A casual observation of the stock market movements in recent past will indicate nothing very outstanding for investors to cheer about. The news and data pouring in from the government is not very encouraging either, fuelling up plenty of pessimism. To quote from an Edelweiss Research report: “Today the investors are under immense pressure to generate returns in markets controlled by central banks. However, there is hope (investment hope) that there will be real economic growth and markets will escape the control of central bank, it springs up in every investor’s heart given enough pressure and enough time.”

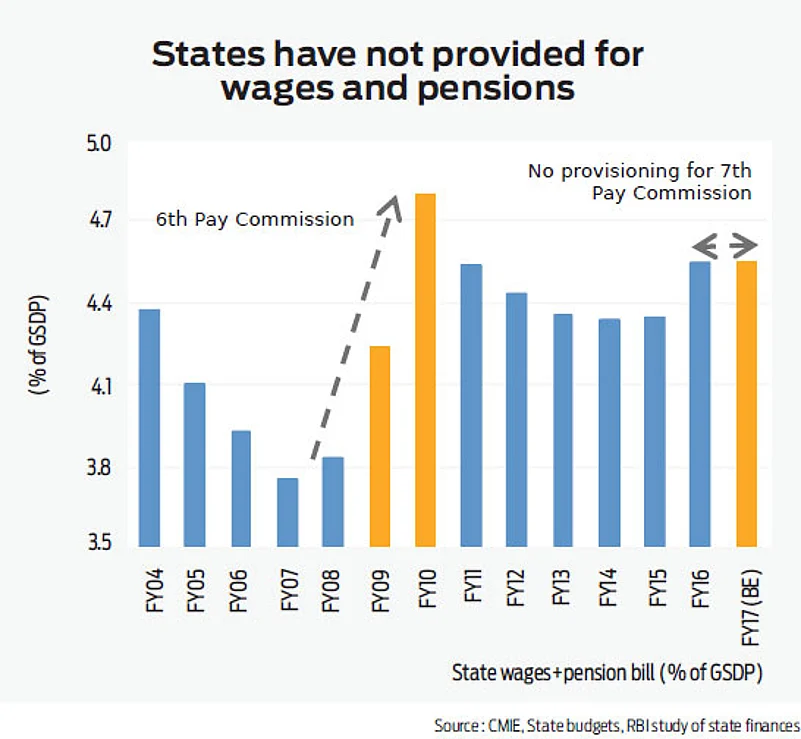

Yes, markets are full of optimists who live on hope and belief, even though there is no evidence from the real world to support it. From the available data, it seems that the Indian economy is progressing, but at a tepid pace, compared to the 2003 and 2009 recoveries, which in contrast were swift, broad based and persistent. Today, among the many other hopes, is the hope for a good monsoon and the belief that the 7th Pay commission payoff will have a rub off on growth to pick up.

Believing on two factors which are riding heavily on anticipation is like saying a prayer when you know the patient is on deathbed. For a full scale recovery to happen, the need is for fiscal and monetary policy and not announcements on FDI relief. Add to it, the interconnected global world that we live in causes concerns over the way the US Fed rates would go, not to disregard the outcome of the US elections and situation in EU.

Government spending

Yes, it is good that the government is spending, which is reflected in the various social schemes it is championing. It does help the nationalist spirit, but it does not generate jobs or productivity, which could otherwise leave more money into the hands of the people than they have today. So, despite spend on public infrastructure, it does not indicate any direct impact on the state of the economy. Yet, there is growth in the cement sector, truck sales and 2-wheeler sales, which gives ring to optimism, but IIP manufacturing, railway freight and non-oil imports are sluggish, including unimpressive car sales in recent months.

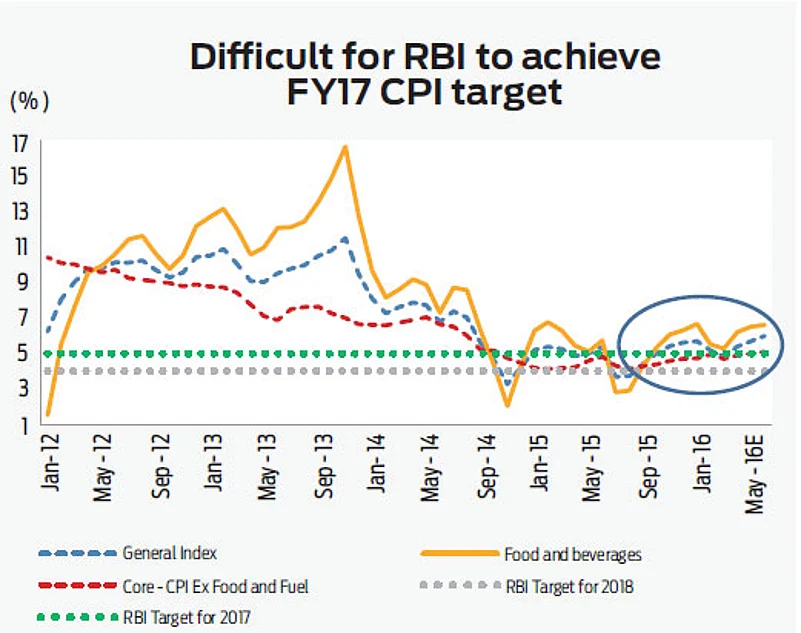

Inflation is yet to come to levels where it is comfortable and looks difficult to reach the levels that RBI has targeted; one of the reasons why the central bank kept the repo rate on hold at 6.50 per cent in its recent monetary policy statement. The monsoon has set in and even as one debates its quality, the RBI has maintained that it will take the next call only when the first round of monsoon effect will be seen. How the monsoon impacts inflation and commodity prices will be the factor that will decide the course of rate cuts.

Factor in poor rural demand that was witnessed in FY16, things are not very encouraging. Traditionally rural demand has been the trigger for a broad-based economic recovery on which hinges how things pan out. Until then, it is like movie Lagaan, minus the cricket match—you keep looking out for the rains to not just wash out the roads, but also cleanse the economy and step up growth.