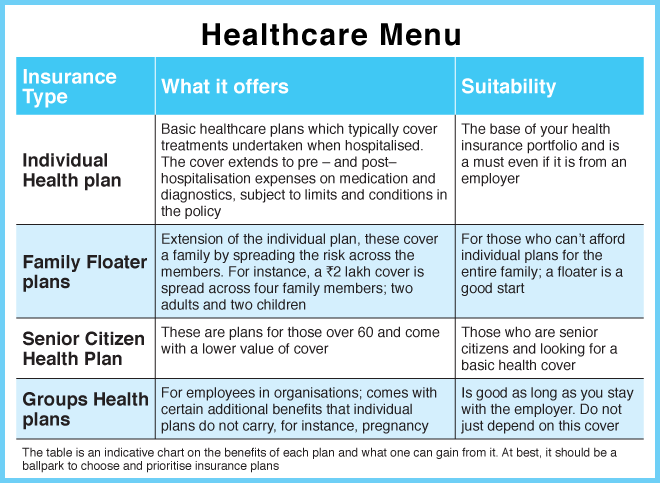

Just as the case is while selecting any other policy, while choosing a health insurance policy, you are bombarded with choices—Individual health insurances, top-up plans, critical illness, floater, senior citizen plans and so on. To make the best choice, it is necessary to be well informed about what each policy does and does not provide. Though there is no shortage of options when it comes to health insurance, it is shocking that Indians are grossly underinsured. Unlike other forms of insurance that may lose its relevance with time, health insurance is a must-have all throughout your life. Old or young, ill-health can catch you any time. This makes it all the more necessary to review your health insurance plan every year.

Chances are you will have someone else take you to hospital and get you treated and use the insurance policy. You may have adequate health insurance but that does not guarantee that you will be paid your claim. That makes it necessary to have all the policy-related documents in order and easily accessible to your nears and dears. However, the fact remains that there are instances of the claims being rejected; mostly due to the mistakes committed by the insured. Ignorance is never bliss. Make sure that you know in detail about your policy and its scope to benefit from it when you need it the most.