The ‘customer is king’ epithet worked only on paper, at least when it came to health insurance. The proof of the product benefits— claims in case of  health insurance— has been a subject of great debate. Ask any insurer and they will vouch that they are not only the most correct with their products, but also with their services.

health insurance— has been a subject of great debate. Ask any insurer and they will vouch that they are not only the most correct with their products, but also with their services.

In contrast, most policyholders who have ever raised a claim would have a different tale to narrate.

Says Delhi-based senior consultant radiation oncologist Dr. Sapna Manocha Verma, “We had a bitter experience on account of lack of transparency with my mother-in-law’s claims process.” After having a policy in which they had not raised a claim, the first experience was enough to make her consider shifting her insurer. In that respect, health insurance portability has been a boon for scores of insured who wish to move to health insurers with a better service track record.

Health insurance portability came about in 2011 after regulator IRDAI granted permission for it. In simple terms, portability allows policyholders to carry forward continuity benefits accrued on their policies with a new insurer. These benefits are gained by being under continuous coverage for a certain period, which is essential to continue coverage on pre-existing diseases. This change has allowed policyholders a leeway than being stuck with a policy only to retain the waiting period benefit.

Simple and straightforward

Says Sanjay Datta, chief-underwriting and claims, ICICI Lombard

General Insurance: “A portability proposal is treated just like a fresh health insurance proposal. But the acceptability depends on the underwriting policy of the company, which is uniform for all health insurance policy proposals.”

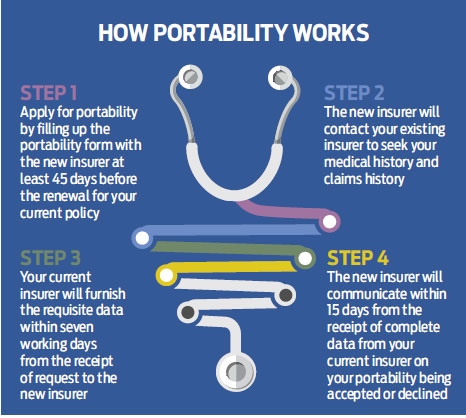

So, how does one port insurance policy to another insurer? All that a policyholder has to do is to apply for portability with a new insurer at least 45 days before the existing policy comes up for renewal (See: How Portability Works). Says Verma: “We moved to Apollo Optima Restore Individual policy, which was recommended by our financial advisor.”

Although many policyholders think of shifting to another insurer, what keeps them chained to their existing insurer is the subject of waiting period. Adds V. Jagannathan, CMD, Star Health and Allied Insurance, “There is a misconception that the waiting for certain pre-existing benefits to be covered in the ported policy will need a fresh waiting period, which is not true. They get the continuity benefit with porting.” For instance, if under a previous policy, the pre-existing condition was excluded from coverage for two years and under a new plan with a different insurer the exclusion period for the same condition is three years, the new health insurance policy can only exclude the condition from coverage for one extra year.

However, the smooth functioning of portability entirely depends on sharing of data between insurance companies. “The insurer to whom the customer wants to switch will be interested to know why the customer is switching and what his claims history is—a must to facilitate portability,” adds Jagannathan. It is for this reason that there has been a spurt in the number of health insurance policies being ported.

“We received calls for porting health insurance policies on a daily basis even before portability came into effect. Our internal statistics reveal that on an average, we have been receiving nearly 1,500-2,000 ported policies per month,” says Antony Jacob, chief executive officer, Apollo Munich Health Insurance.

Not without obstacles

Portability is not a one-way traffic for policyholders wanting to shift insurers; it also involves the insurance companies, and they can refuse to port your policy. “The incumbent insurer would reserve the right to accept, reject or load a particular proposal. Hence, it is important for the customer to completely understand the benefits as offered under their existing policy and subsequently match them with the plan that they wish to port to,” says Jacob. As every policy is governed by underwriting principles specific to an insurer and the product which is being ported from and to, insurers may decline porting of policies on a case-to-case basis.

In their interest, policyholders should keep in mind that every policy is different and each insurance company is governed by its own underwriting principles. As such, policyholders should take an informed decision to be on the safe side. “Both my husband and I are doctors. We know very well how painful it is when patients suffer because they don’t get the cashless reimbursement or have to pay from their own pocket,” explains Verma, who made the wise move of shifting her policy after taking the necessary safety measures.

In their interest, policyholders should keep in mind that every policy is different and each insurance company is governed by its own underwriting principles. As such, policyholders should take an informed decision to be on the safe side. “Both my husband and I are doctors. We know very well how painful it is when patients suffer because they don’t get the cashless reimbursement or have to pay from their own pocket,” explains Verma, who made the wise move of shifting her policy after taking the necessary safety measures.