With rapid urbanisation and industrialisation the demand for power has been going up with each passing year. This calls for substantial investments in power generation, transmission and distribution infrastructure. KEC International (KEC) is one such company which has established itself as a global infrastructure Engineering, Procurement and Construction (EPC) major.

Under the flagship of RPG group, KEC today has marked its presence in the verticals of power transmission and distribution (T&D), cables, railways and water and renewables. The company’s T&D business has a manufacturing capacity of 3,11,200 MTs as on March 31,2016.

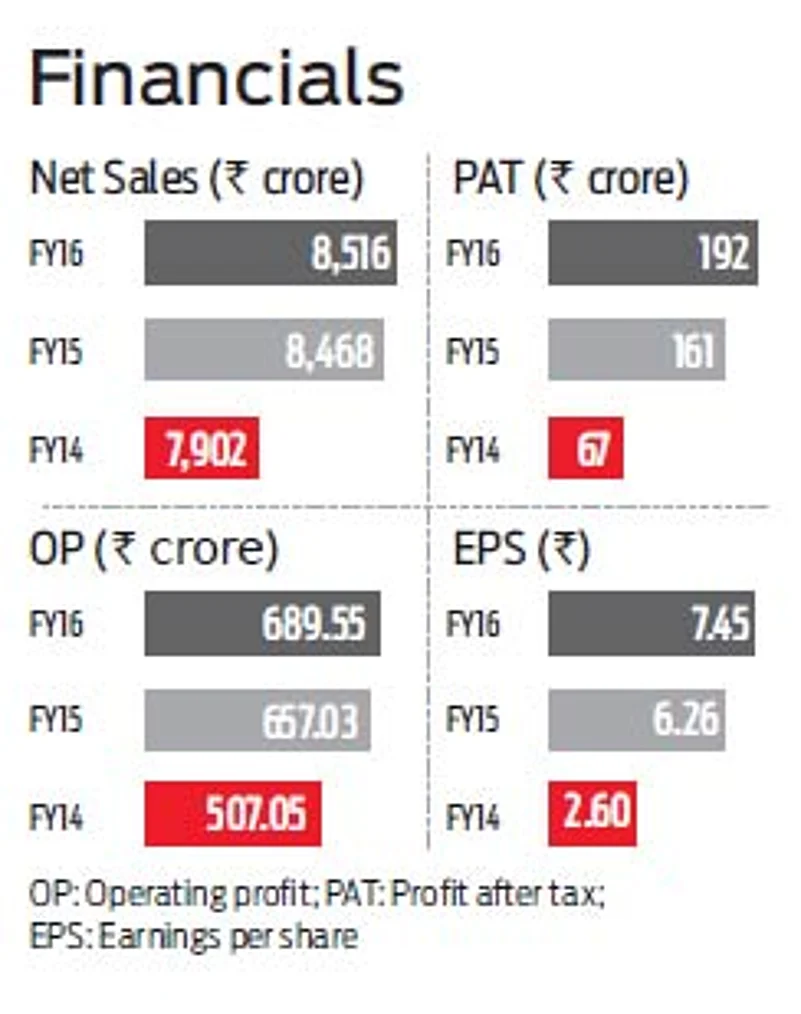

Health barometer

The power transmission and distribution business is the largest business vertical of the company which contributed 74 per cent of the total revenue in FY2016. This was followed by 16 per cent in new businesses like railways, cables and water. KEC is currently executing projects in 33 countries. Around 51 per cent of its revenue came from the international market in FY16. KEC currently has an order backlog of Rs 9,449 crore in FY 2016. In addition, the company has secured new orders of Rs 1,140 crore in the month of April 2016. Its earnings before interest, tax, depreciation and amortization (EBITDA) for the Q4FY2016 stood at Rs 223 crore, an increase of 21 per cent.

The management is targeting sharp growth in railway segment margins to 10 per cent. Cable is likely to record approximately 5 per cent margin levels going forward. KEC also enjoys 25 per cent market share in Power Grid Corporation of India (PGCIL) orders in FY 2016. It also commands strong market share in select state electricity board transmission orders.

Outlook

The government has integrated related ministries like coal, power and renewable energy into one and transmission and distribution is in focus right now. This bodes well for all of company’s business verticals. The scrip has given returns of 101 per cent from January 2013 to June 14, 2016. Investors with long-term horizon can power up their portfolio by investing in the company.

Why Buy

- Margin consistenly achieved, with improving profitability

- Diversified geographical revenue stream

- Healthy order book and strong pipeline

Watch out for

- Delay in execution of order book poses a risk for the company’s revenue

- Forex exchange and commodity risk may impact margins, if input costs rise