Among the many forms of life insurance, the unit-linked insurance plans (Ulips) are most widely discussed for their merits and complex construct. Like every other financial product, if you understand what a Ulip does and take it, you will not be complaining. However, if you have taken it up because an agent sold it to you or you thought it was a wonderful investment instrument, chances are you will be wondering what to do with this lemon.

The year-end sales of Ulips go up mostly due to the last minute tax planning that people get into. Whatever the reason, it is also possible that you may feel the need to weed out Ulips from your portfolio while reviewing it. Before you take that call, you must weigh several options to make sure that you do not end up further compounding the mistake of buying an unsuitable Ulip.

Take the case of 35-year-old Dipan Gajjar from Mumbai; he bought a Ulip, entailing a premium of Rs 33,000 in 2010 primarily to claim deductions under section 80C. “I had purchased it for tax-saving purposes, but the returns were poor. I was not happy with the Ulip,” he laments. It is not that only those without a finance background get it wrong; several people well-versed with finance could also get it wrong. Financial services professional Praful Ghildiyal, 28, faced a similar predicament in 2014 when he realised that his Ulip did not meet his requirements.

He finally decided to surrender the single-premium Ulip he had purchased in 2009. The cumulative premium of Rs 1 lakh had grown to merely Rs 1.29 lakh in 2014, when he finally decided to terminate the policy. He regrets making the ‘investment’. “Mutual funds that come with much lower charges would have been much better option. Even if I had invested the amount in a simple fixed deposit, I would have earned better returns as they were offering high interest rates back then. I waited till I recovered the amount invested and then surrendered the policy,” he says.

Wrong construct

When those who do not need a life cover or already have adequate life cover buy Ulips, they are paying for something—life insurance component—that they do not need. In such cases, Ulips do not work just as an investment product. Mortality charges, which is the insurance cost, eats into your returns without offering any tangible benefit to policyholders across age groups.

Although charges on Ulips have indeed come down after the IRDAI changed the Ulip regulations in 2010, they pale in comparison to investment only products like mutual funds and even the NPS, which many may consider as an option to save tax or as investments. Moreover, unlike the easy liquidity that come with mutual funds, Ulips are suitable for the long run of ten years and more or the full tenure. In the wake of limitations with Ulips, the regulations made exiting Ulips easy by way of allowing surrendering Ulips with a five-year lock-in.

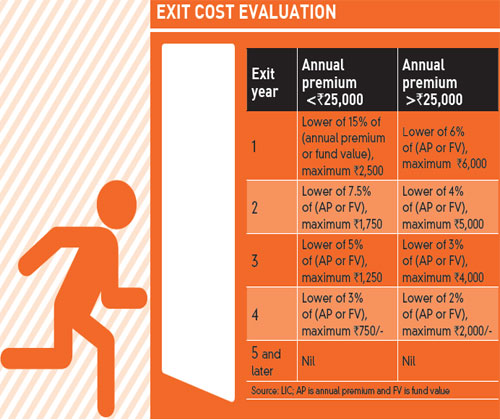

For those mulling exiting Ulips, the five year lock-in is a boon. There are no surrender charges that can be deducted from the fund value post this period. Yes, one can exit earlier than five years, but in doing so, they would lose a part of the fund value in the form of discontinuation charges. But, it is not as simple and straightforward as it looks. For instance, there could be charges like premium allocation and policy administration that are levied from the second year, which are higher than discontinuation charges. In such a case, it would be safe to let go your Ulip in the very year you realise its unsuitability instead of waiting till the minimum holding period is over.

On the other hand, if your fund has delivered desired returns and the charge structure is friendlier in subsequent years, you could consider holding on until the completion of five years. “Inadequate life cover compared to what is needed and your Ulip fund’s underperformance relative to appropriate benchmarks would be other valid reasons for exit,” adds Vishal Dhawan, founder, PlanAhead Wealth Advisors. However, before exiting the policy, make sure you buy adequate term life insurance to replace the loss of life cover.

When it pays to stay

Often, insurance-seekers are misled into assuming that they have to pay premiums for a limited period of five years, which is actually the lock-in period. Many choose to exit post this lock-in, without realising that Ulips necessitate longer investment horizons. Now, if you simply cannot pay beyond five years, surrender could be the only option.

However, if your finances allow you to pay and you are satisfied with the product otherwise, you need to reconsider your decision to surrender. “Turning Ulips, a long-term product into a short term one results in high front-end charges, which cannot be earned back if the premium payment (and the policy) is discontinued. It is simple mathematics—charges get averaged over the policy term. When policies are surrendered or closed prematurely, the time for averaging out does not exist and the policyholder stands to lose,” says RM Vishakha, MD and CEO, IndiaFirst Life Insurance.

Similarly, do not exit Ulips merely because your fund has not delivered expected returns in the short term. “We have seen that equity markets have given positive returns over longer term and hence it is advisable that customer stays over longer period to get desired return. Moreover, many Ulips come with loyalty additions after 5-6 years which boost the fund value,” advises Sanjay Manna, vice-president— products, HDFC Life.

There is also the option to stop paying future premiums by converting the policy as a paid up policy. ‘‘In case of flow issues, policy can still continue as paid-up policy. In fact, most of Ulips also offer the option of partial withdrawal which can help overcome the immediate financial requirements,’’ points out Manik Nangia, director and chief digital officer, Max Life Insurance. The sum assured in a paid-up policy is reduced to a proportion of premiums paid till date by the policyholder and number of times premiums have been paid. So, if you make the Ulip paid-up, policy administration, mortality and fund management charges will continue to be applicable, which will eat into your fund value. But you can let the policy be paid-up after paying for three years of premiums—this is an option wherein the burden of future premium no more rests on you. Also, you do get some insurance cover which you could retain for as long as it lasts. Once you realise a Ulip is not what you had thought it to be or it does not work the way you want it to work, it may be in your interests to cut your losses and exit the policy.