Rise in healthcare risks and incidents of lifestyle diseases have made it practically impossible for most of us to be without health insurance to address the financial implications of hospitalisation. There is no way one can hold the premium that one pays towards a health insurance policy to be an avoidable expense. The fallacy that health insurance is expensive is busted the moment one experiences hospitalisation even for a few days resulting into a sizeable bill. In fact, for most people, even before taking up life insurance, one should take a health insurance policy.

There are several types of existing health insurance policies. Depending on one’s needs, one can select a combination that best addresses their needs. But a standard basic health insurance policy is a must which covers expenses incurred from an accident or hospitalisation. There exists another inherent benefit of taking a health insurance; premiums paid towards the policy come with tax benefits.

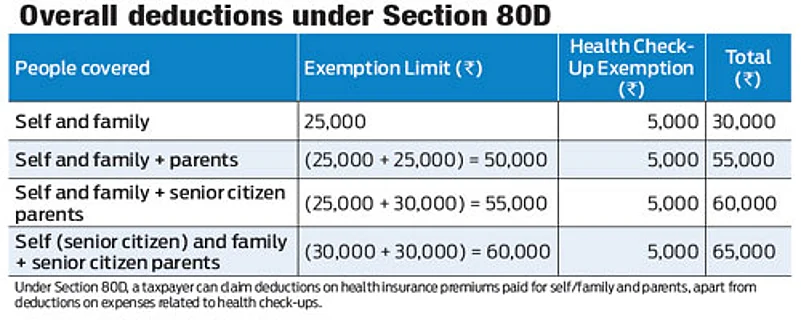

Premiums paid towards health insurance policies are eligible for tax benefits under Section 80D as the health insurance premium paid for self, spouse, children and parents all qualify for tax deductions. In fact, even the Hindu Undivided Families (HUF) can claim deductions under this section. Premium payments of any member in a HUF can be used for tax deduction subject to upper limit as per the Act.

Further, the income tax rules allow for deduction under Section 80D for even preventive health checkup. The aggregate amount you can claim as deduction in a year is Rs 5,000. The health check-up could be done for either the individual or her family, including parents, spouse and children. The scope of health insurance definitely goes up even for those who are sceptical about the benefits of the policy.

However, do not go in for a policy just because of tax benefits. It is best to zero down on a health policy that meets your needs. With the New Year round the corner, it may be a good idea to include health insurance as part of your resolution. But, do not treat it like several resolutions that never tend to be followed.