There is something common to most doctors—they tend to have spouses who are also doctors, are very focused on their profession, but tend to take finances a bit easy. Dr. Aashish Chaudhry, orthopedic surgeon and managing director, Aakash Healthcare, is no different—he has spent all his energies into honing his orthopaedic skills, which has left him with little time to manage his money. His wife, Dr. Minal, a radiologist, is the same. They have a good amount in the bank, which could have been otherwise deployed in a better way for growth.

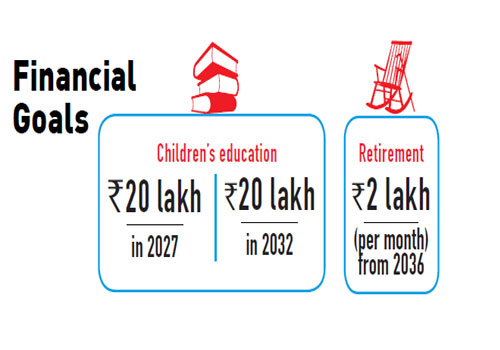

The Chaudhry family comprises of Aashish, Minal, their daughters Ashvika (6) and Anyesha (2), besides Aashish’s parents, his sister-in-law and her two children aged six and four. Expectedly, education is a top priority for them, followed by their own retirement. There is also the desire to build a large multi-speciality hospital, which has not been captured by our planner as it could be taken up for a later date, including the possibility of funding it from private equity and sources other than Aashish self funding it.

Huge potential

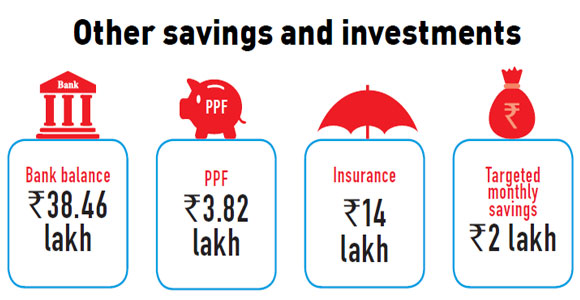

Aashish is a conservative to moderate risk taker—there is adequate risk capacity but low risk appetite. The tilt towards keeping money in the bank or in fixed return instruments is visible, which is definitely not what he should be doing. His current savings is a little on the lower side but as the potential to save is high, he should have pushed the saving pedal to Rs 2 lakh per month, or at least Rs 1.5 lakh a month to start. Based on his present goals, the target of sending both his daughters abroad for higher education can be duly met within the current means. Based on his current expenses, he will need Rs 2 lakh every month in retirement, which may fall short in the last few years. To manage these two big goals, it will be good if Aashish starts understanding about risky assets like equities, which can deliver a return which is inflation-adjusted.

The Chaudhrys currently have insurance cover for Rs 30 lakh, which costs them Rs 2 lakh annual premium. They should immediately think of a term insurance with a sum assured of immediately take a family floater health insurance cover. Being doctors, they will understand the need for health insurance and take a cover for the whole family.

Structured investments

Targeting a 10 per cent return on investments, they are advised to invest Rs 1.5 lakh each month in mutual funds that have the potential to grow and at the same time factoring the risk that the Chaudhrys can take. This way, they will be able to beat inflation and see the value of their savings grow than remaining a fixed sum at the bank.

To start with, debt mutual funds can be considered along with hybrid balanced equity funds to have some equity exposure. As the horizon is long, systematic transfer plan can be adopted for balanced fund investment. And as the goals approach, they can consider moving out of equity-based assets gradually over a two-year timeframe. They should also transfer the money that is in the bank into debt funds for tax efficiency and convenience. With time on their side, the Chaudhrys can benefit from the combination of compounding and long-term investing to achieve his goals with ease. Like annual medical check-ups that are recommended, they too should evaluate the progress made by his investments once a year to check how it has fared and make any changes based on the outcome.