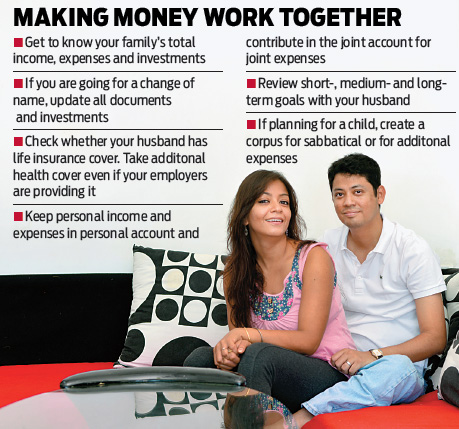

Mumbai-based management consulting professional Kinkini Roychoudhary and Abilin Mukherjee, both 33, have been married for over five months. Naturally, they have been busy with their honeymoon, long work hours and meeting friends and family, but the couple also spends a lot of time discussing money matters. While one might think money is a subject that does not quite gel with love, it is a crucial factor in marriages. While in some families money management might be considered the prerogative of the husband, it is important for the wife to be aware of family finances and take part in financial decisions. Says Kiran Telang, director, Dhanayush Capital Advisors, “First understand the family and then the family finances.

Mumbai-based management consulting professional Kinkini Roychoudhary and Abilin Mukherjee, both 33, have been married for over five months. Naturally, they have been busy with their honeymoon, long work hours and meeting friends and family, but the couple also spends a lot of time discussing money matters. While one might think money is a subject that does not quite gel with love, it is a crucial factor in marriages. While in some families money management might be considered the prerogative of the husband, it is important for the wife to be aware of family finances and take part in financial decisions. Says Kiran Telang, director, Dhanayush Capital Advisors, “First understand the family and then the family finances.

Get started. Before entering into matrimony, you should know how much your husband-to-be earns so that you have an idea of the total family income. You can also ask him about the family’s assets and liabilities. Be aware of spending and saving habits of each. Some women may go for a change of name after marriage. In such instances, change the name in all documents and investments.

Keep emergency funds. When both spouses are working, three months’ expenses, EMIs and insurance premiums in liquid cash in a bank account or as ultra short-term debt funds should suffice. Roy choudhary and her husband have an emergency corpus of about four months. “Both should have easy access to the corpus in the absence or inability of the other,” says Telang.

Maintain separate individual and joint accounts. Couples should work out a plan to manage their incomes, expenses and investments. “Set up a joint account for joint expenses. Keep personal income and expenses in personal account and contribute in the joint account for joint expenses,” says Rohit Shah, founder and chief executive officer, GettingYouRich. Some couples may also choose to live off one person’s income while investing the rest in the other spouse’s salary. In either case, the wife needs to keep some of her money separately. “With increasing number of divorce cases, it is important that husband and wife have their own set of income and investments,” says Telang.

Plan for a break from work. If you are looking to take a break from work after your child is born, it is wise to plan for it in advance. “Look at creating a corpus, which you can use during the temporary break in your income. This can be created by saving on a regular basis in debt-based recurring deposits or debt mutual funds,” says Telang. In case the wife does not intend to take a break, the couple can save an amount for additional domestic help and day-care expenses in the initial years after childbirth.

break from work after your child is born, it is wise to plan for it in advance. “Look at creating a corpus, which you can use during the temporary break in your income. This can be created by saving on a regular basis in debt-based recurring deposits or debt mutual funds,” says Telang. In case the wife does not intend to take a break, the couple can save an amount for additional domestic help and day-care expenses in the initial years after childbirth.

Take insurance cover. Ask your husband if he has life insurance. Ideally, adequate life cover in the form of term insurance should be taken for both. Any term insurance with the wife as the nominee can be taken under the Married Woman’s Property Act, 1874, especially if the husband has business income, so that the wife’s rights are protected. Health insurance should be taken even if the employer is providing it. Says Telang, “You can get a 10 per cent family discount if you take a health cover together. Later, the newborn child can also get a cover under the same insurance.” Consider a policy that offers maternity benefits and take one at the earliest, since these policies have a waiting period of two to four years.

Set goals. Try and meet your immediate goals from your regular income. For medium-term goals, like buying a house or planning a vacation, and long-term goals such as your kids’ education, marriage and your retirement, start investing in equity-based systematic investment plans (SIPs) early to reap the benefits of compounding. “Review discretionary spends with your husband and try to save for your goals by optimising expenses,” adds Shah. Roy choudhary and her husband have prioritised their goals based on one to three, three to five and over five-year periods. The couple also dreams to travel and stay abroad and pen a couple of books. “All this comes at a cost and we are trying to work out the timing of it all to avoid a financial strain for either of us,” says Roychoudhary. You should also ask your husband to make a Will and make one yourself if you want to bequeath any of your assets to parents and siblings. Being moneywise as a couple will ensure that it is never a cause of concern or dispute in a marriage.