Boys’ love for fast bikes was commercially exploited by the Dhoom movie franchise, and the likes of John Abraham and Mahendra Singh Dhoni have only made more Indians open up about their love for superbikes. Realising the potential among Indians to spend on high end bikes, international players like Harley Davidson, Triumph Motorcycles and Indian, among others, have started to spread their operations across Indian cities. The shift is a lot different from what it was some years ago, when owning a superbike meant you explored the auctions by the customs department or got lucky to know someone to bring it into the country legally. For 26-year-old Delhi-based Tanuj Singh, owning a loud and fast

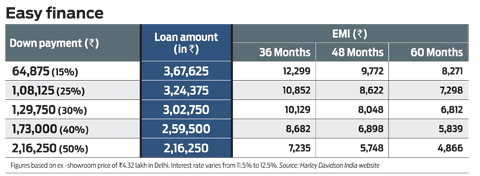

Boys’ love for fast bikes was commercially exploited by the Dhoom movie franchise, and the likes of John Abraham and Mahendra Singh Dhoni have only made more Indians open up about their love for superbikes. Realising the potential among Indians to spend on high end bikes, international players like Harley Davidson, Triumph Motorcycles and Indian, among others, have started to spread their operations across Indian cities. The shift is a lot different from what it was some years ago, when owning a superbike meant you explored the auctions by the customs department or got lucky to know someone to bring it into the country legally. For 26-year-old Delhi-based Tanuj Singh, owning a loud and fast  superbike was a long standing dream, which he realised in 2014. “I took a loan to fulfill my desire to own a Harley and get the adrenaline rush and vroom on city roads,” he says To push their bikes, manufacturers have tied up with lenders who are offering these bikes for lucrative finance schemes (See: Easy finance).

superbike was a long standing dream, which he realised in 2014. “I took a loan to fulfill my desire to own a Harley and get the adrenaline rush and vroom on city roads,” he says To push their bikes, manufacturers have tied up with lenders who are offering these bikes for lucrative finance schemes (See: Easy finance).

The price of a luxury bike starts from upwards of Rs. 4 lakh, which makes some of them cost as much, if not a lot more, than entry level car models, has been a challenge for manufacturers to find more takers for their wares. In order to expand their base, the finance schemes have been an automatic route to create a market for several to consider owning a bike. Easy availability of finance from banks as well as non-banking finance companies for high-end two wheelers and prompt customer service by bike companies has resulted in spurt in sales. Today, about 70 per cent of high end bikes are bought on loan, which is not just because of the entry price being high, but also to keep themselves off the radar of the tax officials. One owner was candid enough to tell us that he could have paid Rs.10 lakh upfront, but decided to take a loan instead to ward off tax officials. Then there are others, who are going to the other extreme of taking personal loans, because they do not qualify for an auto loan due to their low income levels.

Curiously, many banks offer loans for luxury two wheelers at rates lower than that for standard two wheelers. However, the tenures for such loans tend to be long, up to 5 years and more, in some cases. The loan amounts are usually 70- 80 per cent of the bike’s cost, but can also go up to 90 per cent, if the bank is happy with the buyer’s profile. Some of the bike sellers are enhancing the overall bike riding experience by bundling extended warranty on these bikes with insurance. For instance, Harley Davidson India has collaborations with ICICI Lombard and HDFC Ergo to offer extended warranty plans. Whatever the means, the option to finance a superbike is definitely tempting to consider, as long as one realises the risk of riding these bikes without adequate safety measures, given the numerous fatal accidents that have occurred while riding them.