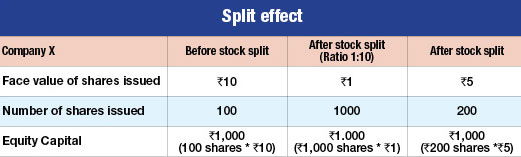

Break-up is not a very healthy phrase, yet when a stock split is announced, investor frenzy sets in because; it provides an opportunity for new investors to invest in the company. Stock split refers to split the face value of the shares of companies. So, when a company goes for a 1:10 split on Rs 10 face value share, it means that the face value will be reduced to Re 1. What it means is that a single share of Rs 10 will now get split into ten shares of Re 1 each. But, such a move comes with a flipside – the price of shares would also fall proportionately split but the total value of your holding remains the same. This means more number of shares will now be available for investors.

How split works?

Understand the difference between the face value and the market value of the stock as these are not the same and should not be confused with. So, whenever a stock split is announced, there is a proportionate fall in the share price of the stock. “In case of a stock split, the balance sheet items remain same except that the total number of outstanding shares of the company increases proportionately to the ratio of split. Stock split increases the number of shares available to trade and also reduces the price,” says Siddharth Sedani, Vice President - Equity Sales, Anand Rathi Securities.

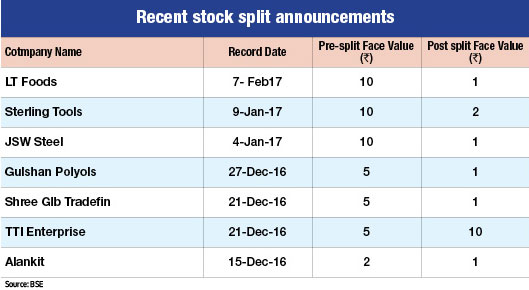

The other important factor that you must be aware of with stock split is the record date. This is the date set by the company that is going into stock split to inform shareholders who will be eligible for the stock split. It is also important to know what an ex-date is – the ex-date is the date on which the seller, and not the buyer, of a stock will be entitled to a recently announced stock split. The ex-date is usually a business day prior to the record date, since T+2 trading cycle is followed for clearing and settlement of trades in India. So, if you are investing at the time of a stock split announcement, act depending on your need.

What does it mean to investors?

Unlike bonus shares which are typically announced when the going is good, stock splits in itself does not give any indication of the future. Stock split is at the discretion of the management. If the management perceives that the price per share has increased a lot and is not attractive for small investors, it may decide to split the stock.

Unlike in the case of a bonus issue, the existing shares are converted into new shares of a lower value. In a bonus issue, additional new shares are allotted to the shareholder; the existing shares continue as they are, and there is no change in their face value.

The difference between a stock split and a bonus issue can also be understood by taking a look at the accounting treatment given by companies to these two types of corporate actions. In a stock split, the company does not pass any accounting entry at all, since the total value of its capital remains the same, and only the description of the capital changes to show a larger number of shares, each of a lesser value.

And, though the affordability of investing in a stock goes post its split, it is no way indicative of the performance of the company or the stock. “The idea is to enhance investor participation. If there is a genuine case, then stock splits are perceived as positive by investors. A classic stock split candidate could be MRF; its stock price stands at Rs. 50,473 per share,” says Sanjeev Zarbade, Vice President- PCG Research, Kotak Securities.

Should you invest because of a split?

Your investment in a share should not be driven by events like stock splits, though these could be used as an opportunity to invest in good companies with prospects which you could have otherwise not invested in because of the high price. Keep track of split announcements by looking up the websites of the stock exchanges which need to be kept in the loop about splits.